Bombshell news dropped this morning. Google, yes, that Google, is preparing to offer massive discounts** on cloud computing services to the U.S. government. And we’re not talking pocket change. According to senior officials at the General Services Administration (GSA), this deal could be sealed within weeks

Here’s the kicker: Oracle fired the first shot last week with a jaw-dropping 75% discount on license-based software and “substantial” cloud service cuts through November. Google’s move? A direct response. Their discounts are expected to land in a “similar spot”. Translation: The cloud arms race just went nuclear.

Why This Matters (Beyond the Obvious)

- $2 Billion Already Saved. Back in April, Google slashed prices by 71% for U.S. federal agencies on business apps like Workspace. If adopted government-wide? A cool $2 billion in savings.

- Domino Effect: Microsoft Azure and Amazon Web Services (AWS) are next in line. The GSA official put it bluntly: We will get there with all four players.

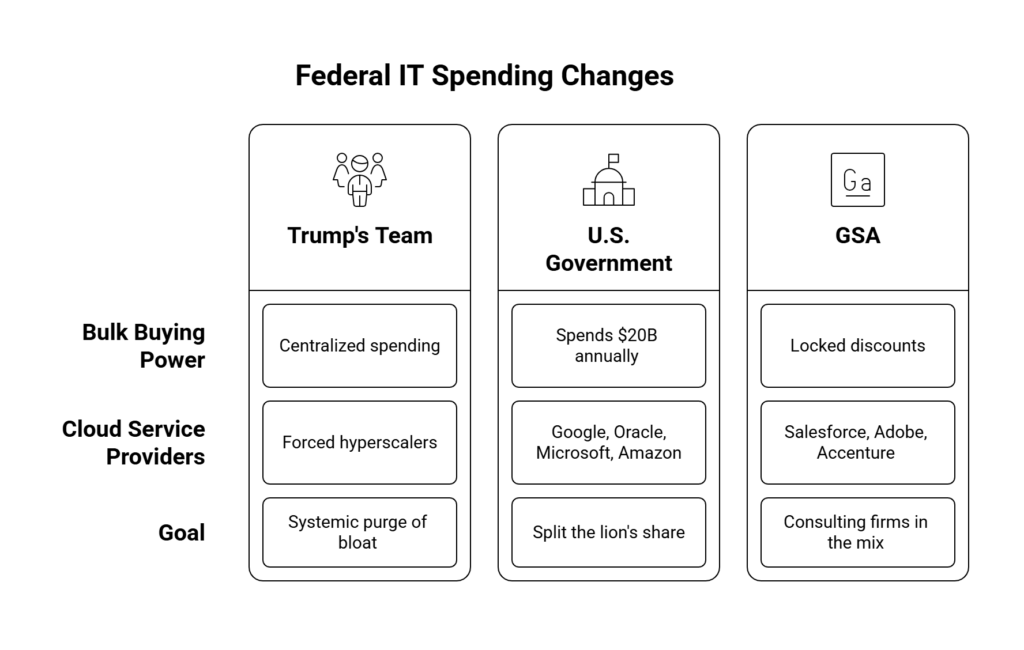

- Trump’s Shadow. This isn’t random generosity. It’s a direct result of the administration’s aggressive cost-cutting crusade, spearheaded by the Department of Government Efficiency (DOGE), formerly led by Elon Musk.

Discount Domino’s Falling Across Big Tech

| Company | Discount Offered | Timeline | Scope |

|---|---|---|---|

| Oracle | 75% on software + “substantial” cloud cuts | Through Nov 2025 | Licenses & cloud s |

| Google (Expected) | “Similar” to Oracle | Deal within weeks | Cloud computing |

| Microsoft Azure | Negotiations early stage | TBD | Cloud services |

| Amazon AWS | Talks ongoing | TBD | Cloud infrastructur |

The Unspoken Pressure Cooker

Funny thing is, this isn’t just about budgets. It’s about political survival. Remember 2019? When did Trump famously yank the $10 billion JEDI contract from AWS and hand it to Microsoft? Amazon screamed “vendetta,” citing Trump’s feud with Jeff Bezos.

Now? Tech giants are scrambling to stay in the administration’s good graces. A senior GSA official spilled the beans: Every single one of these companies is totally bought in. They understand the mission. Translation: Play ball or lose the contract.

What’s Driving the Discount Frenzy?

- Bulk Buying Power: Trump’s team centralized federal IT spending. By pooling demands, they forced hyperscalers to the table. Smart, if brutal.

- The $20 Billion Cloud Tab That’s right. The U.S. government spends over $20 billion annually on cloud services. Google, Oracle, Microsoft, and Amazon split the lion’s share.

- Consulting Firms in the Mix The GSA already locked discounts with Salesforce, Adobe, and Accenture in May. This isn’t a one-off; it’s a systemic purge of “bloat”.

The Ghost of Contracts Past

Let’s rewind. That JEDI deal? It imploded under Biden, replaced by the Joint Warfighting Cloud Capability (JWCC), a $9 billion contract split among all four cloud giants. But now? Trump’s back, and DOGE is wielding a cleaver.

Tech giants are trying to get into Trump’s good books by agreeing to massive contract cuts, or risk losing federal deals altogether.,

What Comes Next?

- Google’s Calculus. They’ve already discounted apps. Now cloud. Why? Foot in the door. Government-wide adoption could offset margin pain with volume.

- AWS & Azure’s Bind. They *have* to match Google. But cloud infrastructure discounts hurt more than software. Margins will bleed.

- Taxpayer Win? Potentially. But critics whisper: Will quality or security suffer? (The GSA insists no, mission focus is uncompromised)

The Bigger Picture: A New Era of Gov-Tech Relations

This isn’t just about 2025. It’s a blueprint for coercion. By leveraging collective demand, the U.S. government just rewrote procurement rules. And tech? They’re trapped. Refuse discounts? Lose market share. Comply? Squeeze profits.

One GSA insider nailed it: We will get there with all four players

Translation: Resistance is futile

Final Thought: When hyperscalers blink first, you know the balance of power shifted. Google folded. Oracle led. Amazon and Microsoft are cornered. And Uncle Sam? He’s counting his savings, one billion at a time.