Starting a business. Exciting, right? But, hold on. Before you pick a name, buy your domain, or send that first pitch email, there’s a critical decision waiting in the wings: Which business structure should you choose? LLC vs S-Corp vs Sole Proprietorship. Three options. Each with its quirks…its perks…and its pitfalls.

Funny thing is, most people rush past this step, eager to dive into “real work.” But who doesn’t love a good surprise? And let me tell you: getting your legal structure wrong can be the kind of surprise you wish you’d avoided. So stick around. We’ll spill the beans on all three, walk through “business structure types,” and, if I’m honest, give you the confidence to choose the best path for your venture.

Understanding Your Options: A Quick Overview

By the time you’re done here, after wading through pros and cons, you’ll feel ready. Ready to decide. Ready to act. Ready to toast to Day One (sparkling cider optional). But first: the basics.

- Sole Proprietorship: The default. You. No fuss.

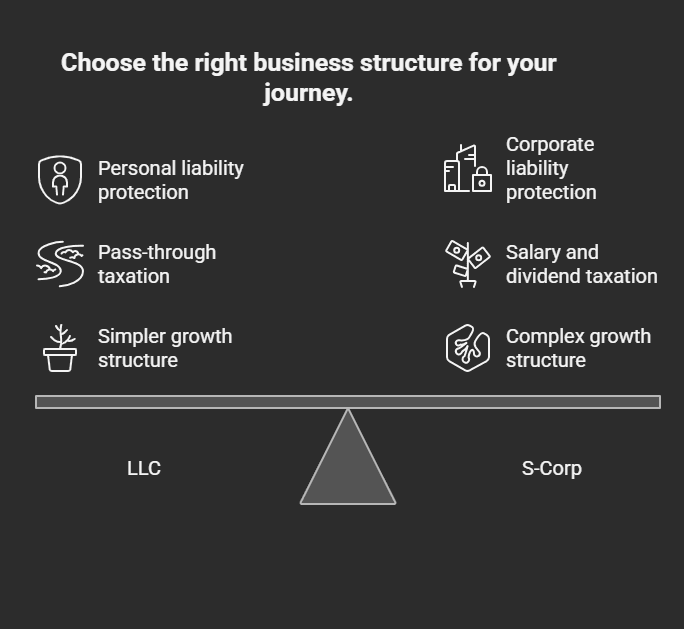

- Limited Liability Company (LLC): Flexibility meets protection.

- S-Corp (S Corporation): Tax advantages…with a few strings attached.

Believe it or not, these three cover most small-business scenarios. So, let’s break them down, clause nesting and all.

Sole Proprietorship: Flying Solo

What It Is

A sole proprietorship is, you guessed it, ownership by one person. No legal separation between you and the business. If your venture and you had a Venn diagram, the circles would practically overlap.

Pros

- Simplicity Rules: Want to get started today? Just sell something, invoice someone, and voilà, you’re a sole proprietor. No formation paperwork needed (unless your state requires a “doing business as” filing).

- Full Control: All decisions. All profits. All the glory.

- Tax Simplicity: Income and losses flow directly to your tax return. No separate corporate return to file.

Cons

- No Liability Shield: Creditors and lawsuits can come after your assets. Got a judgment against the business? Your car, house, even that stash of vintage comic books, could be at risk.

- Hard to Raise Capital: Investors generally prefer formal entities. Banks, too, may view sole proprietorships as risky.

- No Continuity: If you’re hit by a bus (god forbid), the business essentially dies with you.

LLC vs S-Corp vs Sole Proprietorship: A Quick Comparison

| Feature | Sole Proprietorship | LLC | S-Corp |

| Formation | File Articles of Organization with the state | File Articles of Organization with state | File Articles, then IRS Form 2553 election |

| Liability Protection | None | Strong personal asset shield | Strong personal asset shield |

| Taxation | Pass-through | Default pass-through; can elect corp taxation | Pass-through; avoids self-employment taxes on distributions |

| Admin Requirements | Minimal | Moderate (annual reports, fees) | Higher (strict record-keeping, meetings) |

| Profit Distribution | You only | Flexible | Based on share ownership |

| Ideal For… | Freelancers, solo sellers | Small to mid-sized ventures seeking protection | Businesses with steady profits and payroll |

Limited Liability Company (LLC): The Best of Both Worlds?

What It Is

LLC stands for “Limited Liability Company.” Think of it as a hybrid, part corporation, part partnership, part proprietorship. It’s the business structure that says, “Let’s have our cake and eat it too.”

Pros

- Liability Protection: Your personal assets are generally safe if the business trips over a lawsuit.

- Flexible Tax Treatment: You can stick with pass-through taxation (like a sole prop or partnership), or, if it makes sense, elect corporate taxation to optimize self-employment taxes.

- Less Red Tape: Compared to an S-Corp or C-Corp, LLCs usually have fewer mandatory formalities.

Cons

- State-by-State Variability: LLC rules and fees differ from Delaware to California to Florida…so you’ll need to check your home turf.

- Self-Employment Taxes: If you don’t elect corporate taxation, members pay self-employment tax on all profits. (Here’s the kicker: that can add up.)

- Raising Capital: Venture capitalists often prefer a C-Corp structure, so if you’re aiming to skyrocket and raise serious rounds, an LLC might feel limiting.

S-Corp: The Tax-Savings Specialist

What It Is

An S Corporation isn’t a different entity at the state level; it’s a tax election with the IRS. You form either an LLC or a corporation, then file Form 2553 for “S-Corp Status.” Why? To unlock certain tax advantages.

Pros

- Pass-Through Taxation: Income passes through to owners, avoiding the dreaded double taxation of C-Corps.

- Self-Employment Tax Savings: Shareholders who work as employees pay payroll taxes on wages, but distributions aren’t subject to self-employment tax. If you play your cards right, you could save big.

- Credibility and Perception: “We’re an S-Corp” can sound more professional to banks, vendors, and partners.

Cons

- Strict Eligibility Rules: No more than 100 shareholders, all must be U.S. residents, and only one class of stock allowed.

- Rigid Payroll Requirements: You must pay yourself a “reasonable salary” before tossing out distributions.

- Administrative Burden: Annual meetings, minutes, and tighter record-keeping. Not for the faint of heart.

Deep Dive: Liability and Legal Implications

Personal Asset Protection

- Sole Proprietorship: Personal and business are the same. An unpaid invoice or lawsuit? It knocks on your door.

- LLC & S-Corp: Both structures offer a liability shield; creditors go after the business, not your home equity or personal checking.

Contractual Capacity

- Teaching Moment: Only formal entities can sign certain contracts or bid on government projects. Banks sometimes insist on corporate or LLC status before issuing loans.

Unpacked

Sole Proprietorship

- Pass-Through by Default: Business income on Schedule C. Easy-peasy.

- Quarterly Estimates: You’ll need to send money to the IRS every few months. Don’t let penalties sneak up on you.

LLC

- Default Pass-Through: Profits and losses to members. But here’s the caveat: you pay self-employment tax on all earnings.

- Electing Corporate Tax Status: File Form 8832 to be taxed as an S-Corp (or C-Corp), potentially reducing self-employment taxes.

S-Corp

- Salary vs. Distribution: Imagine you earn $100,000. Pay yourself a “reasonable” $60,000 salary, subject to payroll taxes, and take $40,000 as a distribution, tax-free at the self-employment level. Smart, right?

- Extra Filings: Corporate tax return (Form 1120S) plus K-1s for shareholders. More paperwork, but the savings can justify the effort.

Administrative Requirements & Costs

| Requirement | Sole Proprietorship | LLC | S-Corp |

| Initial Filing Fee | None/minimal | $50–$500 (state dependent) | Same as LLC or corp |

| Annual Report | Rarely required | Usually required | Required (if LLC as corp) |

| Meeting Minutes | Not required | Not typically required | Yes, must document meetings |

| Payroll Setup | Only if you hire | If taxed as S-Corp | Mandatory for owner-employees |

| Tax Preparation Complexity | Simple | Moderate | High |

The Decision Matrix: Which One’s Right for You?

No two ventures are identical. But you can ask yourself a few pointed questions:

- What’s Your Risk Tolerance?

- If you’re in a low-liability field (writing, consulting), a sole prop might suffice. But if you’re in fitness studios, product manufacturing, or anything that invites possible lawsuits, lean toward an LLC or S-Corp.

- If you’re in a low-liability field (writing, consulting), a sole prop might suffice. But if you’re in fitness studios, product manufacturing, or anything that invites possible lawsuits, lean toward an LLC or S-Corp.

- How Will You Be Taxed?

- Want straightforward returns? Sole prop.

- Okay with a bit more complexity for tax savings? Consider S-Corp election.

- Want straightforward returns? Sole prop.

- Do You Plan to Raise Capital?

- Bootstrapping with personal funds or small loans? An LLC can flex.

- Aiming for angel investors or VCs? They often prefer C-Corps…so plan ahead.

- Bootstrapping with personal funds or small loans? An LLC can flex.

- What’s Your Growth Trajectory?

- Slow, steady, lifestyle business? Less formality, sole prop or LLC default.

- Aggressive scaling? Incorporation and eventual S-Corp or C-Corp status, might be smarter.

- Slow, steady, lifestyle business? Less formality, sole prop or LLC default.

- Where Are You Located?

- State fees and regulations vary wildly. California’s LLC fees can make you wince. Delaware’s franchise taxes can surprise you. Do your homework.

- State fees and regulations vary wildly. California’s LLC fees can make you wince. Delaware’s franchise taxes can surprise you. Do your homework.

Common Pitfalls and How to Avoid Them

- Mixing Personal and Business Finances: Shabby separation can pierce your liability shield. Open a dedicated business account, no exceptions.

- Skipping the Corporate Formalities (for S-Corps): If you don’t hold annual meetings or document decisions, you risk “corporate veil” issues.

- Underpaying Yourself: The IRS watches S-Corp salaries. If yours is suspiciously low, hello, audit.

- Ignoring State Requirements: Missing an annual report or franchise tax deadline can lead to penalties, dissolution, or both.

Frequently Asked Questions (FAQ)

Q: Can I switch my structure later?

A: Absolutely. Many startups begin as sole proprietorships, then form an LLC once they’ve validated the concept. Later, they elect S-Corp status to optimize taxes. It’s like leveling up.

Q: What about C-Corp vs S-Corp?

A: C-Corp “double taxes” profits at the corporate level and again on shareholder dividends. But, ring any bells? VCs love C-Corps for their unlimited growth potential and share classes. If you aim for big rounds, C-Corp is the norm.

Q: What is a “Series LLC”?

A: A flexible structure (available in some states) that lets you create multiple “series” within one LLC, each insulated from the others. Useful for real estate portfolios or multiple product lines.

Q: Are there other structures?

A: Sure, Partnerships (general or limited), Nonprofits, B-Corps. But for most early-stage, for-profit ventures, Sole Prop, LLC, or S-Corp covers 95% of cases.

Next Steps: Making It Official

- Consult with Professionals: Even the savviest entrepreneurs seek advice. A business attorney and CPA can tailor recommendations to your situation.

- File the Paperwork: Whether with your Secretary of State or the IRS, get those forms in, and keep copies.

- Open a Business Bank Account: Keep finances neat. Helps with taxes, audits, and growth.

- Document Everything: Meeting minutes, resolutions, financials, store them safely, review them annually.

Give it a try! The right structure today can save you headaches, sleepless nights, and money down the line. Your future self will thank you.

Wrapping Up: c

Choosing between LLC vs S-Corp vs Sole Proprietorship isn’t just legalese; it’s the foundation of your entrepreneurial journey. So, if you’re on the fence, don’t beat around the bush: weigh your liability tolerance, tax appetite, growth ambitions, and state rules. Then, pick the structure that aligns best.

Because, here’s the kicker, once you lock it in, you can focus on what really matters: growing, innovating, and turning that big idea into reality. And isn’t that why you started this whole adventure in the first place? Good luck out there, and here’s to your success!