You know, when folks think about Wyoming, what often springs to mind? Probably wide-open spaces, Yellowstone, maybe even cowboys, right? But for us business-minded types, there’s another image that comes to mind: an incredibly business-friendly environment. Seriously, it’s like a whispered secret among entrepreneurs, a real hidden gem. The state, for years now, has been setting itself apart with some truly compelling advantages, especially for small businesses and startups looking to hit the ground running. It’s not just hype, either; the numbers and the laws speak for themselves.

Still, even in the most welcoming of landscapes, there are always rules of the road. And navigating those can feel a bit like trying to find your way through a winding mountain pass in a blizzard if you don’t have a good map. That’s why we’re diving deep today, cutting through the jargon and getting straight to the heart of what you really need to know about doing business in the Cowboy State. Because, let’s be honest, nobody wants to trip over a hidden regulation and end up with a penalty, do they? No way.

The Wyoming Advantage: Why Everyone’s Talking About It

First things first, why Wyoming? It’s not just a beautiful place; it’s a strategically smart one for your business, and here’s the kicker: it often comes down to taxes, or rather, the lack of them. We’re talking about a state with no corporate income tax and no personal income tax. Imagine that! For businesses, especially those structured as LLCs, this can mean a massive difference to your bottom line. More money in your pocket, more to reinvest, more to grow. It’s a game-changer, plain and simple.

But it’s not just about what they don’t tax. Wyoming is also renowned for its incredibly strong privacy protections. Seriously, for LLC owners, this is gold. Unlike some other states where your name and address are splashed across public records for all to see, Wyoming generally doesn’t require the disclosure of members or managers in public filings. This offers a level of anonymity that many entrepreneurs deeply appreciate, a kind of shield, if you will, for your personal information. And believe me, in today’s world, that’s a big deal.

Then there’s the cost. Low formation costs, competitive filing fees, and generally minimal ongoing maintenance. It’s designed to be accessible, to encourage new ventures, to say, “Come on in, the water’s fine!” The overall business reputation? Top-notch. Wyoming has a long history of being innovative with its business legislation, always looking to stay ahead of the curve and adapt to what modern businesses need. This translates into a stable, predictable legal framework, which, as any seasoned business owner will tell you, is worth its weight in gold.

Laying the Foundation: Business Structure and Formation

Alright, so you’re sold on Wyoming. Fantastic! Now, what about actually getting your business up and running? This is where the initial paperwork comes into play, and frankly, it’s often simpler than you might think.

Choosing Your Business Structure

This is step one, and it’s a biggie. Do you go for a sole proprietorship, a partnership, an LLC, or a corporation?

- Sole Proprietorships and General Partnerships: Super easy to set up, almost no formal paperwork with the state. You just… start selling, basically. But here’s the rub: personal liability. Your personal assets aren’t separate from your business debts. Not ideal for everyone, is it?

- Limited Liability Companies (LLCs): Ah, the superstar! This is what most people gravitate towards in Wyoming, and for good reason. They offer personal liability protection—meaning your personal assets are generally safe if the business gets into trouble. They also boast incredible flexibility in management (you can manage it yourself, appoint someone, or hire an outside manager) and flexible taxation. You get that pass-through taxation, which means profits go straight to the owners, avoiding that dreaded “double taxation” corporations sometimes face. Plus, remember that privacy thing? LLCs in Wyoming truly shine there.

- Corporations: More formal, more rules, but they offer the strongest liability protection. Corporations, by default, are taxed as C-Corps at the federal level, which means the company pays taxes, and then shareholders pay taxes on dividends. There are more formalities, like required annual meetings and bylaws. For some larger ventures or those seeking to raise significant capital, a corporation might be the right fit, but for many, the LLC is the sweet spot.

Naming Your Business and Filing Formation Paperwork

Once you pick your structure, you need a name. And guess what? It needs to be unique. No two ways about it. The Wyoming Secretary of State’s website offers a handy search tool to check availability. It’s a good idea to reserve your name, which you can do for 120 days, just to be safe while you get your ducks in a row.

Then comes the filing. If you’re forming an LLC, you’ll file Articles of Organization. For a corporation, it’s Articles of Incorporation. These are submitted to the Wyoming Secretary of State. You can do it online, by mail, or even in person. Online filings are usually processed much faster, often immediately, while mail might take up to 15 business days. So, if you’re in a hurry, online is definitely the way to go.

The Registered Agent: Your Business’s Local Point of Contact

Every business formed in Wyoming, especially an LLC or corporation, needs a registered agent. Think of this person or entity as your business’s official mailbox, its point of contact for legal documents and official state correspondence. They must have a physical address in Wyoming, be available during normal business hours, and be able to quickly inform you of any service of process. Many business owners, especially those not physically located in Wyoming, use a professional registered agent service. It’s a smart move, really, as it ensures you don’t miss anything crucial. Plus, some services even offer mail forwarding and a local business address, which can be super helpful.

The Nitty-Gritty: Licenses, Permits, and Taxes

Alright, so you’ve got your structure, your name, and your registered agent. What’s next on this grand adventure? The licenses, permits, and, of course, the ever-present topic of taxes.

Business Licenses: It’s Not a “One-Size-Fits-All” State

Funny thing is, Wyoming doesn’t have a general state business license for LLCs or corporations. That’s a common misconception, you know? Many states have this blanket requirement, but not Wyoming. However, and this is a big “however,” that doesn’t mean you’re totally off the hook.

Here’s where it gets a little nuanced:

- Sales and Use Tax License: Almost all businesses in Wyoming that sell products, goods, or services that are subject to sales tax must obtain a Sales and Use Tax License from the Wyoming Department of Revenue. This is mandatory before you start making sales. The state sales tax rate is 4%, and local options can add up to another 2%, so you’re looking at a combined rate of 4-6%. You apply for this online through the Department of Revenue’s Taxpayer Portal.

- Local and Industry-Specific Licenses/Permits: This is where you really need to do your homework. While the state might not have a general license, your specific city or county will likely have its own requirements. Think about what you’re doing. Are you running a restaurant? You’ll need food service licenses. A construction contractor? That’s typically handled at the local level. Selling liquor? Obviously, a liquor license. The Wyoming Business Council is a fantastic resource here; they have a Business Outreach Coordinator who can help you figure out what specific licenses and permits your particular industry and location might require. It’s like having a guide for that mountain pass!

Employer Tax Obligations: If You’ve Got a Team

Hiring employees? That’s fantastic! But it also means a new set of responsibilities, particularly when it comes to taxes.

- Federal Employer Identification Number (FEIN): First, you’ll need an EIN from the IRS. It’s like a social security number for your business.

- Unemployment Insurance (UI): You’ll need to register with the Wyoming Department of Workforce Services (DWS) to get your state unemployment tax rate. These rates can vary, but employers are required to contribute.

- Workers’ Compensation: Also handled through the DWS, this is mandatory insurance that protects both your employees and your business in case of workplace injuries.

- Federal Payroll Taxes: Don’t forget about the federal stuff: FICA (Social Security and Medicare taxes) and FUTA (Federal Unemployment Tax Act). You’ll be responsible for withholding and remitting these.

The DWS online portal is your go-to for UI and Workers’ Comp registration, and it’s pretty streamlined. Just gather all your business info beforehand to make the process smoother.

Ongoing Compliance: Staying on the Straight and Narrow

Getting started is one thing; staying compliant is another, equally important, part of the journey. This is where consistent effort pays off, preventing those annoying (and potentially costly) bumps in the road.

Annual Report Filing: Don’t Forget This One!

This is probably the most crucial ongoing requirement for LLCs and corporations in Wyoming. Almost all Wyoming businesses need to file an annual report with the Wyoming Secretary of State. Think of it as a yearly check-in, an update to confirm your business’s information. It includes basic details like your principal address, a list of members/managers or directors/officers, and your registered agent’s info.

The due date? It’s typically the first day of your anniversary month. So, if you formed your LLC on, say, October 15th, your annual report will be due every year on October 1st. The fee is usually quite reasonable, often $60 or based on your Wyoming assets. Here’s a crucial point: Wyoming doesn’t charge a late fee, which sounds nice, right? But here’s the catch: if you miss the deadline, your business will be deemed “delinquent,” and if you don’t fix it within 60 days, the state can administratively dissolve your business. That’s a big deal. You literally won’t be able to conduct business in Wyoming. So, set those reminders! Many registered agent services offer compliance reminders or even handle the filing for you, which, honestly, can be a lifesaver.

Record Keeping: Dotting Your I’s and Crossing Your T’s

Good record keeping isn’t just a suggestion; it’s a necessity. This includes financial records, payroll records, tax filings, and any official communications with state agencies. For employment-related documents, you generally need to keep them for at least four years. Being organized here can save you a world of hurt during an audit or if any questions arise down the line. It’s like keeping your camping gear neatly packed; you’ll thank yourself later.

Diving Deeper: Specific Regulatory Areas to Consider

Beyond the basics, there are other regulatory landscapes you might encounter depending on your business. It’s not about memorizing every single statute, but having a general awareness.

Environmental Regulations: Green Business, Green State

Wyoming, with its vast natural beauty, takes environmental protection seriously. If your business activities have any potential environmental impact, think manufacturing, energy, waste disposal, or anything that could affect air or water quality, you’ll need to pay close attention. The Wyoming Department of Environmental Quality (DEQ) is the primary agency to deal with here. They handle permits for air quality, water discharge (NPDES permits), solid waste, and more. Large-scale industrial projects, for instance, might even require an Industrial Siting Permit. It’s all about balancing economic activity with safeguarding the environment, a fine line, but one the state actively manages. So, if your business has a footprint, be proactive in understanding and complying with these rules.

Data Privacy and Cybersecurity: Protecting Your Customers (and Yourself!)

In our increasingly digital world, data privacy is a huge deal. Wyoming has data breach notification laws in place. If your business experiences a data breach that compromises personal information, you must notify affected residents in the “most expedient time possible and without unreasonable delay.” This usually means written or electronic notice. There are specific thresholds for when substitute notice (like website posting and media notification) is allowed. It’s not just about compliance; it’s about building trust with your customers. Safeguarding Personally Identifiable Information (PII) through strong passwords, multi-factor authentication, and a robust security program isn’t just good practice; it’s essential for avoiding legal headaches and reputational damage.

Consumer Protection: Playing Fair

The Wyoming Consumer Protection Act prohibits businesses from engaging in unfair or deceptive acts or practices. This includes misleading advertising, bait-and-switch tactics, deceptive billing, and aggressive sales practices. While the Attorney General’s office can’t act as an attorney for individual consumers, they do investigate patterns of unfair practices and can file lawsuits if there’s widespread injury to consumers. So, conduct your business with integrity. Be transparent, be honest, and you’ll generally stay on the right side of these regulations. It’s all about a level playing field, isn’t it?

Labor and Employment Laws: Managing Your Workforce

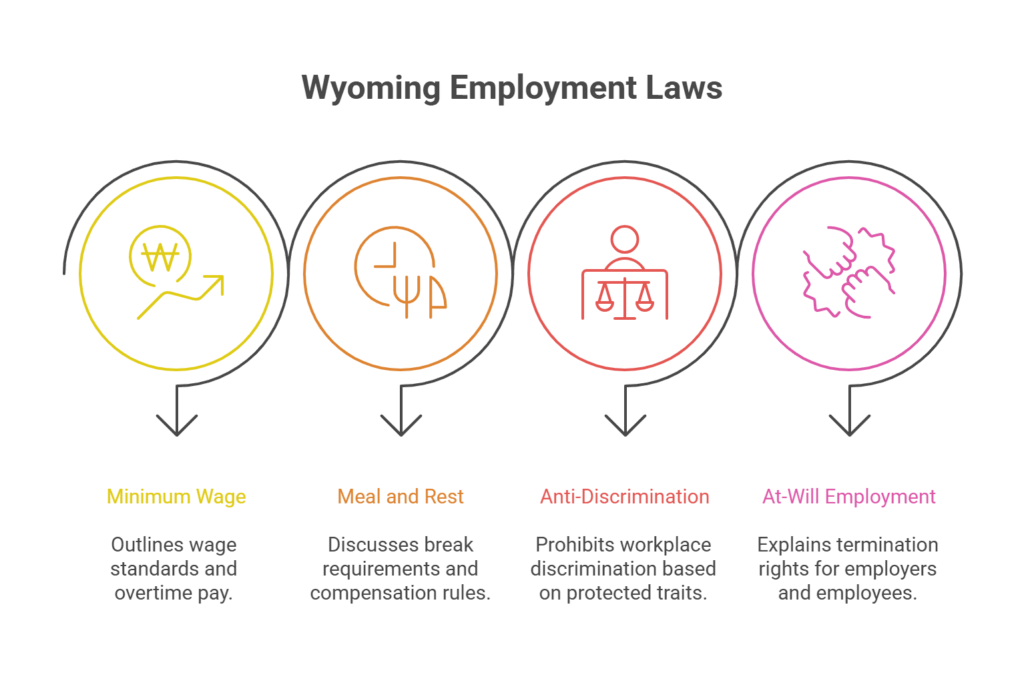

If you have employees, you’re also playing by Wyoming’s labor laws.

- Minimum Wage & Overtime: Wyoming’s minimum wage mirrors the federal minimum of $7.25 per hour. Overtime is 1.5 times the regular rate for hours over 40 in a week, aligning with the federal Fair Labor Standards Act (FLSA).

- Meal and Rest Periods: Interestingly, Wyoming doesn’t mandate meal or rest breaks, though many employers provide them voluntarily. Short breaks (5-20 minutes) are typically compensated, while longer meal periods (30+ minutes) where the employee is relieved of duties usually are not.

- Anti-Discrimination: The Wyoming Fair Employment Practices Act prohibits discrimination based on race, color, sex, religion, national origin, disability, or age (40+). While state law doesn’t explicitly cover sexual orientation or gender identity, federal interpretations under Title VII often extend protections there.

- At-Will Employment: Wyoming is an “at-will” employment state, meaning either the employer or employee can terminate the relationship at any time, for any non-discriminatory reason, unless there’s a contract stipulating otherwise.

Understanding these fundamentals is key to a harmonious and compliant workplace.

Intellectual Property: Protecting Your Big Ideas

Got a catchy business name? A unique logo? A groundbreaking invention? Intellectual property (IP) is your valuable asset.

- Trademarks: You can register your business name, logo, or unique phrases with the Wyoming Secretary of State to protect your mark within the state. This helps prevent others from using something confusingly similar.

- Copyrights: Protects original works of authorship (books, music, software). These are generally federal, but knowing the basics helps.

- Patents: For inventions and unique processes, patents are secured through the U.S. Patent and Trademark Office.

While IP protection often involves federal agencies, state-level registration, like trademarks with the Secretary of State, provides an important layer of defense for your brand.

Contract Law and Dispute Resolution: When Things Go Sideways

Contracts are the backbone of business. In Wyoming, a valid contract generally requires an offer, acceptance, and consideration (something of value exchanged). If a contract is breached—meaning one party fails to uphold their end of the bargain—there are remedies available, like monetary damages or even rescission (termination of the contract).

Should disputes arise, Wyoming courts handle contract disputes. However, the state also encourages alternative dispute resolution methods, like mediation. For employee disputes, for example, the Department of Administration & Information offers a mediation program. It’s often a more efficient and less adversarial way to iron out differences, allowing parties to reach a mutually acceptable resolution without going full-throttle into litigation. Always worth considering, if you ask me.

The Human Element: Getting Help and Staying Informed

Look, navigating all this can feel like a lot, right? Like drinking from a firehose. But here’s the thing: you don’t have to do it alone. Wyoming actually has some fantastic resources designed to help businesses, especially small ones.

The Wyoming Secretary of State’s office is your first port of call for business filings and general business information. Their website is pretty comprehensive. Then there’s the Wyoming Department of Revenue for all things tax-related. And let’s not forget the Wyoming Business Council, which acts as a fantastic hub for business development and support, often with dedicated staff who can answer your questions about licenses and permits. They’re there to help, truly.

Think of it this way: starting and running a business in Wyoming is like embarking on a magnificent journey across its beautiful landscapes. It’s full of opportunity, incredible views, and a sense of freedom. But just like any journey, it requires preparation, a good map, and knowing when to ask for directions. By understanding these key regulations, you’re not just avoiding pitfalls; you’re setting your business up for success, ensuring it can thrive in a state that truly wants it to. So, take a deep breath, do your homework, and go for it. The Cowboy State awaits!