US Tariffs Upend Indian Basmati Rice Trade

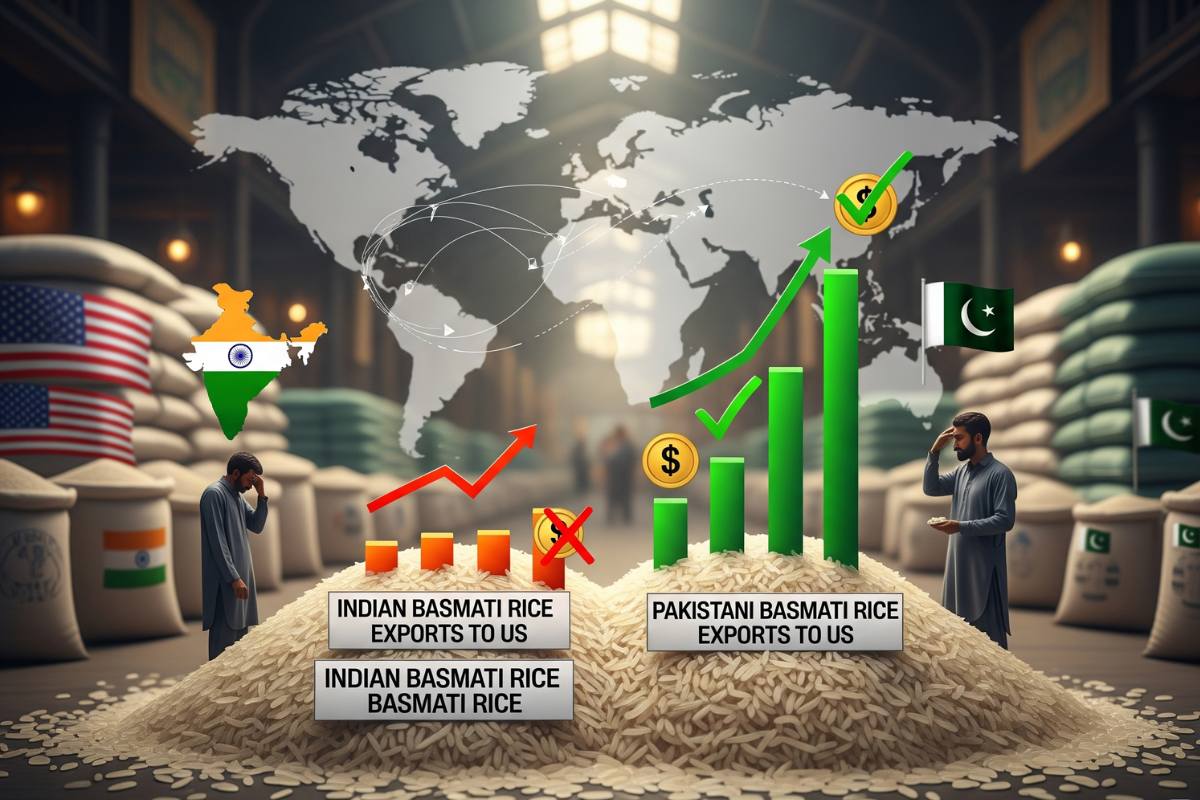

So here’s the situation. In a move that rattled global agricultural markets, and especially the iconic basmati rice industry, former US President Donald Trump raised tariffs on Indian imports to a massive 50%. Hard to overstate the impact: for Indian exporters, this isn’t just a stumbling block. It’s more like a wall suddenly erected in the middle of a highway.

And amid the shakeup? Pakistan, India’s longtime competitor in the fragrant, highly prized basmati trade. Suddenly, almost overnight, Pakistan has a meaningful advantage in the lucrative US rice market.

What Happened, and Why?

To understand what’s at stake, let’s unravel things a bit. On August 1, 2025, the Trump administration didn’t just increase tariffs for the sake of trade protectionism. The catalyst was political: India’s continued energy and defense ties with Russia, especially oil imports, amid broader tensions over the Ukraine conflict. The White House, aiming to squeeze Moscow’s revenue stream, slapped on an extra tariff penalty for Indian goods, raising import duties on Indian basmati rice from a previous 25% up to an eye-watering 50%.

And here’s the kicker: At almost the same moment, tariffs on basmati from Pakistan were cut from 29% to 19%. That’s not just a small gap, it’s a gulf.

Baseline: India’s Former Dominance

- Before these changes, India was king in the US basmati rice market.

- According to trade data, India shipped about 3 lakh metric tonnes (LMT) of basmati to the US each year, worth roughly $350 million.

- Pakistan, by contrast, exported 1.8 LMT to the US.

- Punjab, responsible for 40% of Indian basmati output, was at the heart of this trade, alongside states like Haryana and parts of Uttar Pradesh and Rajasthan.

Crunching the Numbers: Suddenly Uncompetitive

Let’s talk numbers. Before the tariff change:

- Indian basmati: $1,200 per metric tonne (MT)

- Pakistani basmati: $1,450 per MT (due to a 29% US import duty)

- After the tariff hike, Indian basmati in the US jumps to $1,800 per MT (an extra $600 from new duties)

- Pakistani basmati, after the duty cut, sits at just $1,450 per MT.

That’s a $350-per-tonne price differential. For commodity traders, that’s enormous.

What does that mean in plain English? Indian rice has become significantly and suddenly more expensive than Pakistan’s alternative. If you’re a rice importer, grocer, or South Asian-American consumer, that difference adds up fast at the checkout counter.

Exporters Scramble, Farmers Worry

It didn’t take long for anxiety to ripple through the supply chain. Industry leaders warned of an “existential threat” to Indian basmati exports:

- Small and medium exporters: Many operate on tight margins. For them, a 50% tariff isn’t a temporary hurdle. It’s an existential risk.

- Rice millers: Stocks are piling up in Indian warehouses. With US buyers retreating, there’s just nowhere to send the rice.

- Farmers in Punjab, Haryana, UP: Lower export demand means millers offer lower procurement prices. Domestic wholesale prices are already down, and local rates have dropped Rs 9 per kg in just weeks. That’s real money lost for producers.

A top official from the Punjab Rice Millers Exporters Association put it bluntly: unless the tariff situation is resolved, Indian basmati’s US market could “vanish.” The impact isn’t limited to big companies; it’s hitting the ground level, threatening decades-old business relationships and farmers who rely on basmati as a cash crop.

Why Pakistan Gains, and By How Much

Here’s where the story turns for India’s northern neighbor.

- The US tariff reduction (from 29% to 19%) makes Pakistani basmati more attractive to American buyers.

- Pakistan’s exporters, while smaller in volume, now have a window to expand and establish brands in the US grocery ecosystem.

- With India’s price advantage erased, importers and consumers may simply shift away, potentially forming new long-term buying preferences.

To make things clear:

- Indian basmati exports to the US could plummet by 50–80%. That’s not just a dent. That’s potential collapse.

- Pakistan, with new price competitiveness, could double or even triple its current export volumes to the US if American buyers switch supply sources.

US Basmati Market: More Than a Niche

You might wonder: isn’t basmati a niche product in the US? Not exactly.

- Basmati rice commands shelf space in mainstream and ethnic supermarkets across America. It’s not just South Asian families buying; the wider market for “healthy,” aromatic, low-glycemic-index rice is on the upswing.

- For India, the US is a critical buyer, historically absorbing 8–10% of total basmati exports.

If those exports disappear, the ripple effects could be felt throughout India’s rural economy. Losses among exporters, packagers, logistics firms… even the branding agencies that market the “Taste of India” overseas.

Not Just India: Interlinked Global Markets

Believe it or not, this isn’t just a tug-of-war between two South Asian nations. The global rice trade is highly interconnected:

- The US itself grows some rice, but aromatic and long-grain varieties (like basmati) are mostly imported.

- Pakistan and India are the world’s dominant basmati producers. When one falters, the other usually benefits.

- Other rice producers (Vietnam, Thailand) also export to the US, but they focus more on unrelated rice varieties.

The upshot? A shift in US basmati sourcing could change crop planning, pricing, and even trade strategies in Asia for years.

The Political Backdrop: US–India Tensions

Let’s zoom back out for a moment. These tariffs aren’t happening in a vacuum:

- The US is using trade as leverage because of India’s position on Russian oil and weapons purchases, in hopes of isolating Russia economically.

- India, for its part, maintains that its energy decisions are based on market needs. Officials in New Delhi have called the US tariffs “unfair” and even “unjustified”, an understandable response when billions are on the line.

- There’s talk of possible trade negotiations, but as of August 10, 2025, no breakthrough is in sight. Markets are bracing for ongoing uncertainty.

What About the India–Pakistan Rivalry?

India and Pakistan have always vied for global basmati dominance. This round, though, it wasn’t a matter of agricultural prowess or clever marketing. External political decisions (and, you could argue, some sheer bad luck) gave Pakistan a clear, but perhaps fleeting, edge.

Some points to consider:

- India is by far the world’s top basmati exporter, in 2024–25, shipping over 60 lakh metric tonnes worldwide versus just over 5.4 lakh tonnes for Pakistan.

- The US alone isn’t enough to make or break the entire Indian industry. Still, the loss hurts: buyers may form new habits, and market share can be hard to reclaim.

Indian Industry Response: Not Going Down Without a Fight

Is India just sitting back? Not a chance.

- Exporters’ associations and government spokespeople are pressing the US to reconsider the tariff hike, at least on agricultural products like rice.

- There are calls for financial support, export subsidies, and urgent diversification into other markets (think Canada, the Middle East, and Europe) to offset US losses.

- Brand-building, even retooling marketing for non-US buyers, is underway.

But, short-term? India’s exporters will feel a squeeze. And farmers may face pressure to switch from basmati production toward less vulnerable crops.

US Consumers: What’s Changing at the Grocery Store?

Here’s a twist. For South Asian Americans and even general rice fans in the US, there are two stark choices right now:

- Pay as much as 50% more for Indian basmati

- Switch to Pakistani basmati (or, possibly, other imported long-grain rice)

Some diaspora groups consider Indian rice a “must-have,” but price differentials of this size do tend to change habits over time. Wholesalers might favor cheaper alternatives, meaning the average consumer’s options start to look very different.

The View from Pakistan

Pakistani rice exporters see an opportunity, no doubt. Reports suggest companies are ramping up production, expanding US-facing distribution, and courting new partnerships while the competitive window is open. It’s a rare, perhaps even fleeting, moment of ascendancy in a market long dominated by their eastern rival.

Long-Term Implications: What Happens Next?

Let’s not forget the lessons of global trade. Tariffs can change, sometimes overnight, due to shifting governments, economic lobbying, or international negotiations.

Potential scenarios:

- If India and the US find a diplomatic compromise, tariffs could fall back, restoring competitive parity.

- If the current policies persist, Indian backup markets (the Middle East, Europe) will become even more vital.

- For Pakistan, the challenge will be ramping up output and quality to meet higher global demand, something that comes with its risks and potential rewards.

A broader truth? Major economies using trade policy as a geopolitical tool make for churn and volatility. Importers, distributors, and even everyday rice lovers across three continents are caught in the unpredictable crosswinds.

By the Numbers: Quick Facts

- Indian basmati to US (pre-tariff): ~$1,200 per MT

- Indian basmati to US (post 50% tariff): ~$1,800 per MT

- Pakistani basmati to US (post 19% tariff): ~$1,450 per MT

- US share of India’s total basmati exports: About 8–10%

- Punjab’s share of India’s basmati crop: 40%

Quotes from the Ground

Here’s what insiders are saying:

- “The US imported nearly 3 lakh metric tons of Indian Basmati last year, valued at approximately $350 million. The additional 25 per cent tariff poses a serious challenge to the industry, effectively increasing the total duty to 50 per cent.”, said Vice-President, Basmati Rice Miller and Exporter Association

- “If our sales decline, we will have to reduce our purchases, which will ultimately affect farmers, and they too will bear the brunt.”, President of Punjab Rice Miller Exporters Association

- “A blanket 25% tariff could not only choke current orders but push long-term buyers to look for alternatives.”, Haryana Rice Exporter

What to Watch For

- India–US trade negotiations: Any progress here could shift the calculus, and quickly.

- Consumer pricing trends: Will US buyers absorb the price hike, switch loyalties, or abandon basmati altogether?

- Pakistan’s logistics: Can their exporters meet the sudden spike in US demand, maintaining both quality and consistency?

- Indian crop shifts: If basmati acreage shrinks, the knock-on effects could ripple through rural economies and even global rice pricing.

Final Word

Global markets, political tension, and daily dinner tables sometimes connect in the most unexpected ways. Right now, a diplomatic spat thousands of miles away is sending shockwaves through Indian farmland, US grocery aisles, and Pakistani export offices.

Will Indian basmati reclaim its former US market share? Or has the field, for the first time in years, truly tilted in Pakistan’s favor? For now, the only certainty is uncertainty, and the fact that a beloved grain has become the focal point of the world’s latest trade war.

This is how geopolitics begins to take shape. And the ripple effects are just beginning.