Soaring borrowing rates and economic uncertainty are tempering home purchases: inventories are increasing, and buyers are becoming more powerful.

Changing Market Dynamics

Following over two years of historic price appreciation, the U.S. housing market is finally starting to tire. Home prices have started to fall, and inventories of homes yet to be sold are bulging to levels not experienced since pre-2008 crisis times. Buyers – whether first-timers or high-end buyers – are growing more likely to walk away from a sale or demand deep discounts. Practically, the market is turning the maniacal seller’s market of the past few years on its head, and buyers have more leverage.

Increasing Mortgage Prices and Trade Volatility

One of the main drivers is increasing borrowing rates. The 30-year mortgage rate has risen to nearly 7% as of mid-2025 – about twice pandemic-era lows. That increase in rates has already priced most buyers out of the market. And all at once, uncertainty surrounding trade policy is rocking consumer confidence. Together, higher mortgage rates and increasing economic uncertainty surrounding tariffs have created a slew of reasons for consumers to hold back. Higher financing costs and trade concerns, therefore, represent headwinds, moderating overall demand

Inventory and Construction Dynamics

With demand weakening, inventory is piling up. Unsold new single-family homes reached 117,000 in April 2025 – the highest level since July 2009 and 31% above year-ago levels. Total homes for sale, including existing homes, have climbed to their highest levels since late 2020. In response, builders are starting to lower prices and offer incentives. The median price of new homes declined 2% from year-earlier levels in April, and surveys of the industry indicate that the percentage of builders providing discounts is the largest in almost 18 months. Increased availability of unsold homes is presenting buyers with a larger number of choices and forcing sellers to fight for visibility.

Shifting Buyer Behavior

Homebuyers are adapting to the weaker market. Almost 50% of sellers currently market concessions like price reductions or closing-cost assistance, and agents report buyers expect a concession as a matter of course. An Oregon agent recalled a recent deal where a buyer negotiated $50,000 from the asking price – and then backed out altogether, citing economic uncertainty. In upscale markets, too, the pattern is the same: luxury residential sales declined some 10% last month from the previous year, the largest decline in a year. Even affluent buyers are hesitating, as trillions of dollars remain idle instead of being invested in property. In this setting, customers feel confident to seek out deals, while sellers now must pressure prospective buyers to make offers sweeter to generate interest.

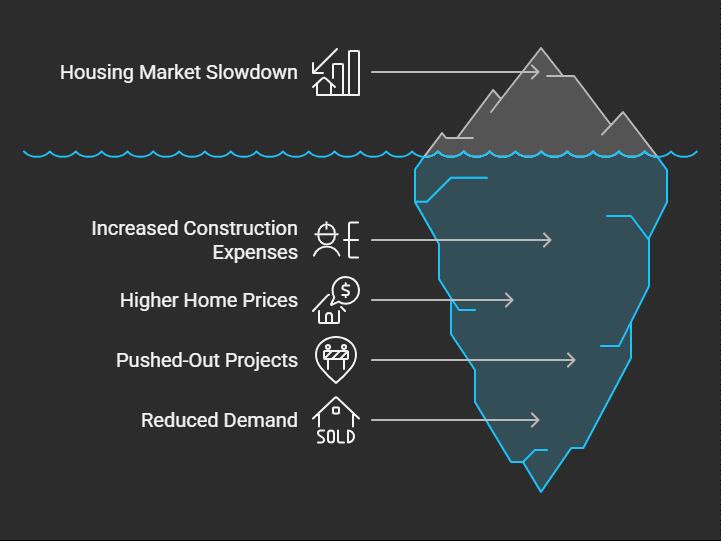

Tariffs and Supply-Chain Strains

From interest rates, the broader economic pressures are contributing to the slowdown. Tariffs imposed recently on imported building materials have pushed up construction expenses. Tariffs are estimated to have added almost $11,000 to the cost of constructing an average single-family home. These increased expenses can manifest in higher home prices or pushed-out projects. Builders still report supply-chain bottlenecks, and shortages of steel, lumber, and other essential materials are driving up prices and slowing down construction. In a nutshell, supply disruptions and trade policy are increasing both the price of homes and mortgage financing, further reducing demand.

Effect on Buyers and Sellers

The net result is a more balanced market – or perhaps a standoff. Numerous potential buyers are holding back because of the high cost of mortgages and uncertainty in the economy, thus having greater negotiating leverage. Sellers, therefore, have to reduce prices or provide inducements to seal deals. Meanwhile, the inventory of houses for sale isn’t overwhelming the market: owners are afraid to put their homes on sale since they are tied to extremely low pandemic-era mortgage rates and don’t want to lose that cheap money. The market is caught between hesitant buyers and reluctant sellers. This tension is likely to keep sales volumes low, despite only modest price declines.

Most experts now expect only mild price corrections. Forecasts suggest slight home-price declines of 1–1.5% over the next year. The era of double-digit annual price gains appears to be over, but a crash is not in sight. What’s unfolding is shaping up less as a crazed seller’s market and more as a regular market where buyers can haggle and sellers must bid. Whether this moderation is merely a course correction or the setup for a sharper decline will be determined by the overall economy. Meanwhile, homebuyers and sellers alike are adjusting to the new reality of higher rates, increased inventory, and persistent economic headwinds.