It’s a headline that, just a few years ago, might have felt like a fantasy: an Indian taxi network, nationwide, owned and managed by its drivers, funded by iconic cooperatives, poised to reshape the way people move across cities big and small. Yet here we are, staring straight at the imminent arrival of Sahkar Taxi, a bold, cooperative alternative to the Silicon Valley-powered ride-hailing giants Ola and Uber. But how did this idea gain traction? What’s really at stake for drivers, passengers, and the transport system itself? Let’s open the doors, quite literally, on this new ride.

What Is Sahkar Taxi? The Cooperative Model, Unpacked

At its core, Sahkar Taxi isn’t just another taxi company. It’s a cooperative society, which means this: ownership, management, and profits aren’t decided in San Francisco boardrooms or by remote investors. Every driver is a member, yes, an actual stakeholder, with a say and a share in how the business runs and grows. It’s grassroots, not top-down.

Funny thing is, while the concept might sound revolutionary for the taxi world, India knows cooperatives well. From the dairy sector’s Amul model to banking, housing, and retail, cooperatives have boosted financial inclusion and local prosperity for decades. The vision now? Apply this principle, “Sahakar se Samriddhi” (“prosperity through cooperation”), to a tired, often exploitative, ride-hailing industry.

The Players Behind the Wheel: Who’s Funding and Running This Service?

Make no mistake, Sahkar Taxi isn’t a small-town experiment. It’s bankrolled by a coalition of India’s eight heavyweight cooperatives. Names that make any business insider perk up:

- The National Cooperative Development Corporation (NCDC)

- Indian Farmers Fertilizer Cooperative Ltd (IFFCO)

- Gujarat Cooperative Milk Marketing Federation (GCMMF, makers of Amul)

- Krishak Bharati Cooperative Ltd (KRIBHCO)

- National Dairy Development Board (NDDB)

- National Bank for Agriculture and Rural Development (NABARD)

- National Cooperative Exports Ltd (NCEL)

- Several others in allied sectors

With ₹300 crore (about $36 million) in authorized capital, the service has already started onboarding drivers, regions like Delhi, Gujarat, Uttar Pradesh, and Maharashtra. There’s zero government equity, funds come entirely from partner cooperatives, ensuring autonomy and member ownership. The vision is national, with a platform built for expansion.

Why Now? The Context for Cooperative Urban Mobility

Why’s India making such a big move now, after years of letting the private sector steer the ride-hailing game? Let’s break this down:

- Driver Unrest: Widespread frustration over shrinking incomes, lack of social security, and what many drivers view as unfair (sometimes opaque) commissions and penalties from big private platforms.

- Urban Mobility Needs: Demand for more affordable, accessible, sometimes localized, services, particularly in smaller towns and peri-urban areas where Ola and Uber’s presence is patchy or absent.

- Policy Shifts: With a broader push towards economic inclusion, job creation, and rural-urban balance, the government’s Ministry of Cooperation has prioritized new-age, technology-based cooperative projects for the transport sector.

Ultimately, the cooperative model is pitched as both a balm for drivers’ grievances and a new choice for passengers, and yes, as a counterweight to the market power of Silicon Valley-style tech giants.

What Makes Sahkar Taxi Different?

Let’s get specific: what stands out about Sahkar Taxi? The talk on the street is not just about “a taxis-for-less” deal. The backbone is philosophical as much as financial.

Key Features and Philosophies

- Driver Ownership: Each driver doesn’t just “use” the app; they own a piece of the business, vote on decisions, and share in its profits. Bluntly: “Be your boss” is no longer marketing fluff; it’s baked into the company structure.

- Zero Commission Model: Unlike private firms that take commissions (sometimes as high as 20–30%), Sahkar promises drivers will keep 100% of their fares. That’s a seismic shift in earnings, with only operational costs and minimal administrative fees to cover.

- Transparent Pricing Policy: No surge pricing, no last-minute “dynamic” fares. Riders and drivers know what they’ll pay and receive before they start the trip.

- Local Cooperatives in Every City: Sahkar isn’t a vague national brand: each city’s operations are overseen by a local cooperative board, closer to ground realities and customer needs.

- Multiple Vehicle Types: Not just cabs. The platform is designed for auto-rickshaws, two-wheeler taxis, and other local mobility options, tailored to India’s diverse urban landscape.

- Social Security and Well-being: A focus on including health benefits, welfare schemes, and retirement provisions for members. In other words, working as a Sahkar driver should, eventually, mean more than just a paycheck.

A Closer Look at the Driver-Owner Model

Let’s zoom in. What does it mean for drivers to “own” the business?

Here’s the kicker:

- All members have voting rights.

- Profits are divided equitably among the member-drivers, as opposed to being funneled to venture capitalists or tech giants overseas.

- Drivers help set company policies: everything from minimum fares to customer service standards to insurance offerings.

- There’s collective negotiating power for discounts (on vehicles, fuel, insurance) and direct participation in decisions about tech upgrades.

So, when you get into a Sahkar cab, you’re not just funding a corporate machine. You’re supporting your local community, often your neighbors and friends.

Benefits for Drivers: Fair Earnings and Dignity at Work

Let’s be blunt: much of the momentum behind this cooperative surge comes from dissatisfaction with current earnings models. On Ola and Uber, drivers say, costs keep rising and their share keeps shrinking. Sudden changes in compensation policies, monthly targets, or algorithm-driven penalties can gut stability overnight.

Sahkar’s promise is clear and radical:

- No commissions. No middlemen.

- All profits after basic expenses flow back to the drivers.

- Greater job security, more predictable hours, and a support system built into the cooperative structure (think credit access, training, group legal counsel).

As many drivers will tell you, dignity matters. Contested bookings, “ratings” wars, and fluctuating commissions all eat away at morale. The cooperative approach pledges a fair shot for each member and a chance to own a slice of the business they build.

All About the Passenger Experience

But what about you, the rider? How does Sahkar Taxi’s “people-powered” network compare to the tech titans?

- Affordability: Transparent, standardized rates. No shocks at checkout, no last-minute surges when it starts raining.

- Reliability: Local roots mean drivers know their towns deeply. More familiar faces usually have better city knowledge. Early pilots stressed clean vehicles and courteous service, with strict standards set by each cooperative region.

- Choice: Want to ride a scooter? Prefer an auto? Sahkar’s expanded fleet options make it easier to pick what fits your needs and your budget.

- Simplicity: The booking app, built for mass usage, is designed to be intuitive and lightweight, ideal for users new to ride-hailing tech or living in regions with limited digital infrastructure.

Sahkar’s pitch isn’t for those seeking luxury or AI-driven matching; the target is broader inclusion, reliable basics, and a touch of local community trust.

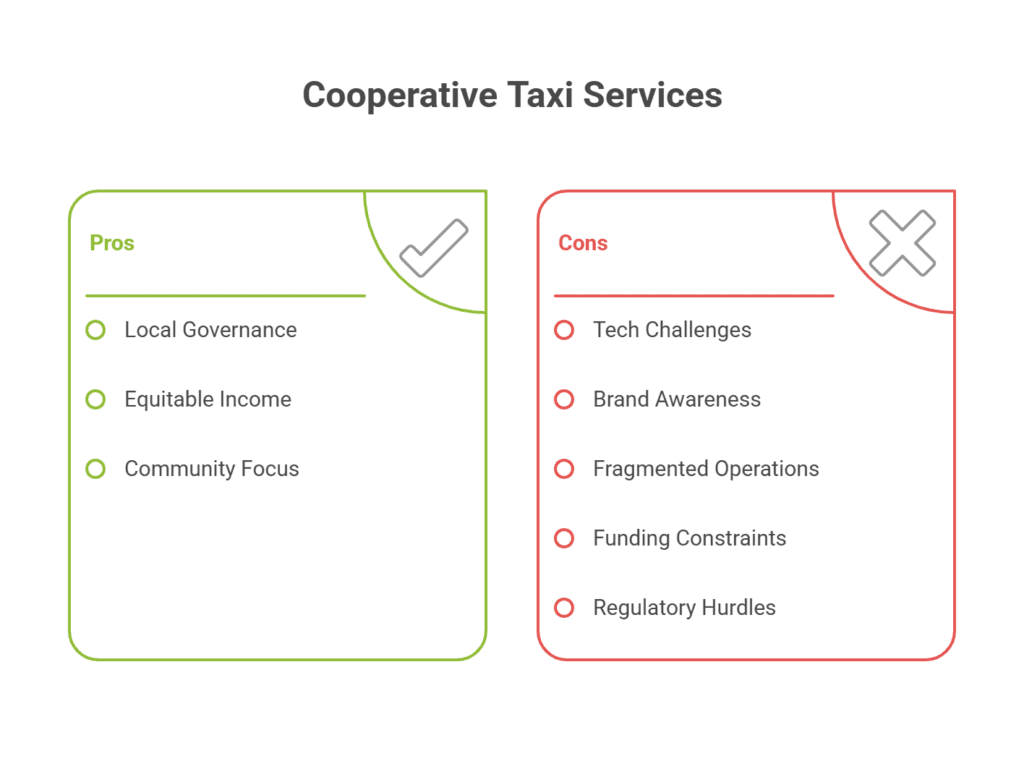

Challenges Facing Cooperative Taxi Services

Here’s where things get tricky. As inspiring as the cooperative model may be, it faces tall hurdles, some old and some new:

- Scaling and Tech Infrastructure: How does a member-run, locally managed cooperative build and maintain reliable booking apps, route algorithms, and customer service ops on par with the tech-rich portfolios of Ola and Uber?

- Brand Awareness and Customer Trust: Changing habits takes time. Many urban Indians see convenience and seamless payments as non-negotiable. Sahkar has to win hearts and wallets against entrenched brands.

- Fragmented Operations: The strength of hyper-local governance can also be a weakness. Without national scale efficiencies, cooperatives may struggle to offer standardized services or coordinate peaks in demand across regions.

- Funding and Profit Priorities: Cooperatives tend to prioritize equitable income over profit maximization, which can limit reinvestment in quality upgrades, driver incentives, and tech improvements.

- Regulatory Burdens: Navigating India’s state-by-state regulatory maze is no small task, especially as laws and taxi norms can vary wildly.

It’s a tall order. But the hope, insiders say, is that the unique strengths, community ownership, flexibility, and price fairness, will balance out these inherent headwinds.

Will Sahkar Taxi Rival, or Complement, Ola and Uber?

Here’s what’s intriguing: while some frame Sahkar Taxi as a “direct challenge” to private ride-aggregators, many analysts believe the ecosystem will simply become more diverse.

- Sahkar’s Strengths: Localized, affordable, community-centered rides, especially in smaller cities and towns where national players are weak or absent.

- Ola/Uber’s Strengths: Advanced tech, dynamic pricing, vast marketing, and 24/7 support in metros and high-demand corridors.

The likely scenario? Not a winner-takes-all. Instead, both models could grow in parallel, serving different segments of India’s giant and complex transportation market. Cooperation, even active partnerships, aren’t off the table, especially as urban mobility needs explode.

Technology, Pricing, and Service Features

Let’s dig into some specifics.

- The App: Designed for widespread accessibility and able to function with basic smartphones and slower internet, critical for inclusion.

- No Surge Pricing: Prices stay steady, rain or shine, rush hour or not, a major difference from the algorithmic pricing of big private apps.

- Expanded Services: Besides standard cabs, Sahkar Taxi incorporates bike taxis and auto-rickshaws, linking underserved areas and boosting last-mile connectivity for millions.

- Payments: Digital payments are supported, but there’s recognition of India’s ongoing cash economy, cash rides, local wallets, and other options are kept alive.

- Quality Standards: Local cooperative boards handle driver vetting, training, and standards enforcement, raising the bar on service consistency in theory.

Scaling Up: From Local Pilots to National Rollout

The plan is serious. Early pilots in Delhi, Gujarat, Maharashtra, and Uttar Pradesh are laying the foundation. Expect slow, deliberate expansion, with a focus on city-by-city launches led by local cooperatives. The network will grow in concentric circles, from nearby towns, secondary cities, and, over time, nationwide coverage.

Driver recruitment is ongoing. Cooperative partners are funding app development, fleet upgrades, and community outreach. The stated aim: to have a robust presence in the largest 50 Indian cities within the next 24 months, with national operations by 2025’s end, or sooner if early results are encouraging.

The Broader Impact: Economic Inclusion & Local Development

For policymakers, the cooperative taxi experiment holds meaning well beyond transit. Here’s why:

- Driver Welfare: Wage fairness, predictable schedules, and access to group benefits (insurance, loans, retirement funds).

- Community Wealth: Profits stay local, circulating in regional economies instead of being siphoned to platforms headquartered in other countries.

- Financial Inclusion: With India’s vast informal sector, cooperatives can bring more drivers into the formal banking, insurance, and social welfare net.

- Women’s Safety & Inclusion: Women-led cooperatives or women-exclusive fleets could expand safe, dignified work opportunities for female drivers, a persistent challenge in the male-dominated gig economy.

- Sustainable Growth: By experimenting with clean vehicles, pooling models, and reducing empty rides, community-driven policies can align better with local environmental needs.

Future of Mobility in India: Can Competition and Cooperation Coexist?

Ultimately, Sahkar Taxi’s arrival is both a statement and a challenge:

- Statement: That India’s economic future can, and perhaps should, be built on community-driven, inclusivity-first models, not just winner-take-all tech capitalism.

- Challenge: To both private and public sectors, to keep innovating, whether through smart technology, new policy frameworks, or by putting people, not just profits, at the heart of mobility.

Believe it or not, this “taxi story” is about so much more than a cheap ride across town. It’s about the dignity of work, the democratization of city life, and the sometimes-bumpy road toward a more equitable, yet still dynamic, urban economy. The road ahead is long. But, if I’m honest, with cooperatives taking the wheel, it just got a bit more interesting, and, for millions, a lot fairer.

Keywords for SEO: Sahkar Taxi, cooperative taxi service India, driver-owned taxi platform, Ola vs Sahkar, Uber competitors India, local urban mobility, democratic ride-hailing, taxi cooperatives, affordable taxi India, driver welfare, zero commission taxi, community-owned transport, Indian transport coops, Sahkar se Samriddhi, NCDC taxi initiative, Amul cooperative benefits

Published by Truthupfront. This article is independently produced, fact-checked, and based exclusively on verifiable public records and statements from official sources, participating cooperatives, and sector analysis as of August 2025.