It started as a headline. But then, almost overnight, Donald Trump’s new 25% tariff on Indian goods ricocheted through India’s economy, boardrooms, and government offices like a thunderclap. In global trade, there have always been winners and losers, but rarely does a policy shift feel this personal. For Indian exporters, the message was blunt: do business with America, pay the price.

The timing? Uncanny. Just as India, post-pandemic, was finding its rhythm again in international trade, the goalposts moved. And not gently, but by a full 25% jump, no exemptions, no soft landing, no slow phase-in. That’s the story. But the plot only thickens from here.

What’s the Backstory? US-India Trade, Always a Balancing Act

Truth is, the India-US trade relationship has never been, you know, smooth sailing. Behind the talk of friendship, strategic partnership, and economic opportunity, there’s been nagging friction, a tug-of-war over tariffs, market access, and a perennial US trade deficit with India.

Some quick context:

- The US is India’s largest export destination. The two-way trade hit around $186 billion in 2024–25: India exported roughly $86.5–$87 billion worth of goods to the US, while importing about $45 billion in return.

- For India, the US soaks up around one-fifth of all exports, everything from T-shirts and gemstones to mobile phones and pharmaceutical drugs.

- Yet, Washington complains about Indian tariffs, the red tape faced by US farm and dairy goods, and New Delhi’s purchases of Russian oil and arms.

This isn’t a new dance. For years, the US has pressed India to lower its own import duties on American products (think whiskey, high-end motorcycles, and farm produce) while grumbling about what it calls unfair trade practices. India, for its part, points out that US tariffs on textiles, steel, and some agricultural items can be pretty steep, and that Washington rarely opens its own markets fully either.

Trump’s Tariff: What’s New, What’s Different

This summer, the dynamic took a sharp turn. Here’s what’s changed:

- Trump announced a sweeping 25% tariff on most Indian-origin goods, effective August 7, 2025. The order, called “Further Modifying The Reciprocal Tariff Rates,” was signed as an executive order from the White House.

- No sector was spared: Unlike with other nations, where some items, like pharmaceuticals or electronics, got a pass, India faces a blanket 25% duty. In effect, just about every export item got tagged.

- A penalty looms: The US President also mentioned unspecified “penalties” tied to India’s purchases of Russian oil and arms, with the threat of tariffs going even higher and extra levies for “trans-shipped” (re-routed) goods.

- Competitors fare better: Countries like Bangladesh, Vietnam, and Pakistan all received lower rates (15–20%), with China, historically America’s top target, setting a different, negotiated tariff level. India? Singled out for being “tough,” as the US side put it.

Funny thing is, even seasoned policy hands admit: the scale and sweep of the move caught nearly everyone napping.

The Numbers: How Much, How Big, and Who Feels the Burn?

The initial panic was understandable. The US, after all, buys up a massive share of India’s global exports. On paper, a 25% tax on everything, from garments and gems to engineered goods, looked like it could be a body blow. But is it?

GDP Impact: Not as Dire as Headlines Suggest

- Most economists peg the overall GDP hit at 0.2% to 0.4%, not insignificant, but, for a $4-trillion-plus economy, “manageable,” say government sources.

- Exporters face trouble, sure. Yet, broader impacts are likely muted by several factors: India’s diversified trade, growing domestic demand, and the fact that not all US-bound exports will take the full knock.

“GDP loss from the 25% US tariff is unlikely to exceed 0.2 per cent…a hit, but a limited one.”, Source, NDTV

How Much of India’s Exports Are At Risk?

- “About 50% of India’s US exports could get hit right out of the gate by the new duties, roughly $43–$48 billion worth of goods,” according to government and industry estimates.

- Some sectors, especially those already struggling in the global market, could see orders slashed, contracts cancelled, and new layoffs announced.

Which Sectors Stand to Lose Most?

Textiles and Apparel

Let’s start here, because that’s where the alarms are loudest.

- The US gobbles up about a third of all India’s textile and apparel exports. For many Indian firms, these buyers provide the bulk of annual revenue.

- Impact? Early signs of panic, exporters report US clients freezing or cancelling orders, especially with America heading into peak back-to-school and holiday buying seasons.

- Why the worry? Cotton T-shirts and home textiles coming out of Bangladesh and Vietnam now undercut Indian goods by as much as 20%, purely on price, thanks to those lower rival tariff rates.

- The specter of mass layoffs is real, particularly for small and medium-sized players.

Gems and Jewellery

Another big victim.

- The US is a major buyer, taking over $10 billion annually of these exports.

- Blanket duties “inflate costs, delay shipments, distort pricing, and place immense pressure on every part of the value chain,” warns India’s Gem and Jewellery Export Promotion Council.

Electronics & Smartphones

This one stings for two reasons. First, India recently leapfrogged China as Apple’s biggest iPhone supplier to the US.

- Now, with the 25% duty, US-bound phones and electronics suddenly look much less competitive (for both Indian firms and Apple’s US market plans).

- Electronics makers say the cost “most likely forces Apple and others to rethink their proposed expansion plans” in the country.

Pharmaceuticals: Saving Grace or Undercurrent?

Here’s the twist. Some sources suggest that, unlike most other products, pharmaceuticals, some critical minerals, and key electronics remain exempt. But others, especially government and think-tank sources, say the new order closes even these doors for India.

- The pharma sector makes up a huge chunk of India’s American exports, over $9 billion a year.

- Ambiguity remains, with exporters seeking clarity and warning that if exemptions are rescinded, the fallout will be huge.

Petroleum Products and Energy Exports

- Petroleum products are a top-three category for India to the US.

- Blanket tariffs and loss of exemptions that China and other nations keep mean even these strategic exports get hammered.

Why Did the US Do This? The Rationale (and the Russia Link)

Trade wars rarely have a single cause. This one, though, wears its rationale on its sleeve.

- The Trump administration cites years of “tariff and non-tariff barriers” on American goods trying to enter India, especially food, farm, and dairy products.

- The extra “penalty” ties directly, US officials say, to India’s ongoing energy and defense procurement from Russia, particularly in the face of the Ukraine war and Western sanctions.

- Underlying all this? Old-fashioned hardball. Washington wants leverage, a way to negotiate India into a wider trade (and maybe even strategic security) agreement, on US terms.

India Compared: Why Are Our Rivals Getting a Better Deal?

Here’s the bit that stings for Indian exporters: We’re, believe it or not, the outlier.

- Bangladesh and Vietnam both face a 20% tariff.

- China, after much haggling, saw rates come down from over 140% to around 30% for key sectors.

- Japan and South Korea? Both negotiated their way to just 15%, and the European Union isn’t far behind.

- Only a handful of others, Brunei, Kazakhstan, Moldova, and Tunisia, join India at the 25–30% club.

What’s more, other trading partners got product-by-product exemptions, especially for sectors deemed “strategic.” India? A blanket hike, with no such carve-outs.

On-the-Ground: Exporter Concerns, Layoff Fears, and Broken Contracts

The worry isn’t academic. In boardrooms and factory floors, the pain is real:

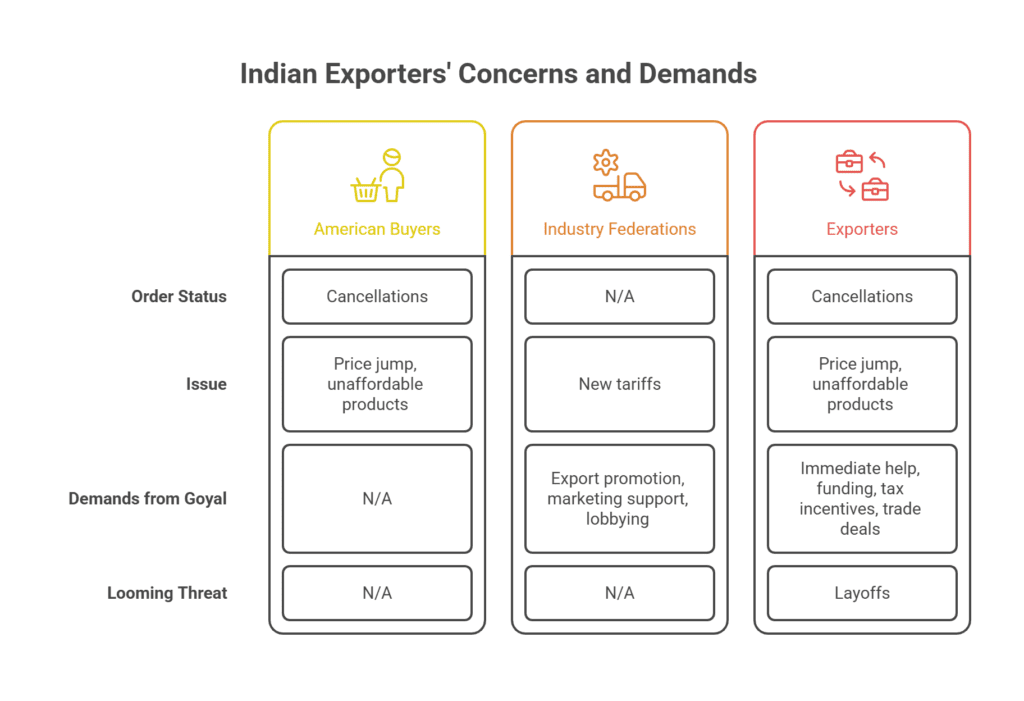

- Exporters in sectors from engineering goods to home textiles warn of sudden, widespread order cancellations from American buyers, as the price jump makes Indian products unaffordable for US importers.

- Industry federations have rushed to Commerce Minister Piyush Goyal, seeking everything from “export promotion missions” and marketing support to lobbying the US for at least a phased approach to the new tariffs.

- Some are asking for immediate government help, more funding for credit and marketing, expanded tax incentives, and, crucially, new trade deals with other countries to open up new export markets.

- Layoff warnings, especially in labor-heavy sectors like textiles and gems, loom ever larger.

Government Response: Calm on the Surface, Action Underneath

So how’s India reacting? Publicly, the government’s tone remains measured. No calls for retaliation. Instead, lots of talk about dialogue, resilience, and protecting Indian interests:

- The Ministry of External Affairs says, “The broader US–India partnership has weathered transitions and challenges… should not be derailed by short-term frictions.”

- Commerce Minister Goyal promises to “safeguard the interests of our farmers, workers, and small entrepreneurs” with a focus on careful diplomacy.

- At the same time, several agencies and trade associations (from gems to textiles) have asked for stronger action: more financial support, efforts to diversify target markets, and even reported discussions about WTO challenges.

Behind the scenes, government negotiators are reportedly pushing for a rollback, at least a partial one, as part of renewed US–India trade talks set to resume soon.

What Happens Next? The Search for Solutions

This is still a moving story. And while the pain is real, and in some corners, acute, there’s a growing focus on adaptation.

Possible Short-Term Actions

- Indian exporters are looking to diversify markets: Europe, ASEAN, West Asia, and Africa all feature more prominently in their plans now.

- Industry groups are urging the government to enhance incentive schemes, like the Rebate of States and Central Taxes and Levies program, so firms have at least a fighting chance on price.

- There are even suggestions that Indian companies may explore US bases and joint ventures as a way around direct tariffs, though this is easier said than done.

Long Shot: Global Trade Rebalancing?

- Some trade-watchers hope that, just as in previous dust-ups, things may settle after the drama. Fresh negotiations, compromise deals, or at the very least, sector-specific exemptions could eventually be on the table.

- Many quietly admit: If India is to keep growing as a manufacturing hub for the world, it can’t afford to depend so heavily on a single market, especially one as politically volatile as the US.

Global Trade and Geopolitics: More Than Just Money

There’s a broader story here, too. The new tariffs come amid a shifting global order, a world where supply chains are fragmenting along geopolitical lines.

- India is being, in the words of some analysts, “made an example of” for its choices on Russia, and as a warning to others about crossing US priorities.

- The US still needs India, geopolitically, in Asia, as a counterweight to China, but the trade fight puts that partnership on ice, at least for now.

- India, in turn, faces a test: Can it pivot fast enough to keep its export engines running? Can it forge new alliances where old ones are fraying?

Funny thing is, the world’s not quite as flat as it used to be.

Conclusion: An Uncertain Road Ahead

So, where do we go from here? Truth is, few expect the tariffs, headline-grabbing as they are, to force a reckoning or collapse on either side. For the average Indian firm, though, the challenge is immediate, not abstract: stay nimble, stay open to new markets, and hope the next executive order brings some relief.

Here’s the kicker: The India-US trade story has always been one of fits and starts. But never has a single White House order sent quite so many ripples, so quickly, so personally, felt in factories, ports, and boardrooms across the subcontinent.

And that, perhaps, is the new normal. In a global economy where politics, policy, and power move faster than ships or shipments, every exporter is now, unavoidably, in the crosshairs.