India’s UPI System Gets a Major Makeover

UPI, or Unified Payments Interface. Just one of those acronyms everyone in India knows, whether you’re buying vegetables at a street corner, paying for cab rides, or splitting dinner bills. Funny thing is, the digital payment backbone that’s become, well, second nature to most Indians, is about to change in big and surprising ways.

You may have already heard whispers. Starting August 1, 2025, the National Payments Corporation of India (NPCI), which manages UPI, is rolling out a strict new set of rules. This isn’t just a tweak or a patch: it’s the largest overhaul in years, designed to keep UPI robust, stable, and fair as users, and the value of their payments, skyrocket every year.

Let’s break it all down. Piece by piece. No confusion. No jargon.

Quick Highlights: What’s Changing With UPI in August 2025?

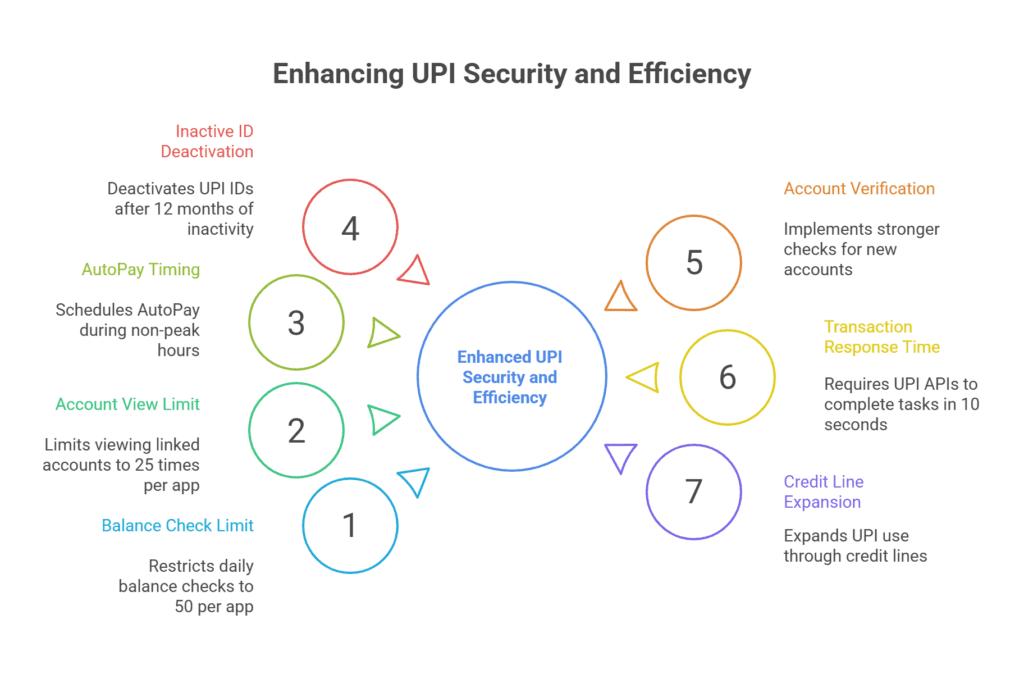

Here’s the short version, if you’re itching for the gist:

- Daily cap on balance checks: Max 50 per day, per UPI app.

- Limit on viewing linked bank accounts: 25 times per app, per day.

- AutoPay payments and mandates: Only during specified “non-peak” hours.

- Inactive UPI ID deactivation: 12 months of inactivity triggers removal.

- Tighter account verification: New accounts face stronger checks.

- Faster transaction response: UPI APIs must complete tasks in 10 seconds.

- Using UPI through credit lines: Pilot expands from August 31, 2025.

Think that’s it? Not quite. The devil, or for us, the detail, is in the fine print.

UPI: Setting the Stage for Change

You know, India’s payment ecosystem is kind of extraordinary. In June 2025 alone, UPI facilitated more than 18.4 billion transactions, processing upwards of ₹24.04 lakh crore. That’s 613 million payments, every single day!

No wonder the system’s under strain. More users. More apps. More banks (675 at last count). And with digital payments not just for techies but for every shopkeeper, student, and pensioner, the potential for network congestion, failures, and even fraud multiplies.

That’s why, believe it or not, NPCI decided it was time for some tough love. The new UPI rules are meant to reduce server overload, cut down on failed transactions, prevent misuse, and generally keep the pipes flowing smoothly, especially when everyone seems to be making a payment at the same time (yes, there are digital rush hours).

Daily Balance Checks: Now Strictly Limited

Let’s talk about one of the rules causing the most chatter. Up until now, checking your account balance on any UPI-enabled app (hello, Paytm, PhonePe, Google Pay, Amazon Pay, banking apps, etc.) was… well, unlimited (for most people). Now, it’s capped at 50 times per day, per app.

- Why put a limit? Turns out, repeated balance checks hijack system bandwidth. Sometimes it’s the app checking (in the background), sometimes it’s users. Either way, with millions checking again and again, especially when a transaction is stuck or slow, the servers groan under the weight.

- From August 1, 2025, only 50: After you hit that cap, you’ll have to wait until tomorrow.

- And what about background checks? They’re out. Only manual, user-initiated requests count. Apps can’t sneakily ping the bank anymore.

- A helpful twist: After every successful UPI payment, the app will auto-display the available balance, so you might never need to check again until your next spend.

And if you’re juggling more than one app (say, Paytm and PhonePe), good news. The 50-cap applies per app.

Linked Bank Account View Limit: 25 Times, Then You Wait

Ever wondered which of your bank accounts is connected to a particular UPI app? Maybe you double-check before transferring a lump sum, or you’re comparing balances between banks. Now, the “List Account” or “linked account view” function is capped at 25 requests per user, per app, per day.

- This isn’t about stopping you from managing money; it’s about preventing apps (or robots, or glitches) from hitting the banks with endless information requests.

- The new process: Each request must be user-initiated. If something fails, retry only after you explicitly approve it.

- Why? Unnecessary or repeated attempts can cause mini slowdowns, and in millions of cases per day, the whole system wheezes.

Scheduled Autopayments & Mandates: No More Chaos

Recurring mandates have made paying bills, online subscriptions, and even EMIs a set-and-forget affair. But under the surface, they’ve been adding to the chaos. Multiple retries, failed executions, and, during peak hours, massive spikes in server load.

NPCI’s answer:

- Autopay executions now restricted to off-peak hours:

- Only run before 10:00 AM,

- between 1:00 PM and 5:00 PM,

- or after 9:30 PM.

- Only run before 10:00 AM,

- Each mandate execution gets 1 shot + 3 retries. That’s four attempts, tops, for each cycle.

- No more unlimited retries, so failed automatic payments won’t flood the system.

The aim: Fewer failed mandates. Smoother, less congested service, especially when the whole country is making payments during those notorious morning and evening rushes.

Inactive UPI IDs: Use Them, or Lose Them

There’s always that stray UPI ID tied to an old number, or to a bank account you don’t use. These unattended UPI IDs have become a soft spot for fraud and confusion, especially when numbers change hands.

The change? UPI IDs inactive for more than 12 months (that’s a whole year) will be automatically deactivated. Keeps things tidy. Lowers the risk of your old account being misused.

Bank Account Verification: Safety Gets a Boost

If you’re adding a new bank account to your UPI app, the process just got stricter. NPCI now requires:

- Enhanced validation steps (think: stronger KYC, multi-factor checks).

- Aimed at stamping out impersonation and accidental linkages.

- Bonus: It also means fewer “payment to wrong person/wrong account” mishaps.

UPI API Response Times Tightened: Speed Is the Name of the Game

Ever waited forever (okay, 30 seconds) for a UPI payment to finally confirm? NPCI’s new technical mandate is tough: All core UPI APIs must respond within 10 seconds, down from the previous maximum of 30 seconds.

That covers:

- Payment initiation

- Balance check

- Account list viewing

- Transaction status

Ten seconds or bust. The message: UPI should be seamless, even under pressure.

UPI Via Pre-Approved Credit Lines: Opening More Doors

A headline-chaser: UPI payments via approved credit lines (like pre-sanctioned overdraft or credit facilities from banks or NBFCs) will be available from August 31, 2025. What’s the difference? Right now, most UPI payments pull from savings or current accounts. With this change, select users can pay through available credit, up to a set limit.

Expect more details as banks roll this out, especially on eligibility, fees, and security.

Broader Transaction Limits: Any Shifts?

Here’s the twist: Your existing UPI transaction limits remain unchanged.

- Regular UPI: ₹1 lakh per transaction

- Specific categories (insurance, foreign remittances): Up to ₹2 lakh

- Select high-value tasks (IPO, RBI retail, etc.): ₹5 lakh

- UPI Lite: ₹1,000 per transaction, ₹10,000 per day

- UPI Autopay mandates: ₹15,000 by default, ₹1 lakh for special categories

- (All per current NPCI guidelines)

- (All per current NPCI guidelines)

Most users shouldn’t notice any new spending caps. The focus is behind-the-scenes, ensuring the network can handle the relentless rise in transactions.

Peak Hours: When UPI Really Feels the Heat

NPCI’s data shows clear traffic spikes. Here’s when the system sweats:

- Morning: 10:00 AM – 1:00 PM

- Evening: 5:00 PM – 9:30 PM

If you’re checking balance, setting up an autopay, or running mandates, avoid these hours for a smoother ride.

Transaction Status Checks: Hold on, Don’t Hammer the Button

Ever made a payment, then tapped “check status” over and over, hoping for instant closure? Under the 2025 rules:

- You can only check the status of a transaction three times, and there must be a minimum gap of 90 seconds between each attempt.

- This keeps desperate users and overeager apps from overloading the server with rapid-fire queries.

Merchant Interchange Fees: Still Not Your Problem

Some confusion in the air about UPI fees. For users: There are still no direct UPI fees for sending money, paying bills, or buying from shops when your UPI account is linked to your bank.

The recent tweak:

- An interchange fee (up to 1.1%) may apply to merchant transactions above ₹2,000 if you’re paying via PPIs (prepaid wallets like Paytm Wallet).

- For ordinary users: Zero change; you won’t pay these fees. Merchants and wallet providers sort it out in the backend.

System-Wide Fraud Prevention: More Than Just Numbers

Tighter limits on API requests, stricter verification, inactivity deactivation, clearly, NPCI’s aiming to cut down on scams, phishing, and fraud.

It’s not just a numbers game. As crooks get smarter, so must UPI’s digital defenses.

What About Existing Mandates, Scheduled Payments, or Direct Debits?

These still work, but with new rules:

- Old mandates will be rolled over to the new schedule; no need to recreate them.

- Annual renewals, monthly bills, and EMIs will fall into the new timing windows.

- If an execution fails, you’ll get up to three more tries, and all retries will avoid peak hours.

What Doesn’t Change?

Oddly enough, despite all the new checks, balances, and schedules, most daily users will see very little difference for common, everyday payments. NPCI promises the new rules won’t break existing workflows or require you to mess with your app settings.

- No change to your spend limits.

- No new charges to users.

- No change to the pay, receive, or transfer flow.

- Upgrades are handled automatically by apps, behind the scenes.

How Do These Changes Affect You? (Use Cases)

It really depends on your pattern:

- Light users (occasional payments): No impact. You likely never hit the balance or view cap.

- Power users (frequent transfers, multiple accounts): You may notice the new daily caps. Plan accordingly!

- Merchants: Transaction processing and linked account management become more predictable and secure.

- Businesses with bulk autopay mandates: Must schedule executions outside peak hours, or face more rejections.

- Users with old/unused UPI IDs: Prepare to re-activate if still required.

Why the Drastic Overhaul? (Some Context…)

Several factors collided to force the NPCI’s hand:

- Massive growth: UPI is nearly three-fourths of India’s retail digital payments (by transaction volume).

- Rural and international expansion: UPI now works in eight countries, not just India, Singapore, France, the UAE, and more.

- Fraud, inefficiency, and mistaken payments: They spike when the rules are too loose, or network congestion sets in.

It’s a classic case of growing pains, and scaling up to meet the next billion payments isn’t easy.

NPCI’s Enforcement Warning: It’s Serious

It’s not just a gentle guideline. NPCI has given banks and payment service providers (PSPs) until July 31, 2025, to implement these changes. Fail to comply and:

- Banks could lose API access.

- Severe cases may trigger penalties, onboarding freezes, or suspensions for banks that ignore the mandate.

What Should You Do, Honestly?

Don’t panic. But, if I’m honest, here are a few tips:

- Think twice before repeatedly checking balances. The new cap is in force.

- Schedule recurring payments and autopay mandates outside peak slots.

- If you add new banks to your UPI, be ready for more authentication.

- Don’t be surprised if an old UPI ID vanishes; just set up a new one if you need it.

- Businesses: Rework bulk payment schedules to avoid rejections.

Final Word: The UPI Revolution Presses On

India’s UPI is still the envy of the world. These changes, like them or not, are designed to secure its future, boost performance, tighten security, and keep digital payments fair and reliable for another decade.

The real story isn’t the restrictions. It’s about scalability, safety, and building a system that works even when the entire country (and a few others) jump online and click “Pay” at the same time.

So, next time you settle a bill with a single tap: remember, there’s an entire digital universe behind that “ding.” And as of August 1, 2025, it’s running just a little smarter, a little safer, by design.