Why the pet market in the UAE suddenly matters a lot

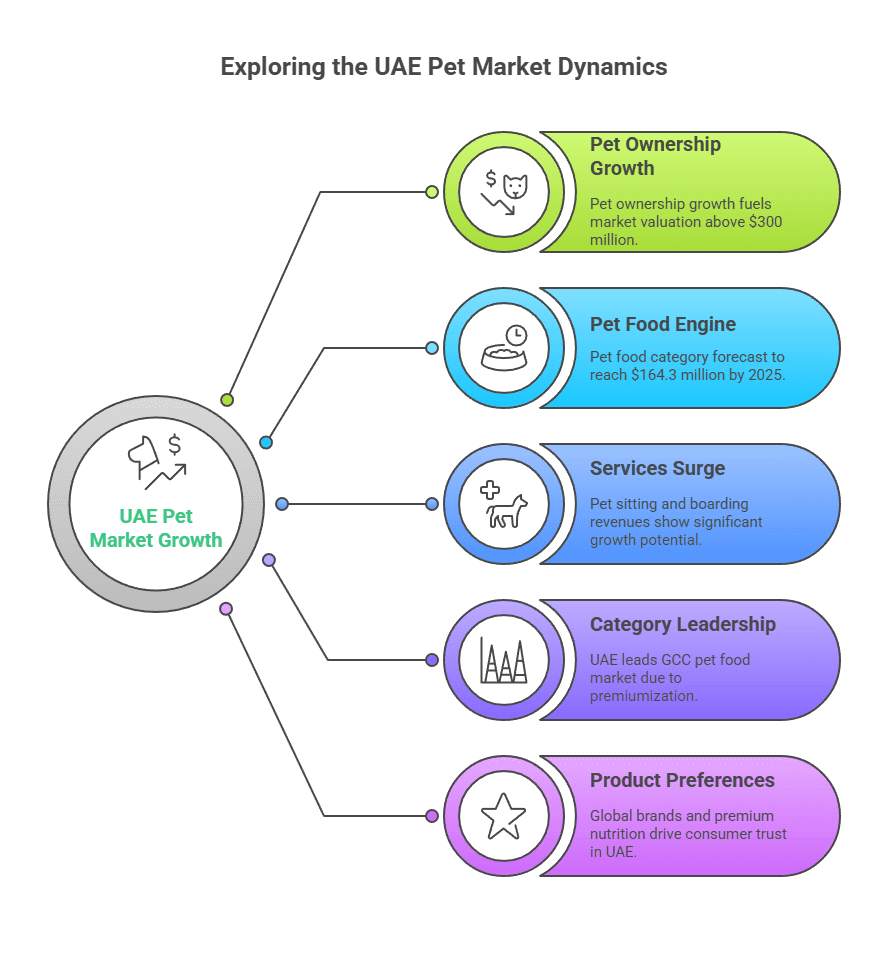

The numbers tell the story, clearly and, frankly, quite loudly. The UAE’s pet sector has accelerated from a niche category to a high-growth, mainstream market, powered by a sharp rise in pet ownership, premium spending habits, and the spread of digital commerce. Recent industry briefings around Pet World Arabia noted that pet ownership climbed by about 30% during and after the pandemic, lifting the domestic pet economy to an estimated $300 million, and fueling ambitions to touch the multi‑billion mark across the wider region. Believe it or not, some estimates presented at trade events projected a $2 billion industry goal within a few years, underscoring just how quickly consumer behavior has shifted nationwide.

Zoom in a bit. Pet care and adjacent services are expanding in parallel. Pet food revenue in the UAE alone is projected at roughly $164 million in 2025, with annual growth expected near 8.9% through 2030, signaling sustained consumer demand and SKU premiumization. Meanwhile, services are moving fast, too: pet sitting and boarding are both scaling, with 2024 revenue estimates of $25.5 million and $28.8 million respectively and solid growth forecasts through 2030, another sign that owners aren’t just buying better food; they’re investing in full‑spectrum care.

Here’s the kicker: the UAE is often the demand leader within the GCC. Across the Gulf’s pet food market, the UAE captured the largest share in 2024 thanks to high ownership rates, premium preferences, and robust e‑commerce adoption, helped along by a strong expatriate base and urban lifestyles that favor packaged, functional nutrition. All of this results in a market where retailers, groomers, clinics, and online sellers feel the heat to keep assortments fresh and relevant. And where suppliers who can move quickly, curating what local consumers want right now, win.

The pet numbers every UAE retailer should know

- Pet ownership growth: Industry event statements and press communications have pegged pandemic‑era UAE pet ownership growth at around 30%, catalyzing a local market valuation above $300 million and energizing broader MENA growth ambitions.

- Pet food engine: The UAE pet food category is forecast to generate about $164.3 million in 2025, with market growth expected to average nearly 8.9% annually through 2030, a strong indicator of sustained demand and trading‑up behavior.

- Services surge:

- Pet sitting revenue reached about $25.5 million in 2024, with an anticipated CAGR of 14.7% from 2025–2030.

- Pet boarding revenue stood near $28.8 million in 2024, with an 8.6% CAGR expected from 2025–2030.

- Pet sitting revenue reached about $25.5 million in 2024, with an anticipated CAGR of 14.7% from 2025–2030.

- Category leadership in GCC: The UAE led the GCC pet food market in 2024 due to high ownership, premiumization, and the strength of online and specialty retail.

- Product preferences: Survey findings show strong awareness and engagement with global brands, signaling that recognizable, science‑led nutrition lines, alongside emerging premium and specialized offerings, drive consumer trust in the UAE.

What does this all mean in plain English? The sector isn’t just growing; it’s maturing. Consumers are moving beyond basic products into premium, functional, and tech‑enabled solutions. Retailers and distributors that anticipate these shifts are the ones setting the pace.

The big market drivers (and what they actually look like on the ground)

- Urban lifestyles and expat demographics: Concentrations in Dubai and Abu Dhabi, with affluent, international populations, translate into higher willingness to pay for premium food, accessories, and services.

- Premiumization across the aisle: From breed‑specific formulas to digestive health, dental, and joint support, demand for specialized nutrition is rising in line with broader wellness awareness.

- E‑commerce normalization: The shift toward digital shopping has made it easier for consumers to find exactly what they want, often imported, often premium, right from their phones.

- Service ecosystem expansion: Boarding, grooming, sitting, training, and soon, insurance, complementary services are scaling to match the needs of busy owners and frequent travelers.

- Institutional support and regulation: Government initiatives around animal health, veterinary infrastructure, and standards continue to mature, providing a more structured environment for market development.

Funny thing is, when all these pieces move at once, consumer expectations, retail channels, regulatory lift, the result is a market that demands agility. New SKUs. Faster launches. Credible brands. And constant refresh.

Pet trends reshaping purchase decisions in the UAE

1) Premium and specialized pet nutrition

The single most important trend: the move from “any food will do” to targeted, premium formulas that promise measurable health benefits. Think life‑stage, breed‑specific, limited‑ingredient, and functional nutrition, particularly for digestion, skin and coat, weight control, and dental care. Survey data confirms the enduring pull of established global brands, which often act as anchor SKUs around which retailers can introduce boutique, natural, or veterinary‑adjacent lines.

What works in practice:

- A core shelf of recognized science‑based brands.

- A curated set of premium and super‑premium options (grain‑free, human‑grade, single‑protein, novel proteins).

- Rotational bundles or trial sizes to reduce friction for first‑time premium buyers.

Why it matters: As the market matures, differentiation increasingly hinges on perceived quality and function, not just price.

2) Eco‑friendly and sustainable accessories

Eco‑aware purchasing isn’t a fad, it’s a filter. Toys and accessories made from recycled, biodegradable, or responsibly sourced materials fit a growing sustainability mindset among UAE residents, especially in urban centers accustomed to global retail standards. Retailers that include eco‑friendly lines across toys, bowls, litter products, grooming tools, and collars can earn trust and repeat visits.

What to look for:

- Material claims that are specific and verifiable (recycled plastics, organic cotton, bamboo, biodegradable fillers).

- Packaging that reduces waste and tells a clear sustainability story.

- Durability, sustainable shouldn’t mean short‑lived.

3) Pet tech goes mainstream

From GPS trackers to smart feeders and health‑monitoring wearables, pet tech is no longer a fringe category. It’s part of the wellness arc, and it pairs well with premium food and preventive care bundles. With pet sitting and boarding revenue rising, owners increasingly want visibility and continuity: automatic feeders that align to veterinary nutrition, cameras for check‑ins, and wearables that track activity and recovery.

What’s selling:

- Smart feeders with portion control and app integrations.

- GPS collars and tags suited for desert heat and outdoor conditions.

- Pet cameras with two‑way audio and treat dispense, especially for apartment living.

4) Holistic health: supplements, grooming, and dental

UAE pet owners are leaning into proactive care, not just reactive clinic visits. That opens the door for supplements (joint, skin, gut), dental chews and rinses, and at‑home grooming kits with salon‑grade accessories. Pairing these with nutrition SKUs makes for persuasive cross‑sell opportunities.

5) Services as retail amplifiers

As pet sitting and boarding scale, these services create retail flywheels, trial packs, travel‑friendly products, and post‑boarding bundles can lift per‑customer value. Retailers who connect services with product recommendations, think dietary continuity between home and boarding, win loyalty.

Demand snapshots: What UAE consumers are asking for now

- Dogs vs cats: Dogs dominate pet sitting and boarding revenue today, but cats are the fastest‑growing segment in both services, mirroring broader ownership patterns in dense urban areas.

- Brand gravity: International nutrition brands remain popular anchors for many consumers, reinforcing the importance of stocking trusted names while introducing premium alternatives.

- Online discovery: Digital‑first shopping behaviors, especially among tech‑savvy residents, make rapid listing updates, visual merchandising, and review management must‑dos for sellers.

If I’m honest, none of that should surprise anyone who’s watched consumer behavior evolve in Dubai and Abu Dhabi over the last five years.

The supply‑side challenge: staying current without blowing up inventory risk

There’s a tension here. To stay competitive, businesses need to continuously refresh assortments, premium food lines, sustainable toys, smart devices, wellness add‑ons. But constant expansion can bloat inventory and increase regulatory workload (import rules, label compliance, temperature‑controlled logistics). And that’s before considering seasonality, heat‑resistant packaging, and warranty support for tech devices.

A practical way forward involves three moves:

- Curate a dynamic core assortment anchored by proven brands, then layer in fast‑moving innovations with controlled buy‑ins and test‑and‑learn cycles.

- Lean on suppliers who handle regulatory compliance and provide reliable documentation, especially for imported nutrition and veterinary‑adjacent products.

- Use demand signals from services (boarding, grooming, sitting) to inform replenishment, watch which treats, travel kits, and calming aids owners request around peak travel periods.

That last one tends to unlock quick wins.

How Pets Club UAE helps UAE businesses stay ahead of the curve

Positioned as a forward‑thinking supplier and sourcing partner, Pets Club UAE focuses on exactly the areas the UAE market is pulling toward, premium nutrition, eco‑forward accessories, and meaningful pet tech, while streamlining access for retailers, groomers, clinics, and online sellers.

Here’s how that translates to day‑to‑day advantages:

- Trend‑aligned curation: Inventory that maps closely to what the data shows, premium and functional pet food, sustainability‑minded toys and accessories, and practical tech that integrates into busy, urban pet lifestyles.

- Documentation and compliance support: Guidance and paperwork for import, safety, and label standards, reducing time‑to‑shelf and regulatory risk for merchants expanding into higher‑value categories.

- Flexible order models: Structures that allow test runs, seasonal peaks, and fast reorder on proven winners, so businesses can keep assortments fresh without heavy overstock exposure.

- Regional know‑how: Insights on heat‑resistant packaging, SKU suitability for apartments vs villas, and product lifecycles tailored to the UAE market’s climate and travel patterns.

- Digital‑ready catalog: Product data, images, and content tuned for e‑commerce listings, social discovery, and marketplace syndication, because online is where discovery starts.

And yes, support scales. Whether it’s a neighborhood groomer adding retail shelves or a multi‑branch chain revamping the premium aisle.

Product categories to prioritize in 2025 (and why)

- Premium dry and wet food with functional claims: Digestive health, skin/coat, weight management, and dental benefits continue to drive differentiation in a growing market.

- Limited‑ingredient and sensitive‑stomach options: High‑intent shoppers seek transparent labels and reassurance around allergens and digestibility, often at higher price points.

- Eco‑friendly toys and accessories: Recycled or biodegradable materials, low‑waste packaging, and durability suited to frequent use, aligned to sustainability preferences among urban consumers.

- Pet tech essentials:

- Smart feeders with portion control and app integrations to match veterinary nutrition plans.

- GPS trackers capable of handling outdoor conditions.

- Home cameras for apartment dwellers who want mid‑day check‑ins.

- Smart feeders with portion control and app integrations to match veterinary nutrition plans.

- Wellness add‑ons: Supplements, calming aids, dental solutions, and grooming tools that turn routine care into an at‑home habit, backed by straightforward education and trial sizes.

- Travel and boarding kits: Ready‑to‑go packs for peak travel windows, food portions, hygiene essentials, and comfort items that align with service partners’ recommendations.

A short note on cats. Given service‑market data showing cats as the fastest‑growing segment across sitting and boarding, expanding the selection of premium cat nutrition, litter innovations (low dust, odor control, eco‑friendly materials), and enrichment toys is an easy way to meet demand head‑on.

Merchandising and content: how to convert curious shoppers into loyal customers

- Lead with clarity: On shelves and online, foreground functional benefits, digestive support, dental care, weight control, using plain language and iconography that’s consistent across brands.

- Offer guided choices: Signage or digital filters by life stage, breed size, sensitivities, and goals (active, indoor, senior), reducing decision fatigue and returns.

- Bundle logically: Pair premium food with matching treats, supplements, or dental chews; add a smart feeder to a weight‑management plan; or connect eco‑toys with sustainable bowls and litter liners.

- Use mini sizes for trial: Encourage trading up without commitment, especially for sensitive‑stomach or novel‑protein lines.

- Sync services and retail: Coordinate with sitters and boarding partners to recommend continuity products; place QR codes in service areas leading to curated carts online.

Customers want help choosing. Merchandising that anticipates questions, rather than bombarding shoppers with SKUs, wins.

E‑commerce execution for the UAE pet market

- Rich product pages: Include clear benefits, ingredient callouts, feeding guidelines, size/fit charts, and short video demos for tech devices, because shoppers compare across tabs.

- Heat and climate context: Note packaging resilience and outdoor suitability for tech and accessories, reassures buyers in a hot climate.

- Subscription nudges: Offer timed deliveries for food and litter; add small incentives for 3‑month commitments to lift retention.

- Ratings and Q&A: Leverage verified reviews and staff answers to reduce returns and reinforce credibility.

- Seasonal campaigns: Align promotions with travel peaks (boarding kits), summer hydration and paw‑care, and indoor enrichment during hottest months.

Petsclubuae.com supports partners with digital‑ready content and assortments designed for online merchandising, helping teams list fast and iterate even faster.

Operations: avoiding the common pitfalls

- Regulatory preparedness: For imported foods and veterinary‑adjacent items, ensure labels, ingredients, and claims meet UAE requirements; keep documentation updated and audit‑ready.

- Storage standards: Temperature and humidity can affect product integrity, especially treats and wet foods, so plan climate‑controlled storage and transport where needed.

- Warranty and returns on tech: Clarify support windows and swap policies; keep spare units ready to preserve customer experience.

- Demand forecasting for events: Leverage local calendars and pet‑service bookings to anticipate spikes; coordinate with suppliers on rapid replenishment windows.

The goal is simple: smooth supply, clean compliance, and consistent customer experience.

Putting it all together: a 90‑day playbook for UAE pet retailers

Weeks 1–2: Assess and align

- Review current sales by category and brand; flag SKUs with high trial but low repeat.

- Audit compliance docs for all imported nutrition.

- Identify gaps in premium, eco‑friendly, and pet tech categories relative to market trends.

Weeks 3–4: Curate and source

- Lock in a core premium food set with functional variety; add 2–3 eco‑toy lines and 2–3 tech essentials.

- Work with PetsClubUAE.com on minimum order quantities and documentation support.

- Create a seasonal calendar (travel peaks, summer heat) with matching SKUs and bundles.

Weeks 5–8: Merchandising and launch

- Refresh in‑store signage and online filters around function, life stage, and sensitivities.

- List new products with enhanced content (videos, ingredient callouts, size guides).

- Launch trial‑size promotions and two curated bundles (e.g., “Sensitive Stomach Starter,” “Smart Feeding & Weight Control”).

Weeks 9–12: Optimize and expand

- Track attachment rates (supplements with food, tech with weight‑control plans).

- Survey boarding and sitting partners on commonly requested items; adjust assortments.

- Plan phase‑two adds: dental routines for cats, eco litter innovations, heat‑safe outdoor gear.

Keep iterating. The market will keep moving, so the assortment should too.

Why partnering with Pets Club UAE makes strategic sense right now

- Fast alignment with demand: Access to premium, eco‑friendly, and tech‑forward SKUs that reflect where UAE consumers are headed, not where they were last year.

- Lower friction to scale: Support for compliance, documentation, and product data readiness cuts launch timelines and lowers operational risk.

- Smarter growth: Flexible order models and replenishment windows help teams test, learn, and expand without tying up cash in slow movers.

- Localized insight: Category guidance grounded in UAE realities, heat, travel cycles, urban living, so assortments feel tailored rather than generic.

In short, stay current without staying up all night chasing SKUs. That’s the point.

The road ahead: what to watch over the next 12–18 months

- Continued pet food premiumization, especially functional and sensitive‑stomach formulas, supported by strong e‑commerce growth and brand trust.

- A bigger role for services in shaping retail baskets, with cats as a fast‑rising segment in boarding and sitting driving add‑on product demand.

- Gradual expansion of pet insurance and wellness‑plan models, which could standardize preventive care baskets across clinics and retailers.

- More credible sustainability claims across toys, accessories, and even packaging, helped by consumer scrutiny and retailer curation.

- Pet tech integration with vet guidance: nutrition apps and smart devices that align with clinic recommendations, closing the loop between retail and healthcare.

If that sounds like a lot of moving parts, it is. But it’s also a big opportunity, especially for businesses willing to modernize assortments, tighten operations, and communicate benefits with clarity.

Final takeaway for UAE pet businesses

The UAE pet economy is on a growth track, undeniably so. Pet ownership surged, services are scaling, and premium food is becoming the norm rather than the exception. Consumers are ready for better products and smarter solutions, from eco‑friendly toys to connected feeders and GPS trackers. The only real question is who will keep up and who will lag.

For retailers, clinics, groomers, and online sellers looking to stay ahead, the playbook is clear: focus on premium and functional nutrition, layer in sustainability and tech, sync with services, and keep assortments fluid. And do it with a sourcing partner that removes friction, on compliance, on content, on replenishment, so the team can focus on growth.

That’s the edge Pets Club UAE is built to deliver: fast access to the newest and most sought‑after pet products, tailored to how the UAE market actually shops and cares today.

Because yes, the market is booming. But the winners won’t just ride the wave, they’ll read it, early and often.