So. You’ve got the idea.

The one that keeps you up at night, in a good way. The one you doodle on napkins and talk about with a fire in your eyes. It’s a game-changer, a paradigm-shifter, a this-is-it kind of idea. You’re ready to leap. To build something from scratch. To finally be your boss.

I get it. I’ve been there. The energy is electric, isn’t it? It feels like you’re standing on the edge of a cliff, about to take flight. It’s intoxicating.

But hold on. Just for a second.

Before you jump, before you print those business cards and launch that slick website, we need to talk. About the boring stuff. The stuff that makes your eyes glaze over. The legal stuff.

Yeah, I know. It’s the un-fun part. The paperwork, the jargon, the red tape. It feels like a massive killjoy when all you want to do is create and sell, and conquer. It’s tempting, so, so tempting to just… ignore it. To figure it out later. To wing it.

Please. Don’t do that.

Winging it on the legal front is like building a skyscraper on a foundation of sand. It might look impressive for a little while, but when the first storm hits, a disgruntled client, a tax audit, a problem with a partner, the whole thing can come crashing down. And trust me, you don’t want to be in the rubble of your dream, thinking, “If only I’d taken care of that piece of paper.”

Think of this not as a chore, but as the first, most crucial step in building something that lasts. Something real. This is you, telling the world, and yourself, that you’re serious. This isn’t just a hobby. It’s an empire in the making.

So, grab a coffee. Get comfortable. Let’s walk through this together. We’ll make it as painless as possible, I promise. Consider me your guide through the jungle of legalese. Here’s the checklist that will save you headaches, heartaches, and a whole lot of money down the road.

And whatever you do… don’t skip #5. Seriously.

1. Get Your Structure Straight: Who Are You, Legally Speaking?

Okay, first things first. Before you can do almost anything else, you have to decide what your business is. From a legal standpoint, I mean. This is your business entity structure, and it’s a biggie. It affects everything, how you’re taxed, your liability, and how you can raise money. It’s the blueprint of your entire operation.

Let’s break down the usual suspects.

The Lone Wolf: Sole Proprietorship

This is the default. The simplest. If you just start doing business as yourself, congratulations, you’re a sole proprietor.

- The Good: It’s easy. Unbelievably easy. There’s no formal action to take, no paperwork to file to create it. You and the business are the same. All the profits are yours. The accounting is relatively straightforward (you just report business income on your tax return). It’s perfect for freelancers, consultants, or someone testing a business idea. Simple.

- The Not-So-Good: Here’s the kicker. Since you and the business are one, you are personally liable for everything. Every. Single. Thing. If your business gets sued, they can come after your assets. Your house, your car, your savings account, it’s all on the table. It’s a risk. A big one. As you grow, this lack of protection can become a major liability.

The Partnership Path: General & Limited

Got a co-founder? You might be a partnership. A General Partnership is a lot like a sole proprietorship, just with two or more people. You’re all in it together.

- The Good: Again, simple to set up. You can just agree to go into business together and, poof!, you’re a partnership. You get to pool your skills and resources.

- The Ugly: The liability thing gets even scarier here. You’re not just liable for your actions, you’re liable for your partner’s actions too. If your partner signs a bad deal or gets the company into legal hot water, you’re both on the hook. Personally. All your assets. It’s a level of trust that, if I’m honest, can strain even the best of friendships.

There are also Limited Partnerships (LPs) and Limited Liability Partnerships (LLPs), which offer more complex structures and some liability protection, but they’re more specialized. Let’s keep moving.

The Force Field: The LLC (Limited Liability Company)

Now we’re talking. For a huge number of small businesses, the LLC is the sweet spot. The golden ticket.

- The Good: The name says it all: Limited. Liability. The LLC creates a separate legal entity. It’s a shield. A force field between your business and your personal life. If the business incurs debt or gets sued, your assets are generally protected. It’s the peace of mind that lets you sleep at night. You also get “pass-through” taxation, meaning the business profits “pass through” to your tax return, avoiding the “double taxation” that corporations sometimes face. It’s the best of both worlds. Flexibility and protection.

- The Not-So-Good: It’s a bit more work to set up and maintain. You have to file articles of organization with your state, and there are annual fees and reporting requirements. It’s not a ton of work, but it’s more than a sole proprietorship. Worth it? In my book, absolutely.

Going Big: The Corporation (S Corp & C Corp)

This is the most formal structure. Think big companies, shareholders, and stock options.

- C Corporation: This is the standard corporation. It’s a completely separate legal and tax entity. It can issue stock, raise money more easily, and the liability protection is rock-solid. The downside? It’s complex to manage (think board meetings, minutes, bylaws), and it faces double taxation; the corporation pays taxes on its profits, and then you pay taxes again on the dividends you receive. Ouch.

- S Corporation: An S Corp is a special tax election. It’s still a corporation from a legal standpoint (great liability protection), but it allows profits and losses to be passed through directly to the owners’ income without being subject to corporate tax rates. It avoids the double taxation problem. There are some strict eligibility rules, though (like a limit on the number of shareholders).

So, what do you do? Talk to someone. Seriously. Read up online, for sure, but then have a conversation with a small business lawyer or a CPA. They can look at your specific situation, your industry, your goals, and your risk tolerance and give you tailored advice. Don’t just pick one out of a hat. This is your foundation. Make it solid.

2. Name It and Claim It (The Right Way)

You’ve got the perfect name. It’s catchy, it’s memorable, it’s… available?

Funny thing is, just because the domain name is free or there’s no one on Instagram with that handle doesn’t mean you can legally use the name. This is a minefield. You have to do your homework.

- State Business Registry: First, you need to check if your desired name is available in your state. Every state maintains a database of registered business names. If someone else has registered an LLC or corporation with that name (or one that’s confusingly similar), you’re out of luck. You’ll have to go back to the drawing board.

- “Doing Business As” (DBA): Let’s say you’re a sole proprietor named Jane Smith, but you want to do business as “Sunshine Marketing.” You’ll need to register a DBA, which stands for “Doing Business As.” It’s also known as a fictitious name or trade name. It’s a simple filing that lets the public (and the government) know who is behind the business.

- The Trademark Search: This is the big one. Even if the name is free in your state, someone in another state could have a federal trademark on it. If they do, and you operate in the same industry, you could be setting yourself up for a very expensive cease-and-desist letter down the line. Use the U.S. Patent and Trademark Office’s (USPTO) free TESS database to search. Be thorough. Search for variations, misspellings, everything. If your name is clear, consider filing for your own trademark to protect it. It’s your brand, after all. Protect it fiercely.

Getting the name wrong can mean having to rebrand everything later. Your website, your logo, your marketing materials… all of it. A costly, painful mistake. Do the legwork upfront.

3. Get Your Numbers in a Row: The Tax Man Cometh

Nobody loves taxes. But ignoring them is, well, a terrible idea. To make sure you’re on the right side of the IRS and your state tax agency, you need a special number.

It’s called an Employer Identification Number (EIN).

Think of it as a Social Security Number for your business. It’s a unique nine-digit number that the IRS uses to identify you.

Who needs one? Pretty much everyone who isn’t a sole proprietor with zero employees. If you plan to hire anyone, if you operate as a corporation or a partnership, or if you file certain types of tax returns, you need an EIN. If you’re an LLC, you’ll want one to open a business bank account.

The good news? Getting an EIN is free and surprisingly easy. You can apply directly on the IRS website and get your number in minutes. Don’t ever pay a third-party service to do this for you. It’s a government freebie. Take it.

This number is your key to so many things: hiring employees, opening a bank account, applying for licenses, and, of course, filing your business taxes. It’s non-negotiable.

4. Navigating the Maze: Licenses and Permits

Welcome to the wonderful world of government red tape! Depending on your industry and your location, you might need a whole slew of licenses and permits to operate legally. Federal, state, county, city… they all want a piece of the action.

It can feel overwhelming. Like a bureaucratic labyrinth. But you can figure it out.

- Federal Licenses: Most small businesses don’t need a federal license, but if you’re in a federally regulated industry, you do. We’re talking about things like broadcasting, investment advising, commercial fishing, firearms, and alcohol production.

- State Licenses: This is where it gets more common. Many professions require a state license to practice, such as doctors, lawyers, hairdressers, contractors, and real estate agents. Beyond that, many states require a general business license or permit just to operate.

- Local Licenses & Permits: Don’t forget about your city and county. This is where it gets really specific. You might need a general business operating license from your city. If you have a physical storefront, you’ll need zoning permits, a certificate of occupancy, maybe a sign permit. If you sell food, you’ll need health department permits. Running a business from home? Believe it or not, you might need a home occupation permit.

How on earth do you figure out what you need? The U.S. Small Business Administration (SBA) website is your best friend here. They have tools and resources that can help you identify the specific requirements for your industry and location. Your local city hall or county clerk’s office is also a great resource. Just call them up and ask.

Yeah, it’s a pain. But operating without the proper licenses can lead to hefty fines and, in some cases, being shut down completely. Don’t risk it.

5. The One You Cannot Skip: The Founders’ Agreement

Okay. Deep breath.

We need to talk about the most exciting and terrifying part of many new businesses: your co-founder.

Your business partner. Your work-spouse. The person you’re in the trenches with. Right now, things are great. You finish each other’s sentences. You share the same vision. You’re going to conquer the world together.

And that’s exactly why you need a Founders’ Agreement. Right now. While you still like each other.

What is it? It’s a legal document, a contract that you and your co-founders create at the very beginning. It’s a prenup for your business. It lays out all the uncomfortable “what if” scenarios before they happen.

Think about it. What happens if one of you wants to leave? What if someone isn’t pulling their weight? What if you get a huge offer to sell the company, but one of you wants to sell and the other doesn’t? What happens if, heaven forbid, one of you passes away?

These are not fun conversations. They feel cynical. They feel like you’re planning for failure when you’re just getting started. I know.

But here’s the kicker: not having these conversations is what leads to failure.

I have seen it happen. More times than I can count. Two best friends start a company on a handshake. They pour their life savings into it. It starts to take off. Then… a disagreement. Maybe over the company’s direction. Maybe over money. Maybe one person feels they’re doing all the work. The handshake deal? Suddenly, nobody remembers the terms quite the same way.

The arguments start. Resentment builds. Lawyers get called. The business grinds to a halt, paralyzed by infighting. Friendships are destroyed. The dream dies. All because they didn’t have a difficult conversation and write it down at the beginning.

A Founders’ Agreement is your roadmap. It forces you to be crystal clear on the things that can tear a business apart.

What goes into a Founders’ Agreement?

- Equity Ownership: Who owns what percentage of the company? Is it 50/50? Or is it based on initial investment or contribution? Be specific.

- Roles and Responsibilities: Who is the CEO? Who is in charge of tech? Who handles marketing? Defining roles prevents turf wars and ensures accountability.

- Vesting: This is huge. Vesting means that co-founders don’t get their full equity stake on day one. Instead, they earn it over time (typically four years with a one-year “cliff”). If a co-founder leaves after six months, they don’t walk away with a huge chunk of your company. They only get what they’ve “vested.” This protects the business from an early departure. It’s a must-have.

- Decision-Making: How will you make major decisions? Does everything require a unanimous vote? Or can a majority decide? What qualifies as a “major” decision?

- Exit Clauses (The 4 D’s): What happens in the case of Death, Disability, Departure, or Disagreement? You need buy-sell provisions that dictate how a founder’s shares will be bought out by the remaining founders if they leave for any reason. This prevents a departing founder’s shares from ending up in the hands of their spouse, a stranger, or a competitor.

Creating a Founders’ Agreement is the ultimate act of optimism. It’s you, protecting the future of the dream you’re building together. It’s saying, “Our vision and our friendship are too important to leave to chance.”

Don’t just download a template and sign it. This is not the place to cut corners. Hire a lawyer. A good one. Have them facilitate the conversation. It’s the best money you will ever spend on your business.

I’m serious. If you are starting a business with another human being, do not pass go, do not collect $200, until you have a signed Founders’ Agreement in your hand. This is the one. Don’t skip it.

6. Insure Your Investment: Your Financial Safety Net

You insure your car. You insure your house. You need to insure your business.

Insurance isn’t just for when disaster strikes; it’s a fundamental part of being a professional and protecting your financial future. One lawsuit, one accident, one fire, and everything you’ve worked for could be gone.

The kind of insurance you need depends heavily on your business, but here are the greatest hits:

- General Liability Insurance: This is the big one. It covers you for things like bodily injury or property damage that might happen on your premises or as a result of your operations. Someone slips and falls in your store? You’re covered. You accidentally break a client’s expensive server while doing an IT install? You’re covered.

- Professional Liability Insurance (Errors & Omissions): If you provide services or advice for a living, if you’re a consultant, a designer, an accountant, a programmer, you need this. It protects you against claims of negligence, mistakes, or failure to perform your professional duties. It’s malpractice insurance for business professionals.

- Commercial Property Insurance: If you have a physical location, equipment, inventory, or computers, you need this. It covers loss and damage to your business property due to things like fire, theft, or a storm.

- Workers’ Compensation Insurance: If you have employees (even just one!), this is legally required in almost every state. It covers medical costs and lost wages for employees who are injured on the job. Don’t mess with this one; the penalties are severe.

Feeling a little lost in the options? Find a good independent insurance broker who specializes in small businesses. They can assess your specific risks and put together a package that makes sense for you, without you buying coverage you don’t need.

7. Draw a Line in the Sand: The Business Bank Account

This sounds almost too simple to be on a legal checklist, but you’d be shocked how many new entrepreneurs skip it.

Open a separate bank account for your business.

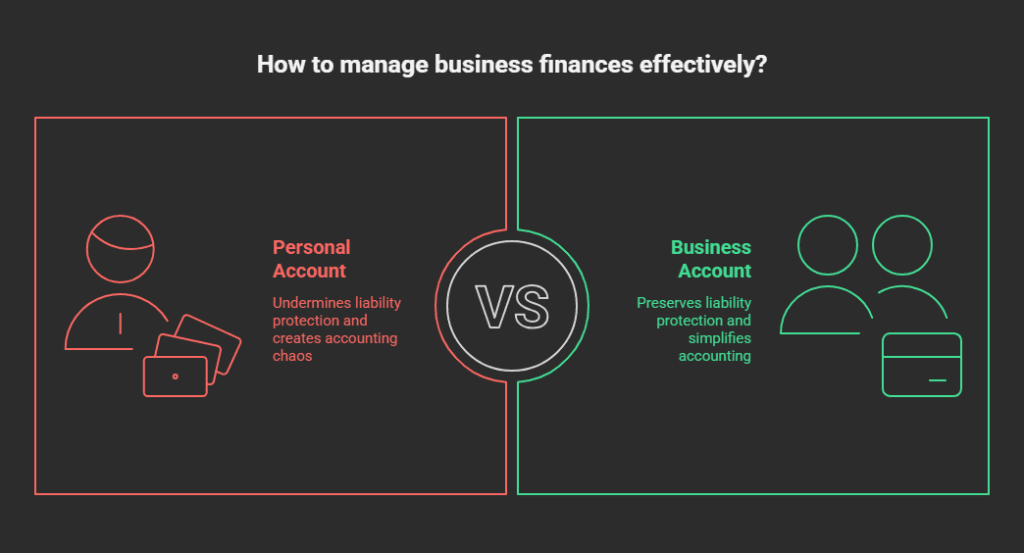

Do not, I repeat, DO NOT, run your business out of your checking account. Co-mingling funds is a cardinal sin in the business world.

Why? Two huge reasons.

- It Destroys Your Liability Protection: Remember that shiny LLC or corporation you set up? The one that creates a legal shield between you and the business? If you’re paying for business inventory with your debit card and depositing client checks into your savings, you’re telling the legal system that there’s no real separation. A lawyer for someone suing you could argue to “pierce the corporate veil,” and suddenly, your assets are fair game again. You’ve just undone the single most important reason for creating an LLC in the first place.

- It’s an Accounting Nightmare: Come tax time, how are you going to separate your business expenses (deductible!) from your ones (not deductible!)? Are you going to spend hours sifting through bank statements, trying to remember if that Amazon purchase was for a new printer or a birthday gift? It’s a recipe for chaos, missed deductions, and a massive headache for you or your accountant.

So, as soon as you have your business structure and your EIN, walk into a bank and open a dedicated business checking account. Pay all business expenses from it. Deposit all business revenue into it. Clean and simple. It’s one of the easiest and most important things you can do.

Give it a try. The clarity is a beautiful thing.

This checklist might seem long. It might feel like a lot of hoops to jump through. And in a way, it is. But it’s also a rite of passage. It’s the process of transforming a brilliant idea into a legitimate, durable, defensible business.

Each step you take, each form you file, each conversation you have… It’s a brick in the foundation of your future. It’s you, building it right. Building it to last.

The world has enough flimsy ideas that burn out before they ever truly catch fire. Be different. Do the work now, so you can focus on what matters later: growing your business, serving your customers, and changing the world with that incredible idea of yours.

Now go on. Go build that empire. The right way.