Rumblings, rumors, and, at last, a flood of official hints. India is gearing up for a major overhaul of its central government pay structure as the 8th Pay Commission (8th CPC) solidifies its place on the nation’s financial calendar. For almost five decades, these commissions have marked major turning points in government employee compensation. Now, a brand-new wave is set to hit on January 1, 2026.

Funny thing is, every time a new pay commission rolls around, it’s not just the 11 million-plus central government employees and nearly 68 lakh pensioners who feel the tremors; India’s entire consumption-driven economy braces for the aftershocks. Estimates peg the overall outlay at a staggering ₹3–3.2 lakh crore, with ripples set to jolt savings rates, consumer spending, and even stock market sentiment.

If you’re one of the many Level 6 employees, or you just want to understand the magnitude of this governmental shift, let’s break down the nitty-gritty. How much will salaries jump? Which factors will drive the new increases? And what’s the real-world impact on your gross and net pay?

What is the 8th Pay Commission and Why Does It Matter?

Let’s wind back for a second. The concept of a “pay commission” isn’t new. Every decade, India’s central government sets up a fresh commission, tasked with recommending pay, allowances, and pensions for its workforce. The last such report, the 7th Pay Commission, took effect in 2016. Its term, like those before, is winding down. The 8th is up next, set to be implemented from January 2026.

Here’s the kicker: each commission doesn’t just tinker with numbers. It recalibrates the entire pay matrix. New formulas, new minimums, new fitment factors…all designed to reflect mounting inflation, cost-of-living spikes, and the changing face of Indian society.

Key details at a glance

- Implementation authority: Department of Personnel and Training

- Scheduled roll-out: January 1, 2026 (pending official notification)

- Beneficiaries: 48.62 lakh employees and 67.85 lakh pensioners

- Expected minimum salary post-revision: ₹20,000–25,000

- Rationale: Combat inflation, ensure wage parity, improve employee welfare

Level 6 Employees, The Numbers That Matter

So, why is everyone talking about Level 6? In government parlance, Level 6 is one of the largest pools in the pay matrix (Basic Pay: ₹35,400 under the 7th CPC). A huge swath of central government workers fall here, clerical staff, junior officers, and more.

Now, with the impending commission, Level 6 salaries are poised for a dramatic leap. Multiple fitment factors are floating around: 1.92, 2.28, 2.57, and even 2.86. The official factor will define the exact jump, but let’s crunch the projections.

- 7th CPC Level 6 Basic Pay: ₹35,400

- 8th CPC projections:

- Fitment factor 1.92: ₹67,968 (rounded to ₹68,000)

- Fitment factor 2.28–2.86: ₹80,700 to ₹101,844 possible

- Fitment factor 1.92: ₹67,968 (rounded to ₹68,000)

Pro tip: The fitment factor multiplies with your current basic pay. It’s the single most important number in this entire exercise, the number that unions, economists, and government negotiators all watch closely.

Table: Projected Level 6 Basic Pay (Various Fitment Factors)

| 7th CPC Basic Pay | Fitment Factor 1.92 | Fitment Factor 2.28 | Fitment Factor 2.57 | Fitment Factor 2.86 |

| ₹35,400 | ₹67,968 | ₹80,712 | ₹90,678 | ₹101,844 |

Breaking Down Your 8th CPC Salary: Fitment Factor, DA, HRA, and More

Now that we’ve tackled fitment, let’s get into the nuts and bolts of take-home pay. Your gross salary isn’t just basic pay, it’s the sum of several allowances, each one calculated as a percentage of your new base.

How the Gross Salary Is Calculated:

- Revised Basic Pay: Current pay × fitment factor

- Dearness Allowance (DA): Percentage of revised basic (estimated DA to be reset at 0% immediately post-8th CPC, then rise; could hit 70% by January 2026)

- House Rent Allowance (HRA):

- X (Metro) cities: 27–30% of revised basic

- Y (Tier-2): 20%

- Z (Tier-3): 10%

- X (Metro) cities: 27–30% of revised basic

- Travel Allowance (TA): Fixed based on city/classification

- Standard Deduction: Subtracted at the end to give net pay

Here’s a simplified breakdown for a Level 6 employee, assuming a conservative fitment factor of 1.92 and metro HRA:

- Basic Pay: ₹68,000

- DA (0% at rollout): ₹0

- HRA (30% for metros): ₹20,400

- TA (approximate): ₹4,600

- Gross Salary: ₹68,000 + ₹0 + ₹20,400 + ₹4,600 = ₹93,000

- Net Salary (after deductions): ₹84,711

And if DA climbs to 50% over time, total gross could exceed ₹1,00,000 for Level 6 employees. That’s no small change, especially compared to the current take-home.

The 8th Pay Commission Pay Matrix

People love tables, so here’s the full expected pay matrix, built off projections and calibrated for clarity:

| Pay Matrix Level | 7th CPC Basic Salary | 8th CPC Projected Basic |

| 1 | ₹18,000 | ₹21,600 |

| 2 | ₹19,900 | ₹23,880 |

| 3 | ₹21,700 | ₹26,040 |

| 4 | ₹25,500 | ₹30,600 |

| 5 | ₹29,200 | ₹35,040 |

| 6 | ₹35,400 | ₹42,480 |

| 7 | ₹44,900 | ₹53,880 |

| 8 | ₹47,600 | ₹57,120 |

| 9 | ₹53,100 | ₹63,720 |

| 10 | ₹56,100 | ₹67,320 |

| 11 | ₹67,700 | ₹81,240 |

These are preliminary figures; government notifications may alter exact slabs or fitment numbers.

So What’s the Big Deal About the Fitment Factor?

No getting around it. The fitment factor is the master key. In 2016’s 7th CPC, it sat at 2.57, so every employee’s current basic was multiplied by 2.57. Now, with various reports buzzing about a range from 1.83 to 2.86, government and staff associations huddle over which multiple strikes the fairest, and most fiscally sustainable, balance.

Some trade unions have pushed for the highest end (2.86), which would nearly triple starting-level salaries. Let’s spell this out: The higher the number, the more dramatic the leap for every basic pay entry in the matrix.

Calculating Your Total Take-Home: Let’s Do the Math

Ready to see what your own pay might look like?

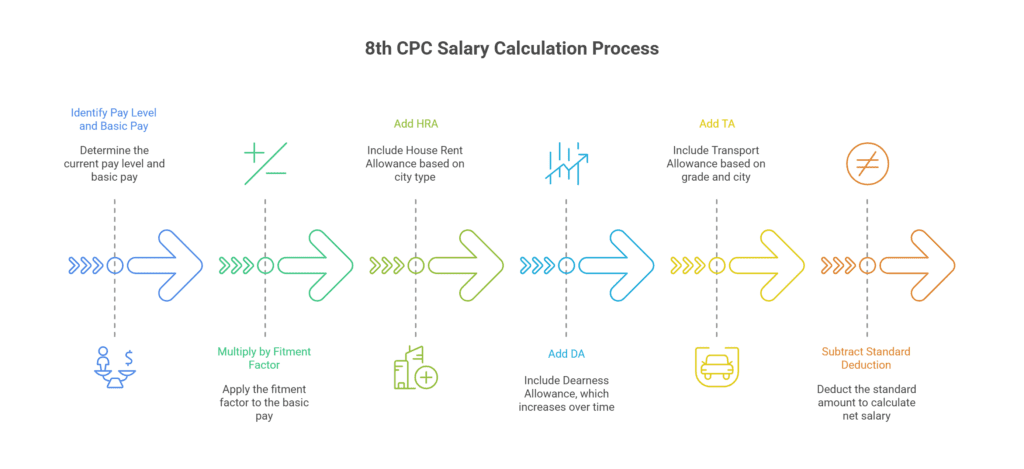

Step-by-Step 8th CPC Salary Calculator

- Identify your current pay level and basic pay (for instance, Level 6: ₹35,400)

- Multiply by the fitment factor proposed (say, 1.92, 2.28, or 2.86)

- Add HRA according to your city (27–30% X-city, 20% Y-city, 10% Z-city)

- Add DA (starts at 0%, but rises rapidly post-commission)

- Add TA (as per grade and city)

- Subtract standard deduction to get net salary

Example, Level 6 Employee in Metro City

- Basic Pay (projection, fitment 1.92): ₹68,000

- HRA (30%): ₹20,400

- TA: ₹4,600

- DA (0% post-implementation): ₹0

Gross: ₹93,000

Net (post-deductions): ₹84,711

If DA climbs to 50%:

Gross: ₹1,27,200

Want to play with the numbers? Numerous online salary calculators help estimate your personalized payout, factoring in every variable you can name.

Dearness Allowance (DA): The Wild Card

Starting from zero when the new pay commission kicks in, DA acts as an incremental buffer against inflation. Each increase (typically every 6 months) lifts salaries further. DA can touch up to 70% by late 2026, adding enormous heft to future paychecks.

House Rent Allowance (HRA): Location

Here’s something most employees don’t realize at first. HRA varies wildly by where you live:

- “X” Cities (metros): 27–30% of basic pay

- “Y” Cities (tier 2): 20%

- “Z” Cities (small towns): 10%

So two employees at the same level, living in different cities, end up with very different HRAs. For Level 6 in a metro, HRA could be as much as ₹20,400 or more, on top of other benefits.

Allowances, Deductions, and the Fine Print

Don’t forget, there’s more than just HRA in the package:

- Transport Allowance (TA): Higher in metros

- Standard deduction and NPS contributions: Automatic income tax and pension deductions apply

- Other extras: Medical, education, LTC allowances, and more, calculated on revised pay

Impact on India’s Economy and Savings

It’s not just about individual windfalls. The 8th Pay Commission will inject billions into the wider Indian economy, temporarily boosting sectors such as autos, consumer goods, and retail banking. The forecast: a short-lived jump in national consumption and savings ranging from ₹1–1.5 lakh crore, as employees and pensioners bank their windfalls or splurge on “revenge” spending.

Automakers, retailers, and even real estate developers have every reason to watch the commission’s progress with hawk-like attention. Historically, pay commission windfalls have created visible, but temporary, upticks in nationwide demand.

Timeline and Implementation: What Happens Next?

- January 2025: The Government is expected to fully notify the 8th Pay Commission panel and chairperson selection.

- Late 2025: Detailed report and recommendations tabled.

- January 1, 2026: Official salary revision takes effect.

- First payouts: After government approval, could take several additional months.

If past timelines hold, implementation and salary “arrears” could be felt in late 2026 or early 2027.

Key Takeaways for Level 6 Employees

- Expect a dramatic basic pay increase: From ₹35,400 to as high as ₹68,000–₹1,01,800 depending on the fitment factor adopted.

- Gross salary could soar above ₹93,000 (initial DA), potentially hitting ₹1 lakh or more in a metro as allowances and DA rise.

- **Net take-home will comfortably exceed ₹84,700 once deductions are applied; many employees will see a 2–2.5x jump over pre-revision pay.

- Future pay growth will accelerate as DA starts building up post-implementation.

The Bottom Line (But Not the Final Word)

As the 8th Pay Commission’s details are still taking shape, final fitment factors, allowance formulas, and tax rules are all up for negotiation; employees should treat current numbers as educated estimates. Still, with the economy rebounding, wage growth lagging inflation for years, and mounting political will for major reforms, the only real question is: How high can the jump go?

Level 6 staff will want to watch this space closely. Because, if history’s any guide, the next 18–24 months are about to rewrite the paychecks and pension slips of nearly five crore Indian households.

Stay tuned. Because, believe it or not, this is just the start. And with a ₹3 lakh crore windfall in the pipeline, India’s public sector could be in for its biggest payday in decades.