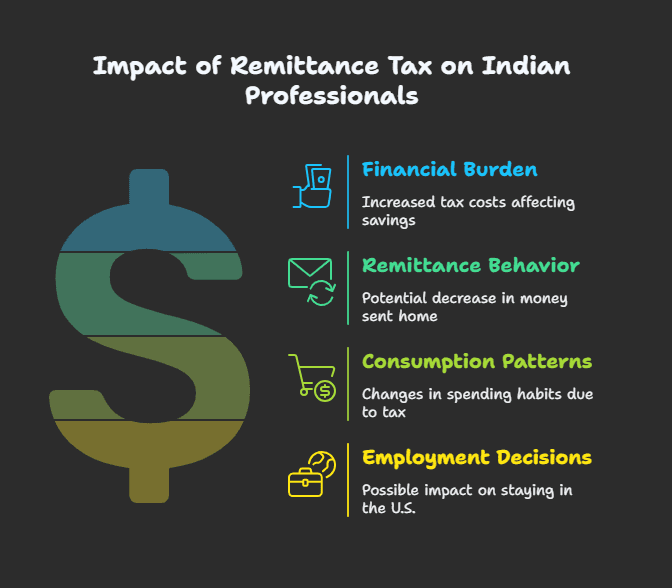

A fresh legislative bill in the United States labeled the “One Big Beautiful Bill” has raised an alarm among Indian professionals in the US. The main cause of the controversy is the imposition of a 3.5% remittance tax on money being sent overseas by non-citizens, including H-1B visa holders and green card seekers. For the Indian diaspora, the remittance tax bill could have financial implications with serious repercussions on their ability to send money to relatives back home and possibly alter their long-term choices regarding residency and employment within the U.S.

What Is the Remittance Tax Bill?

The “One Big Beautiful Bill” is a large tax and spending bill that was just approved by the U.S. House of Representatives. Among its most notable proposals is a 3.5% tax imposed on money sent overseas by non-U.S. citizens. These are international money transfers done by H-1B visa holders, green card applicants, and the like, who are not U.S. citizens.

The remittance tax bill is anticipated to come into effect from January 1, 2026, subject to Senate approval and the final signature of the President. If enacted, this would be a big shift in taxing remittances in the United States, particularly for immigrants sending money back home to their families regularly.

Why Indian Professionals Are Concerned About the Remittance Tax Bill

Indian professionals form a significant portion of the U.S. non-citizen population, especially in fields such as technology, engineering, health care, and finance. A lot of these workers remit funds to their families back home in India every month. The remittance tax bill now means that each time they remit funds abroad, they would pay 3.5% as a tax on the remitted amount.

Suppose an Indian worker sends $1,000 every month to maintain their family. They would be charged $35 for each transfer under the new policy. That would amount to $420 in a year, money no longer being received by their families. For one sending $2,000 every month, the one-year tax would be $840. These are significant sums, particularly when combined with the U.S. high cost of living and other tax burdens.

This economic pressure might deter professionals from remitting money to their homes, modify their consumption patterns, or even affect their inclination to remain employed in the U.S.

How the Remittance Tax Might Impact the Indian Economy

India is the global leader in remittance receipt, followed by the U.S. as the source country. Indian expatriates remit billions of dollars to their families back home every year. The money is used to finance education, healthcare, housing, and small enterprises. They also finance the Indian economy by adding to foreign exchange reserves and domestic consumption.

If the remittance tax bill becomes law, the amount of money sent home would decline substantially. Families would get reduced amounts, and in certain instances, nothing at all if the giver cannot pay the additional tax. A decline in remittances might lower household incomes in India, especially in states such as Kerala, Punjab, Andhra Pradesh, and Telangana, where families depend significantly on foreign money.

In the long run, lower remittances may undermine India’s balance of payments, impact currency stability, and constrain economic growth, especially in money-dependent regions.

Effect on Indian Families: The Human Aspects of the Tax

Behind each cross-border money transfer lies a tale of self-denial, accountability, and emotional attachment. Indian professionals tend to uproot their parents, spouses, and children for greener pastures in the U.S. Sending money abroad is not only a transactional activity; it’s a means of staying connected, of paying one’s dues, and of enabling dreams to be pursued by loved ones.

The remittance tax bill promises to put a price on that assistance. It will push people to make a choice between paying taxes and cutting back on the amount they send. In others, it will create debt, hard budget decisions, or emotional stress within families.

Also, the psychological weight of being taxed solely for remitting money to loved ones can engender feelings of injustice and isolation among immigrants who already contribute considerably to the U.S. economy through taxes and labor.

Could This Influence Immigration and Career Decisions?

For numerous Indian professionals, the U.S. has been the dream destination for career development and individual enrichment. However, if the economic and legal climate is progressively restrictive, it may reverse this trend.

The remittance tax bill would serve as a disincentive for new talent looking at the U.S. as a possible option. The talented professionals may prefer to go to Canada, the U.K., or Australia—nations with relatively more immigrant-friendly policies and fewer restrictions on remitting money overseas.

In addition, individuals who are already in the U.S. may rethink long-term residence, limit transfer frequency, or even opt for an early return to India. This may lead to a brain drain for the U.S., particularly in high-skill industries such as technology and healthcare.

Are There Any Legal or Political Challenges to the Bill?

As with all significant legislative reform, the remittance tax bill may be subject to legal challenge and political backlash. Critics claim that the tax discriminates against foreigners and may contravene the principles of fair treatment. Immigrant advocacy groups are likely to appeal the bill in court or pressure lawmakers to amend or repeal the tax provision.

There is also the risk of diplomatic pushback. Those nations with significant diasporas in the U.S., including India, Mexico, and the Philippines, will likely protest via diplomatic means. They will likely urge their people and ask for exemptions or negotiate bilaterally to fix the situation.

What Can Indian Professionals Do to Prepare?

If the remittance tax bill comes into effect, Indian professionals in the U.S. might have to rethink their personal finance planning. Below are some pre-emptive actions they could take:

- Find Alternative Remittance Channels

Look into remittance service providers that have lower charges or even incentives. There could be some platforms that cover some part of the tax to stay competitive. - Curbing Transfer Frequency

Instead of sending smaller amounts multiple times a month, consolidate transfers to reduce the overall tax burden. - Consider Tax-Deductible Options

Consult with a financial advisor or tax expert to understand if certain transfers can be made through tax-deductible methods or charitable channels. - Advocate and Stay Informed

Join community groups, professional associations, or legal forums that are challenging the bill. Staying informed and involved is essential. - Evaluate Long-Term Plans

Reexamine residency, investment, and immigration plans in light of the changing political landscape of the U.S.

Conclusion: Indian Professionals at the Crossroads

The remittance tax bill marks a watershed moment for Indian professionals employed in America. Its monetary effects are evident, but the more profound impacts on households, choices, and diaspora relationships are still being written.

While debates on the bill go on, professionals need to inform themselves, raise their voices, and strategize. Remittances are not only money; they are care, commitment, and cultural connection. Any policy that touches this relationship is worth noting and well-informed action.