The UAE Central Bank (CBUAE) has issued a firm directive compelling all banks to stop forthwith from going ahead with the planned increments to the minimum balance for individual accounts. The regulatory intervention takes place at a time of public outcry and deep concern among retail clients on how the increments would weigh their pockets. The proposed hikes were scheduled to be effective from June 1, but the CBUAE intervention has suspended them until the policy’s impact on customers is formally assessed. This prompt action by the CBUAE, even before all banks implemented the policy in full, reflects an extremely alert and forward-thinking regulatory approach. It reflects a firm commitment to consumer protection and financial stability, especially for the vulnerable sections of society. It implies that the CBUAE has a close eye on public opinion as well as banking behavior, reflecting a strong regulatory system that is geared towards meeting potential market disturbances in advance.

Context of the Directive: Proposed Hikes by Banks and Upcoming Fees

It was in response to recent notices that the CBUAE announced its directive. Reports had circulated that some major banks planned to increase the minimum required deposit on personal accounts. The move, which would have increased the minimum balance from Dh3,000 to Dh5,000, was to have taken effect on June 1. Importantly, one of the largest financial institutions had already made the change, even before the regulator’s announcement.

As per the suggested policy, customers who were unable to keep the new Dh5,000 balance in their current accounts would have had to pay Dh25 as a monthly fee.

Additionally, certain banks were reportedly planning to increase this penalty even further, possibly to Dh100 or more, depending on the type of account. This act of introducing these hikes by banks is indicative of a market mechanism to maximize profitability or control account liquidity. But the intervention by the CBUAE serves to remind that market forces within essential areas such as banking are under considerable regulatory control, particularly when financial inclusion and consumer protection are at stake. This reflects a built-in tension between bank profit goals and more general public interest factors. The fact that one of the major institutions had already made the change and others were ready to do so meant the possibility of a general, uncoordinated change in banking policy throughout the UAE. The timely intervention by the CBUAE avoids the creation of a disjointed banking sector where various banks have significantly different minimum balances, which would have resulted in widespread customer confusion and dissatisfaction throughout the financial sector.

Public Outcry and Consumer Impact: Burden on Households and Small Businesses

The central motivation behind the CBUAE intervention was the widespread concern and public outcry among account holders. This was in response to the potential financial weight that the minimum balance increase would impose upon low-income individuals and small business owners. The method of the penalty was especially disturbing: clients who could not keep the Dh5,000 balance level would be charged monthly, with some reports indicating such amounts could be extremely high.

The uneven effect on particular sections of the populace was a contentious point.

The monthly wage earners below Dh5,000, and with no qualifying banking products, would have been automatically charged these fees.

The policy, by charging those who could not carry higher balances, could have, in effect, priced out lower-income groups and small businesses out of mainstream banking services or into a vicious cycle of mounting charges. This result would be in direct opposition to financial inclusion efforts and would be likely to force people to turn to less regulated or higher-cost financial solutions, which could ultimately erode overall economic stability. The public backlash regarding monthly fees, particularly those that might rack up, indicates a wider sensitivity towards bank charges that would be seen as unclear or usurious. The CBUAE’s move may presage greater supervision of the way banks publicize and apply such charges, possibly driving more transparency and equity in pricing mechanisms and paving the way for a look at other bank charges in the future.

Facts behind the Suspended Policy and Exemptions: An Examination of the Rules

The suspended policy had particular mechanisms and exceptions that revealed its expected scope and effects. For current accounts, Dh25 would have been charged per month if the balance dropped below Dh5,000. As mentioned, other banks were said to be mulling even greater charges, possibly up to Dh100 or more, for other types of accounts.

To escape these monthly charges, clients would have had to satisfy specific conditions for exemption. These were:

- Shifting a minimum monthly salary of Dh15,000.

- Having a total account balance of Dh20,000 or more in all accounts with the bank.

- Having an operational credit card, overdraft, or loan with the bank.

The planned minimum balance adjustments and related charges, now shelved, are outlined below:

Proposed Minimum Balance Amendments and Related Fees (Suspended)

| Category | Previous Minimum Balance (Dh) | Proposed Minimum Balance (Dh) | Monthly Non-Compliance Fee (Dh) | Key Exemption Conditions |

| Current Account | 3,000 | 5,000 | 25 (potentially 100+) | Monthly Salary ≥ Dh15,000, Aggregate Balance ≥ Dh20,000, Active Credit Card/Loan |

These exemption conditions point towards a desire by banks to segment their customer base, with a bias towards catering to higher-income segments or multiple banking product holders. This necessarily constructs a segmented banking system in which fundamental services are charged more for those with fewer resources, possibly widening wealth imbalances within the banking sphere. The CBUAE’s move successfully counteracts this kind of segmentation.

In addition, the exclusion of customers holding active credit cards, overdrafts, or loans is suggestive of banks trying to encourage cross-selling products. By tying minimum balance fees to product usage, banks try to enhance customer relationships and boost revenue sources other than deposits. The CBUAE’s pause affects this plan, forcing banks to re-evaluate methods of attracting and keeping customers.

The Central Bank’s Position and Coming Steps: Assessment and Consumer Protection

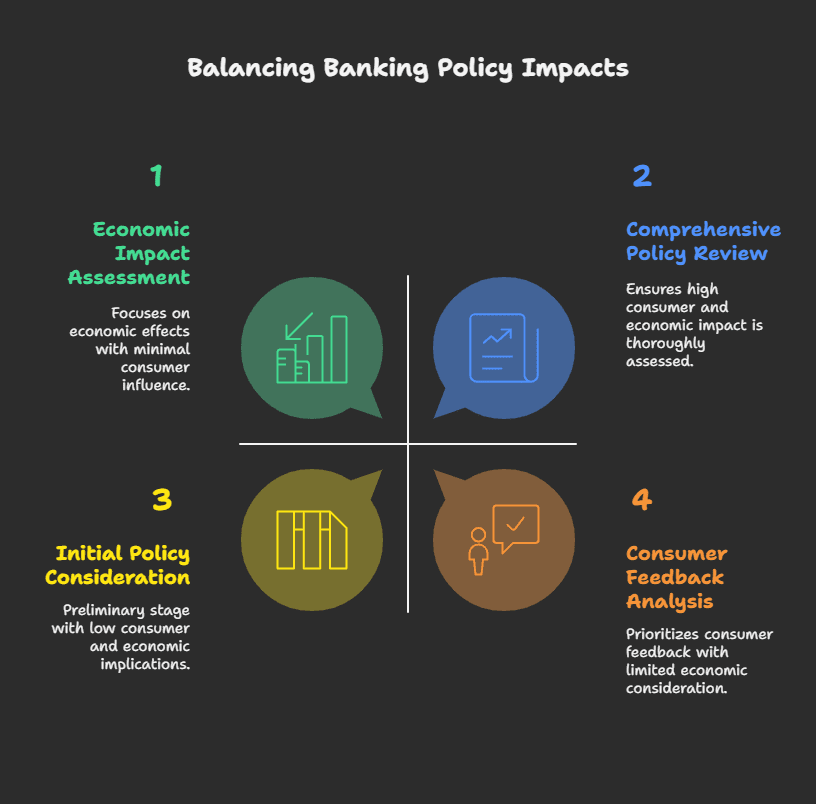

The formal position of the CBUAE is that suspension of the increases in the minimum balance until a formal assessment of how the policy will affect customers is undertaken. This is to say that it is more than likely that the Central Bank will undertake a serious review of proposed changes in order to determine their economic impact and whether they will affect various segments of society.

This firm intervention sends a powerful message for future bank policy reforms in the UAE.

The banks will be more prudent and forward-looking in seeking advice from the CBUAE or self-assessing the impact of important alterations that have a wide consumer base among retail clients. This may result in a more cooperative, but regulated, strategy of banking innovation with a focus on achieving a balance between commercial interests and public good.

The CBUAE’s move to defer the changes until a “formal evaluation” is made indicates its adherence to evidence-based policy making. This means that the final decision will probably be taken in light of empirical evidence of the impact of the policy and not merely based on popular opinion or profitability concerns of banks. This enhances the role of thorough impact assessments in the regulatory process, ensuring that ensuing banking policies are developed with a definite comprehension of their societal and economic impacts. This step upholds the CBUAE’s role as a protector of consumer interests and the integrity of the financial system.

Conclusion/Outlook: A Win for Retail Customers

The CBUAE’s decision to suspend intended minimum balance hikes is an instant positive effect on retail consumers throughout the UAE, saving them from imminent charges. The move reinforces the Central Bank’s active part in protecting consumer interests and ensuring financial inclusion of the UAE banking industry. The events illustrate the dynamic engagement between regulators and banks on equitable practices and bankable business models.

As the CBUAE conducts its official review, the banking industry will likely need to reassess its approach to profitability and customer interaction to ensure that policies for the future align with both commercial interests and financial stability and consumer protection.