The pet economy across the Gulf Cooperation Council is evolving rapidly, and it’s happening right before our eyes. Cat ownership keeps climbing, dry food dominates day-to-day feeding, and premium choices are becoming the default rather than the exception. When these elements are combined, a clear story emerges: retailers, brands, and distributors that realign to feline-first assortments, convenience-led formats, and trusted premium imports are poised to win between now and 2030.

Funny thing is, this isn’t just a “global trend arrives late” narrative. It’s distinctly regional. The UAE leads the pack in market share, cultural preferences make cats the most popular companion across many GCC households, and modern retail, from supermarkets to e-commerce, has reshaped how pet parents discover and buy food for their animals. Here’s the kicker: these shifts aren’t a blip; they’re structural, and they’re moving the market’s center of gravity.

Below is a detailed, SEO-optimized, and data-backed look at how cat preference and feeding habits are driving a retail reset across the GCC, and what that means for product mix, pricing, merchandising, and channel strategy through the end of the decade.

Key Takeaways at a Glance

- Cat food is the largest pet type segment in both the GCC and the UAE, rooted in ownership patterns and cultural preferences.

- Dry food is the dominant product format due to convenience, shelf life, storage ease, and everyday affordability.

- The GCC pet food market was valued at around $266.2M in 2024, with forecasts pointing to steady growth beyond 2030, while UAE revenues alone exceeded $100M in 2024.

- Premiumization and health-focused diets, from breed- and age-specific formulas to natural and specialty options, are reshaping assortments and pricing ladders.

- The UAE acts as a regional hub for international brands and modern retail growth, with a surge in SKUs and imported product availability.

And for wholesale procurement that aligns with this reality, Pets Club UAE stands out as a reliable wholesale supplier in the UAE for bulk pet products, helping retailers and veterinary partners source the right cat-heavy assortment, competitive dry-food ranges, and trusted brands to meet rising GCC demand.

Market Overview: GCC Pet Food through 2030

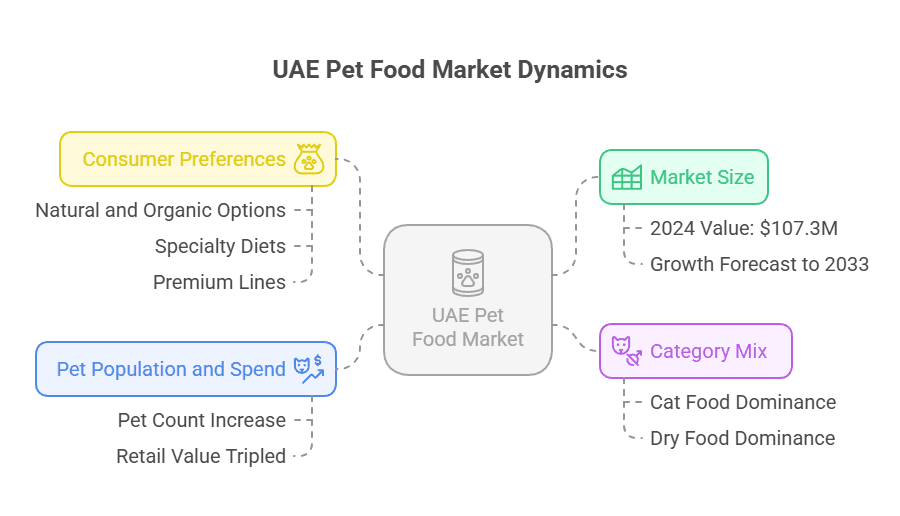

The GCC pet food market has shifted from niche to mainstream, buoyed by rising pet ownership, higher disposable incomes, and, crucially, the steady humanization of pets. Market size estimates for the GCC indicate a base of about $266.2M in 2024, with steady growth underway through the 2030s as retail channels expand and premium choices proliferate. In parallel, the UAE market alone reached roughly $107.3M in 2024, underscoring the country’s outsized role in regional demand.

- GCC momentum: Continuous growth is supported by modern retail expansion, broader access to imported brands, supportive regulations, and growing veterinary infrastructure.

- UAE leadership: The UAE accounts for the largest market share in the GCC, driven by urbanization, expatriate populations, and a strong preference for premium pet care.

- Global tailwinds: Worldwide, pet food remains on a growth path, driven by health-conscious owners, functional formulations, and specialty diets, reinforcing the GCC’s premium tilt.

In short, the macro case for steady GCC growth through 2030 is compelling: structural demand from cats, rising spend per pet due to humanization, and retail sophistication supporting availability and trust.

Why Cats Dominate: Ownership, Culture, and Urban Living

Across GCC countries, cats are the leading companion animal, more adaptable to apartment living and widely accepted culturally, particularly in the UAE, where estimates place cats as the majority of the pet population. That preference has clear commercial outcomes: cat food holds the largest market share by pet type, and retailers that anchor their assortments accordingly generally see faster turns and deeper brand loyalty among cat owners.

- UAE evidence: Cat food is the most popular pet food category by type, reinforced by cultural norms and practical considerations for indoor living.

- Regional trend: GCC-level analysis confirms cat food as the largest segment in 2024, reflecting entrenched ownership patterns.

These preferences shape everything from shelf space allocation to SKU depth by life stage (kitten, adult, senior) and special health needs (urinary care, hairball control, sensitive digestion).

Feeding Habits: Dry Food Rules, Premium Kibble Rises

If there’s one habit reshaping retail strategy, it’s the dominance of dry food. Busy lifestyles, the need for easy storage, longer shelf lives, and cost efficiencies give kibble an edge for daily feeding, especially in large metro areas. That said, demand doesn’t stop at commodity kibble; owners want premium dry formulas with better proteins, targeted nutrition, and functional claims.

- Dry food dominance: Dry food leads in both the GCC overall and the UAE market specifically due to practicality, value, and perceived dental benefits.

- Specialty and natural trends: Owners in the UAE show growing interest in natural, organic, grain-free, and specialty diets, preferences that now influence GCC assortments thanks to the UAE’s role as a regional hub.

- Treats and wet foods: While dry food is the mainstay, wet food and treats fill important roles in palatability, hydration, and training, suggesting retailers should maintain a balanced, cat-first portfolio.

Retailers successful in the next phase prioritize premium dry cat food assortments first, then layer in wet foods and treats that address hydration, variety, and bonding occasions.

The UAE as a Regional Engine and Hub for Imported Brands

The UAE isn’t just a large market; it’s a gateway. With robust e-commerce, pet specialty chains, and supermarkets featuring imported labels, the country has become a preferred launchpad for global brands entering or expanding in the GCC.

- Rapid brand proliferation: Industry observers note the number of brands on UAE retail shelves and websites jumped from roughly 45 to over 120 in a year, an indicator of competitive variety and niche targeting.

- Premium focus: Superpremium and luxury products are disproportionately represented in UAE assortments, mirroring consumer demand and spending capacity.

- Channel mix: Supermarkets, pet specialty stores, and online marketplaces all play central roles; e-commerce, in particular, helps bring long-tail SKUs to smaller GCC markets once supply chains are set up.

This expands the strategic options for retailers across the GCC, especially those that can tap reliable wholesale partners in the UAE to secure consistent, compliant, and competitively priced supply.

Growth Drivers Through 2030

Several tailwinds continue to propel the GCC pet food market. Combined, they form a durable thesis for steady growth and premium mix shift.

- Pet humanization: Owners increasingly treat pets like family, prioritizing health outcomes and quality ingredients, translating into higher spend per animal.

- Urbanization and demographics: Apartment living and a large expatriate base favor small, indoor pets, primarily cats, driving consistent demand for complete and balanced indoor formulas.

- Retail and e-commerce expansion: Wider product access, subscription models, and delivery convenience increase purchase frequency and average basket sizes.

- Veterinary and regulatory infrastructure: Improved animal health services and clearer standards reinforce trust in packaged foods and functional diets.

Some snapshots underscore the pace: UAE pet food retail values climbed from about $61.8M in 2014 to $219M in 2024 as the pet population expanded, with most spend concentrated in dog and cat categories. Market forecasts show sustained growth, with the GCC and UAE continuing their upward trajectories into the 2030s, albeit at different CAGRs by source.

What’s Changing Inside the Basket: Premium, Functional, and Specific

Owners aren’t just buying “pet food.” They’re buying for outcomes, digestive support, weight management, hairball control, urinary care, hypoallergenic formulas, and life-stage nutrition. In the UAE, there’s a pronounced tilt toward natural and organic options, plus specialty diets like grain-free and raw-inspired formulations.

- Ingredient narratives: Animal-protein-forward recipes and high-protein claims resonate strongly, aligning with perceived quality and feline nutritional needs.

- Functional claims: Probiotics, antioxidants, and targeted health benefits continue to gain traction, especially in premium dry cat food ranges.

- Segmentation depth: Life-stage and breed-specific segmentation expands shelf presence, keeping the cat aisle dense with SKUs and price tiers.

For retailers, the practical takeaway is straightforward: grow breadth in premium dry cat food, keep strong baselines in mainstream kibble, and selectively expand wet foods and treats with hydration and health angles.

Country-Level Nuances Across the GCC

While the UAE leads in premiumization and brand variety, other GCC markets, Saudi Arabia, Kuwait, Qatar, Oman, and Bahrain, are following with local tempo and regulatory rhythms.

- Saudi Arabia: Larger population and rapid modernization of veterinary and retail ecosystems point to increasing structured demand, supported by government initiatives in animal health.

- Qatar, Kuwait, Bahrain, Oman: Smaller but steadily evolving markets, where online access and cross-border supply from the UAE help retailers carry the right mix despite limited local distribution footprints.

Because import flows and brand approvals matter, regional retailers often prioritize wholesale partners with consistent inventory, compliance knowledge, and logistics capabilities out of the UAE.

Retail Strategy Playbook: How Cat Preference and Feeding Habits Rewire the Shelves

Here’s how retailers and marketplaces can adapt, quickly and effectively.

1) Lead with Cats: Assortment and Shelf Mechanics

- Allocate more shelf space and digital category depth to cat food, reflecting demand and faster turns.

- Prioritize dry cat food lines by life stage and function, then reinforce with wet formats addressing hydration and palatability.

- Maintain staple SKUs in mainstream price points while expanding superpremium tiers, especially in the UAE and high-income urban pockets across GCC.

2) Own the Dry Food Value Ladder

- Build a clear price ladder in dry cat food, from value to premium to superpremium, so shoppers can easily trade up.

- Use functional signposting on shelves and product detail pages: digestive care, urinary health, hairball control, indoor formulas, sensitive stomach.

- Bundle offers with litter or treats to increase average order value and drive pantry-loading behavior for cat households.

3) Nail the Content: PDPs, Filters, and AI Overview Readiness

- Structure product pages with rich attributes: species, life stage, protein source, grain-free status, vet-recommended notes, and kibble size.

- Add structured product information like ratings, offers, and FAQs to boost visibility and trust in evolving search experiences.

- Answer owner questions directly on product and category pages, “Is this suitable for indoor cats?”, “How does this support urinary health?”, “What’s the protein percentage?”, to align with helpful content standards and improve zero-click discovery.

4) Lean into Subscriptions and Auto-Replenishment

- Cats eat a consistent daily ration, perfect for subscription models that lock in lifetime value and reduce churn.

- Offer small incentives for auto-ship, particularly in dense urban zones where convenience tends to trump small price differences.

5) Localize Logistics and Compliance

- Consolidate wholesale procurement through trusted UAE-based suppliers to stabilize sourcing of imported brands and navigate compliance efficiently across GCC markets.

- Secure regional exclusivities where viable to protect margin and ensure continuity for top-selling feline SKUs.

6) Seasonal and Cultural Calendars

- Align promotions with regional calendars and peak seasons, summer hydration pushes with wet foods, shedding seasons with hairball control formulas, and travel periods with smaller pack sizes and treats.

E-Commerce and Omnichannel: The New Front Door for Pet Food

E-commerce is not just an add-on; it’s a growth engine. In the UAE, digital channels have made specialty and imported brands widely accessible, with pet specialty sites and marketplaces expanding their assortments month by month.

- On-site UX: Improve filters by life stage, protein source, functional benefits, kibble size, flavor, and brand. Cat owners actively search for these specifics.

- Trust signals: Vet endorsements, transparent ingredient lists, feeding guides, and authentic user reviews increase conversion, especially for premium SKUs.

- Content hubs: Publish clear, medically reviewed content on feline nutrition, urinary health, and indoor cat needs to build authority and earn visibility in AI-driven search experiences.

Wholesale and Supply Chain: Why Pets Club UAE Matters

To meet the GCC’s cat-first, dry-led, premium-tilting demand reliably, retailers need robust wholesale partners. Pets Club UAE operates as a reliable wholesale supplier in the UAE for wholesale pet products, helping retailers, clinics, and grooming businesses:

- Source a cat-heavy assortment with the right mix of dry, wet, and functional SKUs to reflect regional demand.

- Access competitive pricing on imported brands through consolidated procurement and logistics centered in the UAE hub market.

- Maintain continuity on fast-moving feline lines, minimizing out-of-stocks and protecting category share as the market grows.

Given the rapid proliferation of brands and SKUs in the UAE, having a wholesale partner that curates, verifies, and keeps inventory consistent is, frankly, a competitive advantage, especially when entering or scaling in neighboring GCC markets.

Pricing, Promotions, and Margin: Finding the Sweet Spot

As premium and superpremium lines expand, retailers need to manage price perception carefully:

- Good-better-best strategy: Position a visible opening price point for dry cat food, followed by a strong mid-tier, then promote premium and superpremium with clear health benefits.

- Mix-driven margins: Balance premium share growth against volume in mainstream kibble to sustain category profitability, use treats and accessories to lift blended margins.

- Promotion cadence: Strategize promotions around subscription onboarding, multipacks, and bundles rather than blanket discounts, protecting price integrity for premium SKUs while driving long-term retention.

Regulatory and Veterinary Factors: Building Consumer Trust

Consumers in the GCC, particularly in the UAE, are becoming more discerning, and veterinary guidance carries weight:

- Vet alignment: Joint education with clinics on urinary health, weight management, and indoor formulas helps move premium cat lines with clear medical rationales.

- Clear standards: As regulations and animal health infrastructure improve, consumer trust in packaged nutrition and functional claims rises, reducing barriers to trade-up.

Retail partnerships with clinics and rescue organizations also create community touchpoints that reinforce credibility and brand preference.

Category Management: Practical Planograms for Cat-First Aisles

Design shelves and digital category pages to reflect real shopping patterns:

- Top rows: Premium and functional dry cat food, grouped by life stage and health need for quick scanning.

- Middle rows: Mainstream dry cat food bestsellers, clear price communication, and family-size packs for multi-cat households.

- Lower rows and ends: Wet food varieties for hydration and palatability, with multipack options; treats and toppers near eye-level to drive impulse.

- Cross-merch: Litter and odor-control near cat food; fountain bowls and hydration aids adjacent to wet foods to drive attachment.

Online, mirror this with smart navigation and algorithmic recommendations that suggest complementary items and up-sell to functional formulas based on pet profile inputs.

Visibility in Evolving Search: How to Stay Discoverable

Search is changing, and pet food queries are no exception. To remain visible:

- Structured information: Present complete product data and FAQs on key pages to improve eligibility for rich and AI-generated results.

- Owner-intent content: Publish concise, medically aligned answers to common questions, dry versus wet for indoor cats, signs of urinary issues, protein needs by life stage, to capture zero-click interest.

- Experience and expertise: Showcase veterinary input, cite credible foundations for claims, and keep product information transparent to align with quality standards.

Operators who treat content like a product, accurate, scannable, and genuinely helpful, will outperform as AI-driven discovery expands.

Competitive Landscape: Brands, Variety, and Choice Architecture

The number of pet food brands available in the UAE has surged, with many imported labels entering to fill niche diets and premium positions. For retailers, that can be a blessing and a headache. Choice is great. Duplication isn’t.

- Curate intelligently: Avoid overlapping SKUs with similar formulations and price points; use data to identify true incrementality by brand and sub-segment.

- Maintain anchors: Keep a few trusted international anchor brands in dry cat food, then layer niche and functional newcomers to capture long-tail demand and innovation seekers.

- Review quarterly: Given fast-moving assortments in the UAE, reassess SKU productivity and swap underperformers to maintain freshness without confusing loyal shoppers.

Again, wholesale partners like Pets Club UAE can help navigate brand proliferation, ensuring that assortment changes translate into actual sales lift rather than shelf noise.

Country Deep Dive: The UAE’s Data Signals

The UAE provides the clearest window into GCC dynamics:

- Market size: About $107.3M in 2024, with steady growth forecast to 2033.

- Category mix: Cat food represents the largest share by pet type in the country; dry food dominates by product format.

- Consumer preferences: Rising demand for natural and organic options, specialty diets such as grain-free, and premium lines align with broader health-conscious behavior.

- Pet population and spend: Pet counts rose markedly from 2014 to 2024, while retail values more than tripled, nearly all of it in dog and cat food, signaling sustained consumer commitment to packaged nutrition.

Given this momentum, the UAE’s retail playbook, cat-first, dry-led, premium-tilted, will likely continue to filter into neighboring GCC markets as supply chains and consumer preferences converge.

Risks and Headwinds to Watch

No market is without friction:

- Import dependencies: The UAE and much of the GCC rely on imported pet food; external logistics or trade shifts can influence pricing and availability.

- Price sensitivity pockets: While premium is growing, maintain value options for price-conscious buyers to retain share during macro fluctuations.

- Regulatory evolution: Changes in labeling or ingredient standards could require rapid assortment adjustments, and work closely with compliant wholesalers and manufacturers.

Balanced assortments and agile procurement help mitigate these risks.

Action Plan for Retailers and Distributors (2025–2030)

- Recalibrate space and search: Expand cat food shelf space and digital category depth, especially in dry formulas and functional SKUs.

- Build premium ladders: Ensure clear step-ups in quality and price; articulate benefits plainly on shelves and product pages to encourage trading up.

- Double down on product pages: Add clear feeding guides, precise ingredients, and veterinary inputs to enhance conversion and visibility.

- Scale subscriptions: Promote auto-ship for dry cat food; anchor with small discounts and free shipping thresholds to lift lifetime value.

- Partner for supply: Use reliable wholesale partners, such as Pets Club UAE, to secure inventory, streamline imports, and manage assortment by demand signals across GCC markets.

- Educate to sell: Create short, credible education blocks on urinary health, hairball control, and indoor nutrition, content that helps owners pick confidently and keeps returns low.

Outlook: Through 2030 and Beyond

Expect the GCC pet food market to keep compounding steadily through the decade, with the UAE setting the pace. Cats will remain the core engine; dry food will stay the everyday base; premium and functional formulations will keep expanding share as owners lean into health outcomes. With modern retail and e-commerce enabling wide access to imported brands, and with wholesale hubs in the UAE sustaining regional supply, the competitive edge will go to operators who curate smartly, communicate clearly, and serve cat owners better than anyone else.

For those building assortments or entering new GCC sub-markets, aligning with a trusted wholesale partner like Pets Club UAE can make the difference between sporadic availability and reliable, scalable growth.

Because in this market, where cats come first and daily feeding habits are predictable, the brands and retailers that meet owners where they are, with the right product at the right moment, will keep winning.