Believe it or not, there are major shifts in the offing for Indian finance. In a development that sounds like a plot twist, Reliance’s telecommunication business, Jio Financial Services, joined hands with the world’s largest asset manager, BlackRock, to start a mutual fund business with a low-cost, digital-led playbook. The Reuters exclusive reports that Jio BlackRock Asset Management is to launch nearly a dozen equity and debt mutual funds by the end of the year, focusing on small investments and bypassing traditional distributors, the hubbub? Because this JV is taking a direct shot at the very center of India’s ₹72.2 lakh crore (approx. $844 billion) funds market. That is, it’s the coming together of the telecom disruptor and asset giant – and it might revolutionize the way Indians invest.

A joint venture with a sting in its tail

Let’s set the stage. On one side, Mukesh Ambani’s Jio – already a household name in India thanks to rock-bottom data and voice plans – is now flexing its might in finance. On the other hand, BlackRock – a Wall Street giant managing $11.6 trillion worldwide– brings global investment muscle (and its sophisticated Aladdin analytics platform). Together, Jio BlackRock Asset Management is the JV feeding off Ambani’s reach and BlackRock’s heft.

According to Reuters, Jio BlackRock has applied to market regulator SEBI to launch eight new mutual funds, atop three schemes they stealthily introduced recently. These funds are not for the common big fish alone – the entry ticket is a mere ₹500 (roughly $6). Picture this: anyone can begin with loose change. The idea is to roll out almost a dozen new funds (equity and debt) by the end of this year. At the same time, small investment sizes and no middlemen are the motto. As one source described it, Jio BlackRock is “skipping distributors to save money,” basically eliminating fund brokers and agents for cost savings. In brief: no distributors, no additional fees, no malarkey.

The gigantic scale of India’s fund market

Now, why is this even a big deal? Look at the scale: India’s mutual fund business is gigantic – around ₹72.2 lakh crore (around $844 billion) in total assets’s a lot of money chasing stocks and bonds through schemes. For decades, this business had been dominated by large AMCs like SBI, HDFC, ICICI Prudential, and the like, and expanded through distribution channels (bank branches, brokers, online platforms, agents). Distributors used to earn commission when you purchase funds, but the whole structure has resulted in more fees buried in mutual funds distributed through those intermediaries.

Reducing fees by avoiding distributors.

That’s the crux of the plan. Jio BlackRock’s funds will be sold directly to investors, both individual and institutional savers. This is not hype from marketing; sources in the industry tell us it does translate into lower expense ratios. So, for instance, those ~1.78% TER funds might pay as little as 1.2% fees in a direct model, simply by eliminating the middlemen’s fee

Here’s the surprise: India’s distributors have traditionally gobbled up a large share.

Fund houses pay commissions to banks and brokers for retail schemes, and that translates into a commission cost, which ultimately the investors end up paying through fees.

(Hello, 2.5% charged threshold!) Jio BlackRock is hoping to cut below that entire hierarchy. By selling directly through Jio’s platforms (MyJio app, Jio Finance, etc.) and cutting out the middleman, there are no trail commissions or broker cuts. One company insider said bluntly: “By being direct only, Jio BlackRock plans to eliminate the cost of distribution.

All I hear from there? Cha-ching. It’s the very same playbook Jio employed in telcom back in 2016: provide huge reach + minimal pricing. Only this time, the product is mutual funds. The impact should be lower plans for investors and a massive disruption for incumbent AMCs. If Jio BlackRock’s fees are palpably lower, look for customers (and perhaps regulators) to take notice.

Jio’s disruptive legacy:

Tying up loose ends here, talking about telecom, let us recall what Jio did before this: it flipped markets on their head. Reliance Jio entered India’s saturated phone market in 2016 with ridiculously low voice and data, capturing 475 million subscribers overnight.

Within years, Jio became the largest carrier in India – all because they simply offered a lot at rock-bottom prices. The Reuters piece nods to this history: “Ambani’s Jio has been known to disrupt markets with its pricing and reach,” it notes.

Flash forward to the present, Jio BlackRock would like to apply that same template to mutual funds. Think of the “Jio effect” in finance. As Reuters notes, the JV will sell funds to a ready-made base of 8 million engaged users on Jio’s digital finance applications. That is, Jio has an inbuilt audience: millions who believe in the brand and are using MyJio/Jio Finance. Those customers become a built-in client base for mutual funds. It’s having a distribution network in place – only now it’s free.

Picture this: you pull out your Jio app and find a savvy, low-cost mutual fund to stash some money.

It’s one click away.”Selected parts of Aladdin will be provided to Jio BlackRock’s investors too,” the report adds – i.e., some premium analytics tools will even be offered to regular Indian customers. It’s consumer power, fueled by technology and a large brand.

Active vs. Passive: The Funds Mix

One quiet spin: Jio BlackRock isn’t entirely going passive, despite BlackRock’s reputation for ETFs. It will have a combination of active and passive approaches. Why should that be? Right now, the majority of Indian retail cash is still in actively managed funds (the sort where a fund manager actively chooses stocks). Passive index funds make up just about 16.8% of the market.

BlackRock, naturally, is great at passive – it controls iShares and the like, overseeing some $7.8 trillion of exchange-traded and index funds globally. Its entry into India could help bridge the gap. The Reuters report observes “passive funds are growing in India every year,” and foresees “potential for BlackRock to further build this segment”. In simpler words, Jio BlackRock may make affordable index funds trendy for Indian savers, along with providing conventional actively managed schemes.

Why is this combination wise? Because active funds continue to reign in India, yet passive is rapidly catching up (25% y-o-y growth). And by providing both, Jio BlackRock covers its bases. Young or techie investors may flock to low-cost index trackers, but others still queue up for stock-picking funds. And then support it all with Aladdin’s data-driven systems for tracking risk and returns. It’s having the best of both worlds if they play their game right.

Tech Power: Aladdin in the Mix

Let’s unpack Aladdin a bit. If you’re not into finance lingo, Aladdin is BlackRock’s secret sauce – an investment and risk management platform that big funds use to crunch market data, run scenarios, and generally help pick investments in a very analytical way. It’s a supercomputer-as-analyst. Jio BlackRock plans to leverage Aladdin for “consistent returns,” says the report.

Practically speaking, that translates into portfolio managers applying Aladdin’s analytics to everything from identifying risk to selecting sectors. More intriguingly, Reuters reports that investors in such funds could even gain access to portions of AladdinYes, you’ve read correctly: ordinary Jio BlackRock fund investors being given a glimpse of fancy-pants analytics. Crazy, right? At a minimum, it makes the offering seem utterly high-tech.

This is yet another way this JV differs. Most Indian mutual funds don’t boast an AI-level platform.

Here, the AdSpot for Aladdin is essentially saying, “We’re not merely bossing at low fees — we have smart software to support it.” It plays to the tech-image: cheap, digital, data-driven.

Key aspects of the Jio BlackRock strategy.

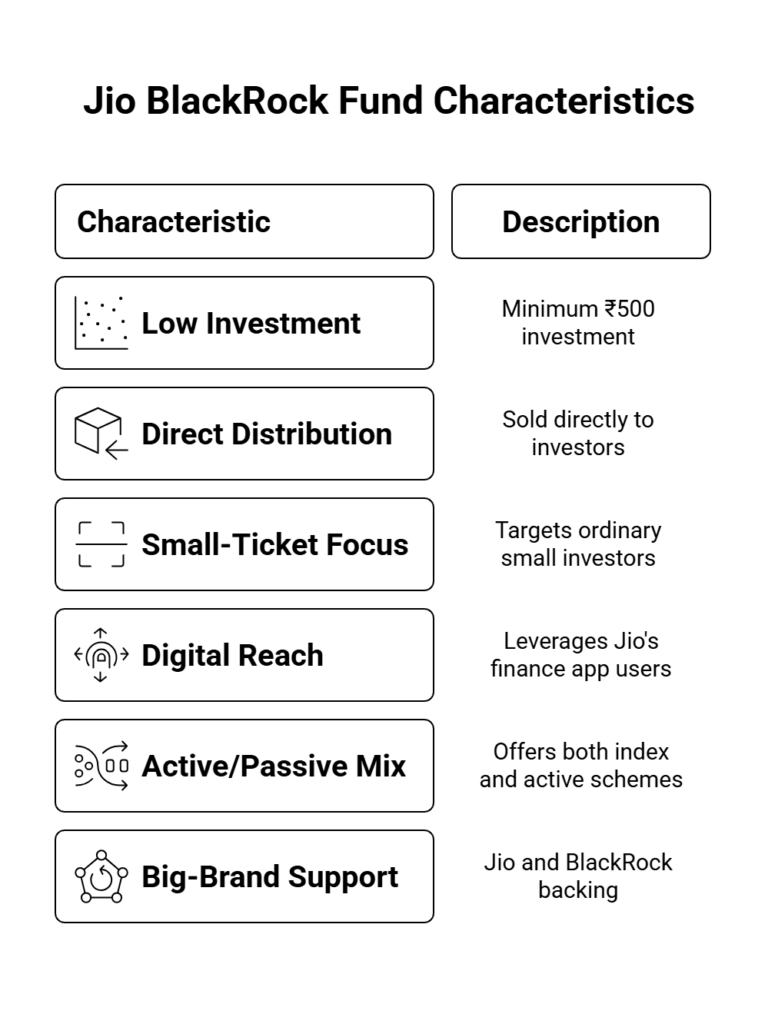

- Low minimum investment: As little as ₹500 (approximately $6) reuters.com. Even students and small savers can join.

- Direct distribution: Directly sold to investors, not through agents or banks. No trailer commissions. Lower costs across the board

- Small-ticket focus: Focus on “small-ticket investments,” i.e., ordinary small investors, not only HNIs.

- Digital reach: Leverages Jio’s 8 million finance app users. Sweet spot of a ready, active base.

- Active + passive mix: Both index trackers and actively managed schemes. Lots of choice, playing on BlackRock’s index strength.

- Big-brand support: Jio (Reliance) = trust and marketing muscle.BlackRock = worldwide AUM muscle ($11.6T). That combination itself is news.

All those bullets above are more than marketing hype –the sources at Reuters essentially corroborated everything. Together, it’s a powerful combination.

What it implies for investors (and incumbents)

Who’s celebrating (or squirming)? Well, Indian mutual fund investors ought to be fairly cheerful.

The lower the fees, the more the net returns (ceteris paribus).Access to a small size through your phone?Convenience aplenty. Who doesn’t relish a nice surprise in the morning cup of coffee, such as “Oh cool, zero-fee funds in my Jio app”?!

For traditional AMCs and distributors, the news is worse (and slightly predictable).

Put yourself in the shoes of a vintage fund house: Jio BlackRock moves in with an unmatchable cost advantage and a captive user base. You may have to rethink your pricing. Some AMCs already provide “direct” plans with lower charges, but a lot of customers still go through banks. With Ambani’s marketing oomph, Jio BlackRock may be able to poach savers. It’s like when Jio Telecom compelled all other carriers to cut prices across the board. We can expect mutual fund charges to be pressure-cooked lower, too.

There are riders. Jio BlackRock is brand-new in funds. It’s raised just $2.1 billion so far in three debt schemes, from 90 institutional and 67,000 retail investors. That’s good for a first outing, but dwarfed by the behemoths (HDFC MF alone has seen ₹15 lakh crore AUM, i.e., almost five times all of Jio’s raise). But money speaks. They’ve shown they can raise funds, so investors will see if they follow through on performance and ease of use. If those initial funds pan out, the $2.1B can turn into $21B overnight (with proper marketing!).

Keep in mind: Jio’s brand for affordable and cheap is riding on this. If the money disappoints or technology hiccups happen, trust can be lost (Jio has a great brand, but financial trust is easily lost).BlackRock’s entry is a two-edged sword as well: it gains respectability, but at the cost of high expectations.

In short: Watch the game board.

Fine, let’s conclude with a snapshot look at the game board. The Reuters story broke the news of an audacious plan: benefit from Jio’s size, deploy BlackRock’s technology, and eliminate fees. It’s a frontal attack on the “business as usual” of Indian mutual funds.

- For retail investors: It translates to more options and perhaps lower costs in the future. Look out for other fund houses cutting TERs or launching new digital platforms, just to keep up.

- For distributors/banks: They’re on notice. The JV intends to cut you out entirely for these funds. You could attempt to raise your own tech game or negotiate with AMCs on improved terms.

- For regulators (SEBI): Competition is generally good news. They will likely monitor closely but probably urge more efficiency and transparency. (By the way, SEBI still needs to approve the funds application Jio BlackRock filed)

- For the industry at large: Think of this as a mega-Mutual Fund edition of the “big new entrant” shock. It could kickstart a price war or a wave of new fintech-MF mashups.

It’s easy to talk in abstract. Here’s a human angle: Suppose you’re saving for something big – a car, education, a dream trip. You’ve been investing in a mutual fund with a financial advisor, taking a bite out of your returns as their commission. Your Jio app now tips you off to a similar fund with twice the fees cut. “Hmm, sweet deal,” you say to yourself. You click invest. The next time somebody asks you about your investment. You reply casually that, “Yeah, actually, due to Jio BlackRock, my cost is reduced, so I retain more gains!” ” That’s not finance talk, that’s actual money in folks’ pockets.

The strange thing is, all of this was hush-hush until Reuters reported it. Now it’s out there and things are going to happen quickly. Will this business shake up the sector like Jio shook up data? Only time will tell. But take note: a telecom icon and an investment giant just bet on something new.”. In the game of high-stakes poker for India’s mutual funds, the cards have turned.