For NRIs residing in the UAE as well as other countries in the Gulf, the possibility of property ownership in India has more than economic significance, but emotional value. It could be a dream house, a future retirement home, or a wise investment; the purchase of property in India is security and opportunity. And as 2025 marches ahead, market signs indicate that now might be the prime time for Gulf NRIs to strike.

Following a phase of high price hikes and booming demand, the Indian realty sector is in the process of stabilizing. For NRIs, that translates to fewer people vying for a share, greater negotiating space, and a higher rupee-to-dirham value proposition. Let us deeply explore why 2025 may prove to be a golden year for Gulf-based NRIs to purchase Indian property, with city-level trends, economic indicators, and practical buyer advice backing this up.

The Current Landscape: Why the Timing Looks Right

Market Stabilization Following Years of Sustained Growth

Between 2021 and 2023, India’s real estate market experienced double-digit annual price increases, especially in major metropolitan cities. But during 2024 and the first half of 2025, the pace has slowed. Major cities continue to grow, but at a reduced, more moderate rate, usually between 5% and 10% per year. This slowdown can be a boon to NRIs who had found themselves priced out or swamped by local competition.

Demand-Supply Shortage in Mid-Income and Budget Housing

Budget and mid-segment houses are in short supply in cities such as Mumbai, Pune, Bengaluru, and Hyderabad. This shortage of demand versus supply implies houses in these segments still hold their value. For NRIs, it’s a chance to invest in houses that should appreciate consistently over the next ten to five years.

Less Competition From Domestic Buyers

Domestic purchases have slowed down somewhat with higher interest rates and real estate prices. Consequently, more incentives are being provided by developers to encourage genuine buyers, such as NRIs possessing ready funds or secure credit lines from overseas. That ensures better chances of negotiating improved bargains.

City-Wise Trends: Where Gulf NRIs Are Buying in 2025

Mumbai and Pune

Mumbai is India’s most costly city, with an average property price currently at ₹1.5–1.6 crore. Luxury category sales have slowed down, and builders are now willing to negotiate prices. A tech park and educational belt, Pune is a sought-after alternative. NRIs are eyeing suburbs such as Hinjawadi, Baner, and Wakad for value and high rental return.

Bengaluru (Bangalore)

Sometimes referred to as the “Silicon Valley of India,” Bengaluru is the go-to destination for tech-savvy NRIs. Prices of property here have increased at a slower pace in 2025 (approximately 5–6% YoY), providing more favorable entry points. South and North Bengaluru, particularly Sarjapur Road, Whitefield, and Hebbal, are sought-after areas by foreign buyers.

Hyderabad

With good infrastructure and business growth, Hyderabad has lower entry prices and high-quality development. Areas such as Gachibowli, Kondapur, and Miyapur are experiencing consistent demand from NRIs based in the Gulf. Prices remain reasonable, and rent demand remains robust due to the expanding tech sector.

Delhi NCR: Noida and Gurugram

NCR is still a good but saturated opportunity. Price appreciation has slowed down, but infra upgradations (such as the Delhi-Meerut Expressway and Metro extensions) are keeping the interest of buyers alive. The NRIs are increasingly looking at gated communities in Noida Extension, Dwarka Expressway, and New Gurgaon.

Chennai

Chennai is growing at a slower pace than other metropolitan cities, but for NRIs from Tamil Nadu, it remains a top priority. Housing prices are stable and relatively low, while OMR, Thoraipakkam, and Porur remain areas with high returns and connectivity.

Tier-2 Cities

Urban centres such as Ahmedabad, Lucknow, Coimbatore, and Kochi are becoming popular for having affordable prices and increased rental yields (5%–6%). Such cities are being viewed more as long-term propositions, particularly for those who are not obsessed with metro returns.

The Currency Exchange Advantage

One major benefit Gulf NRIs have in 2025 is the stable and favorable rupee-to-dirham exchange rate. A weaker rupee translates into better value for money when converting savings or income into Indian real estate investments. In practical terms, it means:

- You can invest in more spacious or luxurious properties.

- You may cut down on the size of home loans.

- Even luxury homes in big cities may be within your reach now.

With the rupee also likely to continue being under moderate pressure, the trend is expected to persist, providing a real advantage to Gulf earners.

Ease of Law and Regulation for NRIs

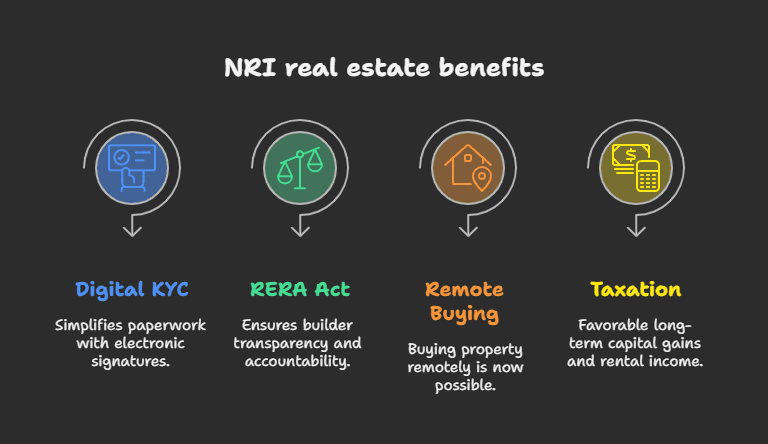

Due to digitalization and regulatory reforms, it’s simpler and more secure for NRIs to invest in Indian real estate.

- Digital KYC and electronic signatures facilitate paperwork.

- RERA (Real Estate Regulation Act) ensures transparency and accountability from builders.

- Remote property buying is possible in most Indian states these days.

- Long-term capital gains and rental income are NRI-friendly when it comes to taxation.

Always refer to a legal professional, but be sure that remote buying of property is not so risky or complicated anymore.

Home Loans and Financing for Gulf NRIs

Indian banks and NBFCs now provide dedicated home loans to NRIs with relatively competitive interest rates and minimal documentation. A few points to keep in mind:

- The loan term can be extended to 20 years.

- The interest rates are competitive (8.5% to 9.5% in 2025).

- They can be repaid using NRE/NRO accounts.

Moreover, numerous banks maintain NRI desks or relationship managers specifically for this purpose, who process the entire thing online or on Power of Attorney (PoA) terms.

Expected Returns: Rental Yield and Capital Appreciation

Investing in Indian real estate in 2025 is not merely finding a home; it’s a return. Here’s what to look for:

- Rental Yields: Average of 3–4% at the national level, but for high-demand micro-markets such as Hinjawadi (Pune), Whitefield (Bangalore), or Gachibowli (Hyderabad), it can go up to 5–6%.

- Capital Appreciation: With prices stabilizing, appreciation may be modest in the short term (5–8% annually). However, quality projects in growing corridors are likely to outperform over 5–10 years.

If you’re investing for income, look at cities with strong tenant demand (IT parks, SEZs, student hubs). If your focus is long-term value, consider fast-growing city outskirts or infrastructure-linked zones.

Practical Tips for Buying Property from Abroad

If you are in the UAE or other parts of the Gulf and would like to purchase real estate in India, the following checklist is something to bear in mind:

- Engage a local property consultant or attorney to check the title, builder reputation, and legal status.

- Utilize your NRE/NRO accounts for all financial transactions to maintain compliance.

- Make one trip to India before closing the transaction (if at all possible), or give a trusted Power of Attorney.

- Compare RERA ID-based projects and builder track record before finalizing.

- Look for gated communities or already completed projects for reduced risk and quicker possession.

With all the online property websites, video walkthroughs, and virtual site visits that are possible now, you can go through nearly the entire buying process remotely with ease.

Emotional and Lifestyle Considerations

Aside from figures, investing in property in India for an NRI is usually a very personal choice. Whether you’re providing for aging parents, planning for your return, or leaving a legacy, the emotional benefit is high.

By investing today, when the market is stable and prices are negotiable, you’re not merely acquiring some real estate; you’re planting roots.

Conclusion: Is 2025 the Right Time for Gulf NRIs to Invest in Indian Property?

Everything suggests a resounding yes. The Indian property market is experiencing a healthy correction, presenting a sweet spot to buyers: stability without stagnation. Gulf NRIs are favored by:

- Positive currency exchange rates

- Simpler regulatory processes

- Slower domestic demand (less competition)

- Better digital access and virtual buying tools

Whether you’re buying your first home in India or expanding your investment portfolio, 2025 offers one of the best windows in recent years to make your move.