A Pledge from the Red Fort

Picture this: August 15, 2025. Independence Day sunlight splashing across the turrets of Delhi’s Red Fort. Prime Minister Narendra Modi steps up to the microphone, his words slicing through the air like confetti, except these weren’t just ceremonial platitudes. Instead, he delivered a promise so sweeping it sent ripples through India’s bustling markets, boardrooms, and every home: “This Diwali, I am giving everyone a great gift, a next-generation GST reform. Taxes on common goods and services will be significantly reduced.”

So what, exactly, is changing? And why does it matter right now?

GST: The Bedrock of India’s Tax System

Let’s rewind a bit. India’s Goods and Services Tax (GST) was first introduced for the nation in July 2017. The idea? Sweep away the patchwork of complicated state and central taxes, streamline compliance, and, believe it or not, make life easier for both consumers and businesses.

Fast-forward eight years. While GST brought benefits like a single national market and improved ease of doing business, the system hasn’t been all sunshine. There are currently five main tax brackets: 0%, 5%, 12%, 18%, and the towering 28% reserved for luxury goods and “sin” items. Some essential household products, think ghee, snacks, even plain soaps, still attract a hefty 12% tax. Small businesses often complain about compliance headaches. Ordinary families grumble about why necessities must be taxed so high.

Modi’s Diwali Promise: The GST Overhaul

Flush with Independence Day energy, Modi pledged something bold: a “next-generation GST reform.” He called it a “double Diwali” for the nation, especially for the average household and small business owner.

What’s Likely to Change

Based on signals from government sources, industry insiders, and recent meetings:

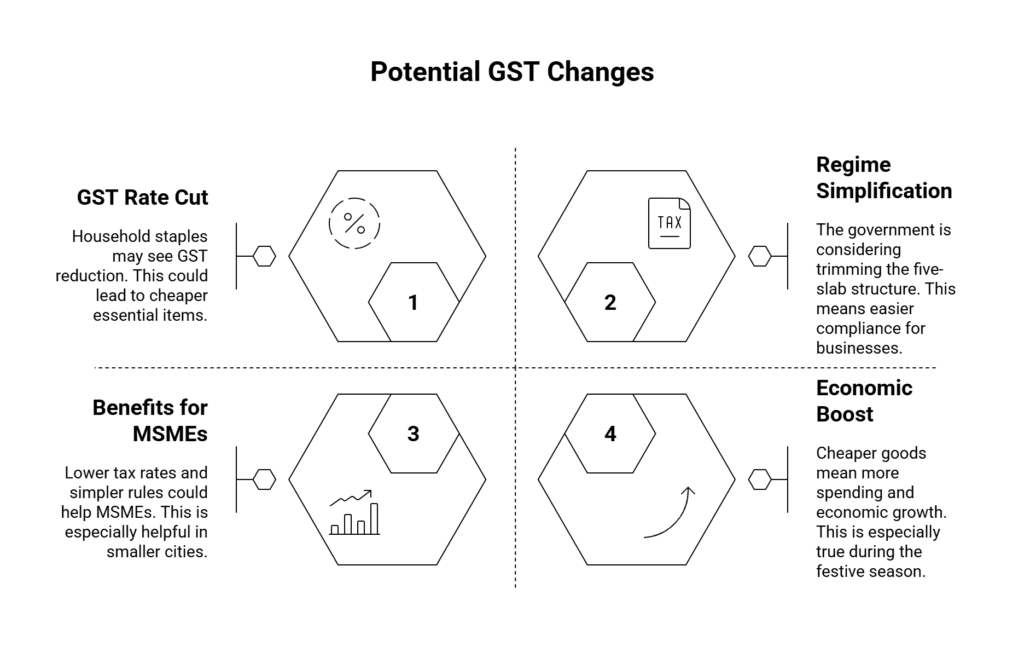

- A major cut in GST rates on household staples: The controversial 12% slab might vanish altogether. Essential items, like food products, cleaning supplies, and personal care staples, could shift down into the 5% bracket. That means products you buy nearly every day could get a lot cheaper by the time you’re lighting diyas this Diwali.

- Simplification of the multi-slab GST regime: The government is quietly considering trimming down the five-slab structure. Fewer tax brackets mean easier compliance. Fewer “gray areas.” Less confusion, less paperwork for business owners and professionals.

- Benefits for small businesses and MSMEs: Modi specifically referenced micro, small, and medium enterprises (MSMEs), the backbone of India’s economy. Lower tax rates and simpler rules could help thousands of shopkeepers, manufacturers, and traders, especially in smaller cities where regulatory burdens often bite hardest.

- Boost for consumption and the broader economy: Cheaper goods mean more spending, especially with the year’s biggest festive season around the corner. That could mean a fresh wind in the sails for India’s economic growth

Few expected such a sweeping move this year, with the GST Council having batted away major changes in previous sessions. But the pressure has been mounting: inflation, consumer demand, and business sentiment all needed a lift.

Why Now? The Push for Change

The current GST system, while a radical improvement over the previous labyrinth, has drawn increasing criticism:

- Complexity: Five slabs, dozens of exceptions, and a mountain of paperwork have made compliance a headache, especially for smaller firms.

- High tax on necessities: Families and advocacy groups have repeatedly questioned why grocery essentials and other household items are taxed at 12% or above.

- Revenue pressures: Some states worry about losing money if rates are cut, but Modi’s administration seems intent on streamlining the system for the greater good.

Believe it or not, the GST still collects record amounts each month, demonstrating its effectiveness but also highlighting a need for balance between government revenues and consumers’ burden.

Context: How Did We Get Here?

The “next-generation GST reform” isn’t just a catchy slogan. Over the past several months:

- Leaders from various states, including the Deputy Chief Minister of Bihar, Samrat Chaudhary, have met to hammer out new proposals.

- Finance Ministry officials floated plans to replace the current four main slabs (5%, 12%, 18%, and 28%) with just two: a “standard rate” and a “merit rate.” Only luxury goods and “sin” items would continue to attract a premium levy.

- The GST Council, India’s highest decision-making body on tax matters, is expected to meet later this month. The clock is ticking. Diwali is right around the corner.

The Blueprint: Structural Reform and Rate Rationalisation

While much of the specifics remain, well, under wraps, here’s what’s cooking backstage:

- Structural reforms: Government task forces have pored over data and feedback for months. Their aim? Slash red tape, boost transparency, and make GST fairer across the board.

- Rate rationalisation: By reducing the number of brackets, compliance could become a breeze. Easier for businesses; clearer for consumers.

- Focus on “ease of living”: Modi made clear that the reforms are about more than economic statistics; they’re meant to make day-to-day life genuinely easier. That means lower prices on essentials, simpler receipts, and less hassle for everyone.

Voices from the Field: How Businesses and Households React

Here’s the kicker. Most industry leaders, including top tax experts at major firms (think EY India and others), have welcomed the proposed shakeup. They see it as:

- A way to unlock working capital, especially by correcting “inverted duty structures” that often trap business cash.

- A measure to boost exports: Rationalising GST rates can make Indian goods more competitive globally.

- A shield against global shocks: Strengthened domestic consumption helps protect the Indian economy from external turmoil.

Meanwhile, speaking to the press, consumer advocates have celebrated the promise, pointing out just how much these changes could mean for ordinary families in Tier-II and Tier-III cities nationwide.

What Does This Mean for the Common Man?

Let’s break it down. If you’re…

- A shopper: Expect lower prices on daily-use products right in time for Diwali. That includes everything from cooking oil to soap, maybe even your favourite snacks.

- A small business owner: Lower slabs mean easier compliance. Fewer forms to wade through, fewer sleepless nights over tax filings.

- An entrepreneur or manufacturer: Reduced rates could free up working capital and make life simpler on both sales and purchasing fronts.

The Road Ahead: What’s Next?

The government isn’t acting alone. All major changes to India’s GST must pass through the GST Council, a body that brings together central and state leaders to ensure a collective decision.

- Meetings are set for later this August. Watch for major announcements and formal decisions.

- Implementation could start in time for the festive season, just as families gear up for Diwali celebrations.

Potential Hurdles: Revenue and State Concerns

Let’s not forget: some states have hesitated. Fear of revenue drops has made certain leaders urge caution. Still, the central government seems prepared to negotiate, perhaps by tweaking compensation formulas or making up the difference in other ways.

A New Chapter for GST

Eight years ago, the launch of GST marked one of the most radical changes in independent India’s tax history. This year, Modi’s “Diwali gift” offers the possibility of another sea change: one that could ease financial pressures on families, remove friction for businesses, and inject new energy into the country’s vast economy.

Key Takeaways

- A major cut in GST rates is expected for household staples; the 12% slab may be abolished, with essentials moving down to the 5% bracket.

- Streamlining of the currently complex multi-slab regime, potentially moving toward just two primary brackets.

- Benefits for small businesses: less compliance, more working capital, and increased competitiveness.

- Possible boost for India’s economy, cheaper goods, increased consumption, and stronger exports.

- Watch for decisions at the next GST Council meeting, likely before Diwali.

Likely Timeline

- Late August 2025: GST Council to discuss, debate, and decide specifics.

- September–October 2025: Implementation plan announced, rates adjusted, notifications issued.

- Diwali 2025: New GST rates become effective, bringing immediate relief to households and businesses.

Conclusion: New Hope for “Naya Bharat”

As dusk gathers over Delhi’s Red Fort, Modi’s promise takes on the air of possibility. For the first time in years, the GST structure, often seen as a source of confusion and frustration, could become an engine of relief, and maybe, just maybe, celebration.

If you’re gearing up for Diwali, expect not only lights and sweets, but a little extra in your pocket. GST reform isn’t just a headline; it’s set to become the newest chapter in how India lives, shops, and builds its future.