The financial scene tends to report headlines that can, quite literally, leave one stopping in one’s tracks and reaching into their wallet. A recent example is the Reserve Bank of India (RBI) suspending the printing of ₹2, ₹5, and ₹2000 notes, rendering them useless, which is a classic case in point. Such statements immediately create confusion and unnecessary fear among the public. It is crucial to clarify the actual situation and understand the nuanced approach the RBI is taking with India’s currency.

To set the record straight right from the outset, the Reserve Bank of India has indeed ceased the printing of ₹2, ₹5, and ₹2000 banknotes, a fact confirmed by its 2024-25 Annual Report. However, and this is the vital distinction, these notes remain legal tender. This implies that they are still legal for all purposes, can be credited to bank accounts, and can be traded. The misunderstanding usually arises from historic incidents, such as the 2016 demonetisation, when some notes were suddenly deprived of their legal tender status. The scenario now is very different; it is a strategic realignment in currency management and not a cancellation of current notes. The public reaction to such releases depends greatly on the framing of such announcements, and having a clear distinction about stopping printing or removal from circulation and demonetisation is extremely important to prevent unwarranted fear. This analysis seeks to speak above the din, offering a comprehensive study of the RBI’s recent currency management updates. It explores the particular reasons for these changes, their economic implications as a whole, and what they can mean for people living their everyday financial lives.

Indian Rupee Notes – Status at a Glance

In order to provide instant clarity regarding the status of different denominations of the Indian Rupee, the table provided below gives an overview of their current printing and legal tender status, along with important facts. This is a quick reference for clearing certain misconceptions.

| Denomination | Printing Status | Egal Tender Status | Key Facts |

|---|---|---|---|

| ₹2 | Stopped since 2024-25 | Yes | Shift towards coins for this denomination. |

| ₹5 | Stopped since 2024-25 | Yes | Shift towards coins for this denomination. |

| ₹2000 | Stopped since 2018-19; formally withdrawn from circulation May 2023 | Yes | 98.26% returned as of May 31, 2025; accepted at RBI Issue Offices and via India Post. |

| ₹500 | Continuing | Yes | Dominant note in circulation; increased counterfeiting detected. |

The ₹2000 Note: A Phased Exit, Not a Sudden Demise

The launching of the ₹2000 note in November 2016 was a done deal, aimed directly at filling the huge cash deficit generated by the demonetisation of ₹1000 and ₹500 denomination notes. It was a strategic decision, one that was intended to inject high-denomination currency quickly into the system and ease the short-term cash shortage.

But the life of this higher denomination note was fairly short-lived. The RBI’s avowed reason for withdrawing the ₹2000 note was that the initial aim of launching it had been fulfilled as soon as enough amounts of other denominations were in circulation. Surprisingly, the printing of ₹2000 notes had already stopped much earlier, in 2018-19, suggesting a planned phasing out instead of a sudden move. Its official announcement of withdrawal in May 2023 was thus a natural follow-up to this long-term plan. The central bank also referred to the scarce usage of the ₹2000 note for regular transactions and the fear of its hoarding potential as factors in withdrawing it. This proves that large-denomination notes, although beneficial to certain economic aims, remain open to ongoing assessment regarding their utility and the risks related to them within the overall currency management system. The central bank actively controls the risk and utility profiles of various denominations, and it has been proposed that future high-denomination notes, if issued, could also have a pre-determined or limited useful life.

The process of withdrawal of the ₹2000 note has been stunningly effective. As of May 31, 2025, a staggering 98.26% of the ₹2000 banknotes issued at the time of announcement of their withdrawal (amounting to ₹3.56 lakh crore on May 19, 2023) have been successfully brought back to the banking system. This leaves only about ₹6,181 crore worth of these notes outstanding as of that date.

For those who still have ₹2000 denomination, it needs to be emphasized that they are still legal tender. Although the facility for exchange or deposit at normal banking branches ended on October 7, 2023, other options are open. These notes can be exchanged or deposited at any of the 19 specified RBI Issue Offices. In addition, for public convenience, the notes can be sent through India Post to any RBI Issue Office, and the value credited to the sender’s account directly. In this way, the people are not kept in a dilemma if they find these notes later.

One major positive effect of the demonetization of ₹2000 notes has been its deterrent effect on counterfeiting. Identification of spurious ₹2000 banknotes in the system witnessed a whopping 86.52% decrease in 2024-25, from 26,035 pieces to a paltry 3,508. This steep decline indicates that the withdrawal successfully put paid to the activities of counterfeiters operating against this high denomination. This result underscores that currency policy is a dynamic, iterative process. The first introduction of the ₹2000 note was a response to a post-demonetisation cash shortage, but later withdrawal was a curative action to counter rising issues such as hoarding and, ultimately, to fight counterfeiting better. One problem’s solutions tend to create additional problems that need to be monitored and realigned on an ongoing basis in currency management.

The Silent Shift: Why ₹2 and ₹5 Notes Are No Longer Printed

The RBI’s latest Annual Report asserts that the printing of ₹2 and ₹5 notes has stopped. Nevertheless, much like the ₹2000 note, it is important to realize that these lower denomination notes are still legal tender. As such, any ₹2 or ₹5 notes floating around are still acceptable for all transactions.

This change in strategy is not a matter of phasing out these values from the currency system but rather a move towards coins for these values. Statistics from 2024-25 indicate a clear trend: the number of coins in circulation grew by 3.6%, and their value grew by 9.6%. Particularly, ₹1, ₹2, and ₹5 coins altogether represent a large part of all coins in circulation, aggregating more than 81% by volume. This shows their global acceptance and use in day-to-day transactions. The RBI’s “Clean Note Policy” also brings this about more forcefully, specifically prohibiting banks from rejecting small denomination notes and coins presented at their tellers, reaffirming their ongoing legal status and practical significance.

The economic rationale underpinning this shift away from notes and towards coins for smaller denominations is based on economic efficiency and longevity. Lower denomination banknotes, like ₹2 and ₹5, have very high circulation velocity. They get exchanged rapidly, resulting in quick wear and tear. This requires more frequent printing, which subsequently contributes to higher costs of security printing and logistics for the central bank. Coins, although possibly having a greater initial minting cost, provide much better durability and much longer life. This makes them a more economical option in the long term for denominations that are being handled constantly. This strategic emphasis on maximizing the physical currency supply is reflective of the RBI’s interest in a more sustainable and economically efficient currency management system, essentially cutting the central bank’s own “shoe-leather cost” of printing and replacing worn-out notes.

Additionally, this trend towards coins for small amounts, together with the speeding up of digital payments, quietly affects consumer behavior. Though coins are resilient, they are also heavier to carry in large numbers than banknotes. When presented with a handful of coins for tiny transactions, the ease of a speedy QR code scan or a swipe of a card becomes ever more tempting. This produces a virtual reflex push away from the distinctly cash-centric micro-transactions. This is part of a more general, long-run attempt to induce a transition towards digital substitutes, which can have more traceability and help formalize economic activity.

The ₹500 Note: India’s Currency Backbone (and Its Challenges)

The ₹500 note is the undisputed workhorse of India’s currency in circulation. It has a whopping 86% share of the aggregate value of banknotes and 40.9% of the aggregate volume. Its omnipresent usage in everyday transactions, ranging from minute purchases to sizeable transactions, only reinforces its pivotal position in the Indian economy.

Yet this very dominance poses a formidable challenge: susceptibility to forgery. While the overall counterfeit detection in the banking system declined marginally, spurious ₹500 notes defied this trend with a disturbing rise of 37.3% in 2024-25. About 1.18 lakh spurious ₹500 notes were found, a significant rise from 85,711 in the previous year, the highest in six years. This renders the ₹500 note a priority target for counterfeiters and criminal elements, particularly given that hoarding a large amount such as ₹10 lakh cash can be done with just 2,000 ₹500 notes. This is an example of the double-edged sword of a dominant note: while it provides convenience for legal transactions, its popularity and high value also render it more naturally appealing to criminal use. The central bank is presented with a delicate balance between handling this efficiency and the high risks.

It is necessary to dispel a consistent rumour on social media: the assertion that the RBI plans to prevent ATMs from distributing ₹500 notes by September 30, 2025. This assertion is false and has been directly refuted by authoritative sources, including the PIB Fact Check unit of the government, which stated that ₹500 notes are not withdrawn and continue to be legal tender.

What the RBI has done, by a circular dated April 28, 2025, is instruct banks and White Label ATM Operators to enhance the availability of lower denomination currency notes, i.e., ₹100 and ₹200, in ATMs. The directive requires 75% of all ATMs to be set to dispense ₹100 or ₹200 notes from a minimum of one cassette by September 30, 2025, and this must increase to 90% by March 31, 2026. The aim, as stated, is to provide greater public availability of these widely used denominations for everyday transactions. This strategy is a classic example of the strategic application of “nudges” in public policy. Whereas demonetisation is a blunt, top-down fiat that has the potential to lead to massive disruption, the RBI is nudging more subtly. By putting substitutes such as smaller currency in circulation, it induces the transformation in transactional habits in a piecemeal manner without the explicit curtailment. This points to a more advanced and less painful transformation of currency management, in recognition of the “shoe-leather costs” and looking to an easier glide path towards a reduced-cash economy.

Yet, encouraging lower denominations has its own practical and economic implications. It costs more than ₹8 to print five ₹100 denomination notes, realizing the worth of a single ₹500 denomination note, and this is much higher than the roughly ₹2.30 it takes to print one ₹500 note. Also, smaller denomination notes degrade faster as they are circulated more, hence they need to be replaced more often. Logistically, recalibrating the country’s vast ATM network to dispense smaller notes is a massive and costly undertaking, estimated at around ₹100 crore a year for ₹100 notes back in 2018. Such a shift would also mean ATMs running out of cash more quickly, demanding more frequent refills, increased cash van trips, and higher security costs. For citizens, this might mean greater “shoe-leather expenses”—time and effort in dealing with cash, like more trips to the ATM and longer lines. The nudge towards smaller denominations is therefore there, but the efficiency of the ₹500 note for the banking system and convenience for most transactions cannot be denied.

Beyond Physical Cash: The Evolving Landscape of Indian Currency

Though talks usually center on physical currency, the changing phase of Indian currency cannot be considered complete without crediting the remarkable progress in digital payments.

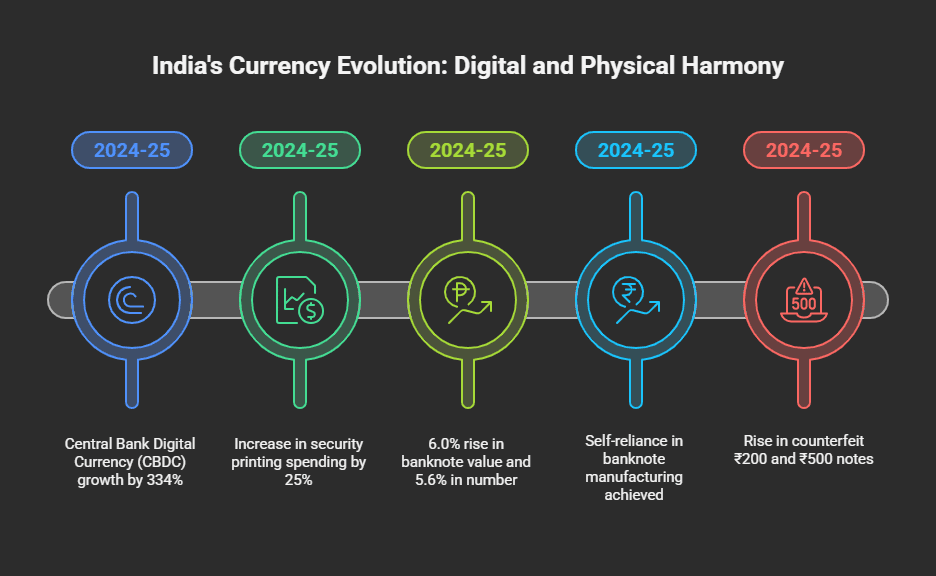

The Central Bank Digital Currency (CBDC) of India, the e₹ (e-Rupee), has seen incredible growth with its value in circulation rising phenomenally by a staggering 334% between 2024-25. This phenomenal growth indicates increasing usage and the RBI’s firm commitment to going digital in the future when it comes to finance. Surprisingly, the digital ₹500 became the most frequently used among digital notes, reflecting the popularity of its physical equivalent.

In a paradoxical twist, despite the hastening rise of digital currency, the RBI’s spending on security printing for physical notes increased in a big way as well. It increased to ₹6,372.8 crore in 2024-25, which was virtually a 25% jump from the last year’s ₹5,101.4 crore. The reason for this spike is largely due to a higher demand for fresh banknotes. This poses an interesting paradox: while strong growth in digital currency is happening, there is an increasing demand for physical cash. This indicates that India’s payment system is not a straightforward zero-sum game wherein digital displaces cash in totality.

It indicates a bifurcated or growing demand wherein various segments of the economy and various types of transactions are still dependent quite significantly on cash, even as digital uptake increases. The RBI will thus have to regulate and innovate on both sides—physical and digital—to meet the varied and increasing demands of its extensive economy. No cashless society is shortly; instead, a complementary hybrid system is taking shape.

General trends concerning currency circulation are also reflective of this complexity. In spite of the digital thrust, the combined value and number of banknotes in circulation still increased by 6.0% and 5.6% respectively in 2024-25. This highlights that physical currency continues to be a part of the economy and won’t vanish within an instant. Additionally, lower-denomination notes such as ₹10, ₹20, and ₹50 remain vital, together counting for 31.7% of the total banknotes in circulation by volume, demonstrating their significance for day-to-day transactions.

The RBI is not stagnant in its method; it is continuously modernizing India’s currency landscape. This entails the ongoing release of new and enhanced security features for banknotes. One of the most impressive feats is the total self-reliance in banknote manufacturing, with all major raw materials now domestically sourced. This is an important milestone towards national security and economic autonomy. The central bank’s “Clean Note Policy” guarantees that good-quality notes are being circulated, requiring banks to distribute new notes and coins and replace dirty or mutilated ones without refusal. New projects such as the ‘Sa-Mudra’ project are designed to make currency handling more efficient, covering sorting, counting, and tracing. New regulations for sorting machines for notes, to be BIS-approved from November 1, 2025, will further ensure efficiency and security. To ensure wider public access to small denomination coins and to help visually impaired people, the RBI is also operating Mobile Coin Vans, Coin Melas, and encouraging the use of the ‘MANI’ app.

The war against fake currency is a continuing, evolving one. While the overall detection of spurious Indian Currency Notes (FICNs) in the banking system declined marginally in FY25 from FY24, what’s significant is the change in counterfeiting trend. The successful demonetization of the ₹2000 note resulted in a steep decline in its fakes. Yet the criminals are resourceful, and this has manifested in the rise of counterfeit ₹200 (13.9%) and, as already mentioned, a large rise in counterfeit ₹500 notes (37.3%). This shifting trend reflects currency security to be an ongoing arms race. Policy interventions, although successful in reducing one danger, tend to drive the criminals in search of fresh weaknesses. This requires persistent watchfulness, persistent innovation in security features, and strong detection and enforcement mechanisms as part of the central bank’s core activity.

Conclusions and Future Outlook

The latest news from the Reserve Bank of India on ₹2, ₹5, and ₹2000 denominations, among general currency management trends, presents a scenario of a dynamic and well-managed financial system. It is important to note that even though the printing of ₹2, ₹5, and ₹2000 notes has been stopped, and the ₹2000 note has been recalled from circulation, all three denominations are still legal tender. They can still be used for payments, and the ₹2000 notes are yet to be deposited or exchanged at specific RBI Issue Offices.

The RBI’s move indicates a high-level dual mandate in currency management. The central bank is not sacrificing physical cash; it is instead maximizing its function alongside promoting digital substitutes. This manifests as the strategic phasing out of less efficient physical notes, vigorous promotion and outstanding growth of the e₹, and ongoing efforts to provide the integrity, security, and sufficient availability of physical cash, especially important smaller denominations. The constant battle against counterfeiting by innovation and becoming self-reliant in banknote manufacturing further reiterates this holistic approach. This realistic strategy recognizes India’s complex economic environment, where digitalization is increasing but cash still cannot be avoided for significant parts of the population. The future of India’s money is probably a complementary hybrid model, rather than an all-cashless one, requiring both physical and digital currency expertise to excel from the RBI.

In the future, more and more gentle urging towards digital payments can be expected. The goal is to get transactions finer-grained and traceable, which has big payoffs in terms of transparency and the formal economy. Physical money will certainly persist, but its function and the varieties of notes used in everyday transactions could change. Smaller notes and coins will likely become even more widespread for small-value, everyday transactions, with larger notes used less often or for highly specialized purposes. The social effect of this currency development is also significant. Although the transition to digital and lower physical denominations is more efficient for the central bank as well as more transparent, it is also likely to bring friction to citizens and small businesses, such as dealing with cash or adjusting to newer digital platforms. The RBI’s efforts, including Mobile Coin Vans and the MANI app, reflect sensitivity to these possible pitfalls and a determination to ward them off so that all sections of the population have an easier time adapting. Eventually, these developments should promote a more sound, secure, and transparent financial system for all Indians.