AU Small Finance Bank Breaks New Ground in India’s Financial Sector

It’s official: on August 7, 2025, the Reserve Bank of India (RBI) granted an “in-principle” approval to Jaipur-headquartered AU Small Finance Bank (AU SFB) to convert into a universal bank. As headlines buzz and the industry takes note, this isn’t just another regulatory update. For the banking landscape in India, it’s an inflection point, the first time in nearly a decade that a small finance bank has been greenlit for universal bank status.

What Does It Mean to Be a Universal Bank in India?

Let’s pause here: what exactly does this upgrade mean? Universal banks in India, such as ICICI, HDFC, or SBI, can offer the entire array of banking services: retail and corporate banking, wealth management, investment products, large-scale lending, and so on. Small finance banks, on the other hand, primarily serve underbanked segments, focus on small-ticket loans, and face more restrictions on growth and operations.

So, for AU SFB, this step is not just a badge of honor. It’s the gateway to a whole new playing field.

The Story So Far: From Grassroots Beginnings to National Recognition

- 2015: AU Financiers, founded by Sanjay Agarwal, gets RBI approval to set up a small finance bank.

- 2017: The bank launches operations as AU Small Finance Bank, focusing on micro, small, and medium enterprises (MSMEs), low-income groups, and rural/semi-urban communities.

- 2024: After several years of strong growth, AU SFB submits its application to the RBI on September 3 under the new April 2024 framework for voluntary conversion.

- 2025: Approval comes through on August 7, making AU SFB the first in India’s small finance bank sector to reach this milestone.

The Changing Regulatory Landscape

Funny thing is, this “promotion” comes against the backdrop of evolving RBI guidelines. In April 2024, the RBI revised its rules for small finance banks looking to go universal:

- At least five years of consistent, profitable operations as an SFB.

- Minimum net worth of ₹1,000 crore.

- Gross non-performing assets (GNPA) below 3% and net NPA under 1% for the previous two years.

- Listed on a recognized stock exchange.

- Sound governance, robust compliance, and proven risk controls.

AU SFB ticked every box, something not many of its peers could claim. As of June 2025, only AU and Ujjivan Small Finance Bank actually met all metrics needed for consideration.

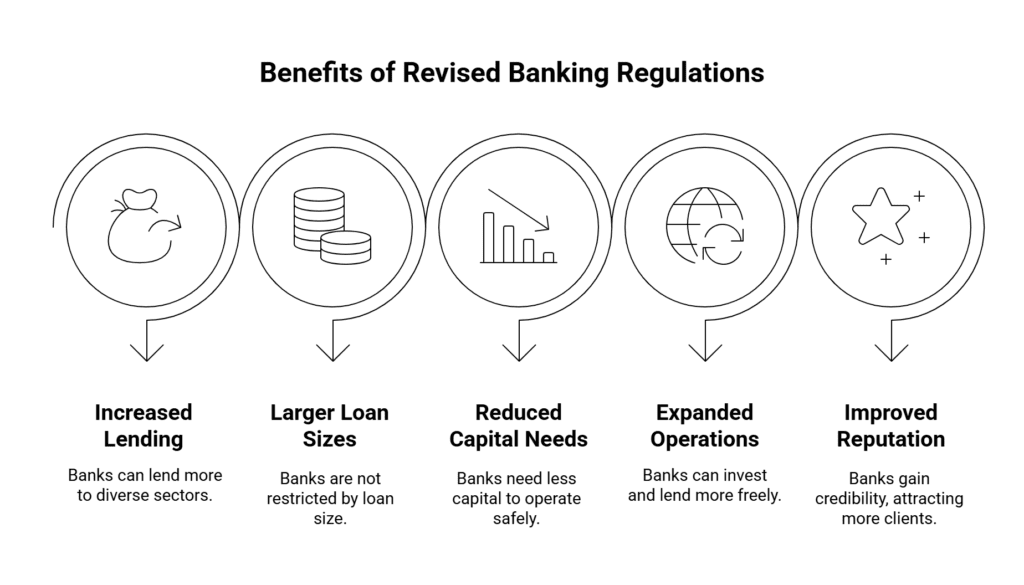

What Changes with Universal Bank Status?

Here’s the kicker: everything from regulatory burdens to brand perception stands to shift.

As a universal bank, AU SFB will:

- No longer be limited to 75% priority sector lending (new minimum: 40%).

- Lose the 50% cap on small ticket size loans (less than ₹25 lakh).

- Face a lower minimum capital adequacy requirement, shifting from 15% to around 11.5%.

- Gain the ability to raise funds, lend, and invest more freely, reaching new business segments (like corporate banking).

- Shed much of the “small bank” tag in public perception, potentially boosting customer acquisition among both retail and large corporate clients.

Snapshot: AU Small Finance Bank by the Numbers

As of June 30, 2025:

- Customers: Over 1.15 crore (11.5 million)

- Branch & Touchpoints: 2,505+ across 21 states and 4 Union Territories

- Employees: More than 53,000

- Total Deposits: ₹1,27,696 crore

- Total Loan Portfolio: ₹1,17,624 crore

- Shareholders’ Funds: ₹17,800 crore

- Balance Sheet Size: ₹1.60 lakh crore

- June-Quarter Net Profit: ₹581 crore (up 16% YoY)

- Total Income (Q1 FY26): ₹5,189 crore

What Drove the RBI’s Decision?

Why did AU SFB cut? Here’s what industry observers and RBI officials point to:

- Growth with Responsibility: Consistent profits, robust asset quality, and effective risk management through different economic cycles.

- Financial Inclusion: Continued focus on underbanked markets, microfinance, and grassroots entrepreneurship, even as it grew.

- Governance: Strong board oversight, compliance culture, and clear succession planning.

- Digital Transformation: A keen push toward digital banking, mobile banking solutions, and a full-service platform.

As Sanjay Agarwal, the Managing Director and CEO, put it: “We have made history by receiving in-principle approval from the Reserve Bank of India to transition into a universal bank. This milestone is a reaffirmation of our purpose, perseverance, and passion. This approval acknowledges not just our ability to grow, but to grow responsibly. It’s a testament to AU’s strength in reaching widely, integrity in serving wisely, and resilience to shine across economic cycles.”

How Did AU SFB Meet, And Exceed, the Eligibility Criteria?

A few details stand out:

- Profit Track Record: In each of the last two years, the bank has delivered consistent growth in net profit, even as industry-wide headwinds challenged others.

- Non-Performing Assets: AU SFB has kept both gross and net NPAs well below the RBI’s thresholds, reporting 2.47% gross NPA and 0.88% net NPA in June 2025.

- Listing: AU SFB has been listed on Indian bourses for several years now, a key requirement for conversion.

- Innovation and Reach: Its embrace of modern digital channels and focus on customer experience, alongside deep rural connections, has set a benchmark for other SFBs.

From Small Finance to Universal Banking

Let’s zoom out for context. The RBI’s universal bank licensing process is famously rigorous. The last full universal banking license granted was to Kolkata-based Bandhan Bank in 2015. AU SFB is the first recipient in almost a decade, a fact that carries plenty of weight in the Indian financial sector.

It hasn’t been a straight shot. While AU SFB began as AU Financiers, focusing on vehicle and MSME lending, it expanded methodically into consumer, business, and even digital banking. The bank built a dense network in Rajasthan before branching out nationally.

All the while, RBI nudged and poked. After the 2014 guidelines that launched the SFB segment, the banking regulator spent years refining its views on what makes an SFB “fit” for a universal license. The April 2024 revision clarified the road forward, setting a higher bar, but for banks like AU SFB, offering a clear goalpost to aim for.

Market Impact and What’s Next

Not surprisingly, the market has responded with a mix of excitement and analysis.

- Shares of AU SFB finished up 1.27% at ₹744 on August 7.

- Brokerages and analysts see the approval as a game-changer, predicting improved funding costs, greater revenue streams, and wider market acceptance.

- There are expectations that the bank, once it receives final approval and completes the migration, could see a re-rating of its market valuation, mainly on account of lower capital requirements and broader service capabilities.

But, of course, the switch is not instantaneous. AU SFB must now meet a series of final conditions and update its operations, compliance, systems, and risk frameworks before the RBI gives the final go-ahead. Once those are complete, a process that could stretch months, the “Small Finance” tag will drop, and AU will become a full-fledged universal bank.

AU SFB: What Does This Spell for India’s Banking Sector?

Big picture: this move could signal a new era of competition and innovation in India’s financial sector. Other SFBs, most notably Ujjivan, Equitas, Jana, ESAF, Suryoday, and Capital SFB, will be watching closely, looking to replicate AU’s example if they can hit the RBI’s eligibility criteria.

In effect, the RBI’s framework is nudging stronger SFBs into the big leagues, creating a more competitive, inclusive industry, one where India’s millions of “new-to-formal-banking” customers have more and better options.

Timeline: Major Milestones for AU Small Finance Bank

| Year | Milestone |

| 1996 | AU Financiers was founded by Sanjay Agarwal |

| 2015 | Received RBI license to become an SFB |

| 2017 | Launched as AU Small Finance Bank |

| 2024 Sep 3 | Applied for a universal bank license |

| 2025 Aug 7 | RBI grants in-principle approval |

AU SFB’s Journey in a Nutshell

- From a modest financier in Rajasthan to a banking powerhouse known nationwide.

- First SFB to meet RBI’s improved, stricter norms for universal bank conversion.

- Boasts a sprawling network, expanding digital reach, and a robust, under-control asset book.

Opportunities, Risks, and Industry Implications

Opportunities abound: AU SFB’s promotion could turbocharge its growth, especially in segments earlier closed off by regulatory ceilings. It could launch new corporate banking products, large-ticket home and business loans, and even wealth management platforms, things it simply couldn’t do as an SFB.

Yet risks exist. For instance, the asset quality has seen some uptick in stress recently, with gross NPAs rising to 2.47% from 1.78% in the previous year, partly due to broader economic pressures. The challenge will be maintaining discipline and ethos even as it scales up and diversifies. The truth is, history shows that not every institution handles expansion smoothly.

Not to mention, the bank’s cultural DNA, rooted in financial inclusion and regional service, will be tested as it moves into more complex, competitive banking arenas. But, if its recent record serves, AU SFB has both the ambition and the systems to adapt.

What Does This Mean for Customers and Stakeholders?

In plain English: more products, more convenience, and more innovation. Expect to see:

- Wider branch and ATM network expansion

- New digital and mobile banking tools

- Enhanced offerings: from bigger loans to new deposit products, and even cross-border services

- Improved brand perception, opening more doors nationally and internationally

Shareholders could see rising value, assuming the bank continues its disciplined growth and steers clear of major asset shocks.

Final Thoughts, And a Look Forward

Believe it or not, a story that began with microloans in Rajasthan about thirty years ago has, step by careful step, reshaped the Indian banking conversation. AU SFB’s journey is proof that with the right mix of patience, prudence, and vision, even the most regionally focused institution can break out and set new precedents.

One thing is certain: with this RBI nod, India’s financial services sector is more open and more competitive than ever before. And, as AU SFB steps up to join the league of universal banks, millions of Indian savers and borrowers could soon discover just what’s possible when ambition meets opportunity in a changing economy.