Believe it or not, the US dollar just climbed to its highest level of the week. And yeah, it’s got a ripple effect, especially for UAE expats sending money home. Let’s unpack what’s happening, why it matters, and what you might want to do next.

A Brief Snapshot

- The dollar is stronger this week, pushing exchange rates up.

- Currencies like the Indian rupee and the Philippine peso are reacting, getting weaker by comparison.

- UAE expats: A stronger US dollar means more value when you convert dirhams into remittance currencies.

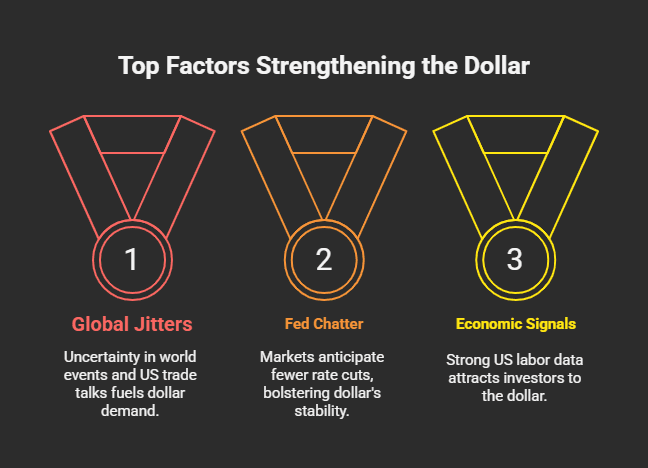

Why the Dollar Is Popping

Funny thing is, it’s not just one thing, it’s a mix:

- Global jitters, uncertainty around world events & US trade talks.

- Fed chatter, markets now think rate cuts are less likely soon, keeping the dollar firm.

- Economic signals, solid labor numbers in the US, are making investors lean into the dollar.

So basically, the dollar’s momentum is driven by global caution plus speculations around Fed policy.

What Expats Are Seeing: More Dirhams, More Returns

Here’s the deal: since the dirham is pegged to the US dollar, any gains in the dollar directly benefit you when you send money home.

- Indian rupee example: Last week, ₹23.50 per AED? That was sweet.

- Philippine peso: Around ₱15.60 per AED? Solid gains, too.

If you sent 10,000 AED last week, you’d have gotten around ₹235,000. Now? Maybe closer to ₹240,000. Or more, if the dollar keeps climbing.

Unexpected windfall? Kind of. But hey, if you’re on the fence, this moment counts.

Here’s the Kicker: Timing Is Everything

By the time salary day rolls around, but before month-end, here’s what matters:

- A few days can make a big difference.

- If the dollar stays on this upward run, you could lock in better remittance rates.

- But if things shift, say geopolitical calm returns, rates could retreat just as fast.

Pro tip: some folks are “splitting remittances”, sending part now, part later. Spread the risk instead of going all-in.

A Wider View: What This Dollar Strength Means

- Imports in UAE (especially non-dollar ones) might get pricier, slowly.

- Tourism to dollar‑priced places? It might jump for Gulf travelers.

- Global trade/investment flows could tilt, since the dollar shapes everything.

But for you? Right now, it’s about remittances.

What You Could Do Now

- Check your history, what’s been the recent range of AED→INR or AED→PHP?

- Stay updated daily via an app or your FX provider.

- Decide your strategy, lock in the full amount, or split it over 2–3 transfers.

- Know your fees; some platforms charge extra, eating into your gains.

- Ask around, sometimes local exchange houses offer better overall value.

Emotional Play: A Bit of Empathy

Look, I get it. Money sent home, it’s not just currency, it’s love, it’s responsibility. So when rates bounce like this… off you go, heart pounding: “Should I send it now? Or wait?” That click-click of hesitation? Normal.

Being smart here isn’t being greedy, it’s being considerate. Your family counts on every rupee, every peso.

Final Takeaway

Short version: The US dollar is up. AED gets you more rupees/pesos now. Could keep climbing. Maybe split your remittance.

Long version: Monitor, plan, hedge. Slight changes in timing could matter a lot. It’s a dance, get the rhythm, step smart.

Summary at a Glance

| Things to Watch | Why It Matters |

| The US dollar is strong this week | Means better remittance value right now |

| Global & US economic/geo news | Could pivot the dollar sharply overnight |

| Split remittance strategy | Spread risk, lock part now, leave part for upside |

| Fees & exchange spread | Eating into your gains? Factor it in! |

itstitle

excerptsa