Kotak Mahindra Bank’s latest notice about its final dividend for Fiscal Year 2025 highlights a period of strong financial performance and compliance with tight regulatory guidelines. The Board of Directors has voted to recommend a final dividend of ₹2.50 per equity share for the year ended March 31, 2025. This proposed payment speaks volumes of the bank’s robust profitability, good capital adequacy, and good asset quality. The declaration is especially pertinent in the backdrop of India’s revised T+1 settlement cycle, which has also made dividend entitlement simpler for investors. The bank’s steady dividend policy, along with its strong financial position, is likely to help bolster investor confidence and continue its good standing in the market.

Dividend Declaration: Details and Definitions

Kotak Mahindra Bank’s FY2025 Final Dividend Amount

The Kotak Mahindra Bank’s Board of Directors has declared a final dividend of ₹2.50 per equity share for the financial year ended March 31, 2025. This is pending approval by the bank’s shareholders at its Fortieth Annual General Meeting (AGM). This dividend declaration follows through on the bank’s history of returning value to the shareholders through consistent payouts.

Critical Dates: Declaration, Record, Ex-Dividend, and Payment Dates

Knowing the timeline of dividend declaration is important for investors to determine whether they are eligible or not. For Kotak Mahindra Bank’s FY2025 final dividend, the critical dates are as follows:

- Declaration Date: The release of the record date and AGM information, after the Board recommends the dividend, was done on July 8, 2025. This is the formal announcement of the dividend plan.

- Record Date: Friday, July 18, 2025, has been set as the ‘Record Date’. This is the key cut-off date on which the bank goes through its records to determine shareholders who are eligible to receive the dividend declared. Only those persons or entities whose names are entered on the bank’s register of members as of this particular date will be eligible to receive the dividend payment.

- Ex-Dividend Date: As per the T+1 settlement cycle introduced in India in 2024, Kotak Mahindra Bank’s FY25 final dividend ex-date will be the same as the record date, Friday, July 18, 2025. It is the first day on which the stock is traded without accounting for its future dividend pay-out.

- Payment Date: On the assumption that the dividend recommendation gets approval from shareholders at the AGM, the actual payment to deserving members is expected on or before Friday, August 8, 2025.

Knowing the Importance of Dividend Dates and the T+1 Settlement Cycle in India

The exact dates of these have important implications for investors. The record date is the snapshot date used by the company for its shareholder base for dividend payment. The ex-dividend date, or “ex-date,” is the effective cut-off period for ownership of shares to be eligible for the present dividend. If a share is bought on or after the ex-dividend date, the shareholder will miss out on the next dividend; instead, it will go to the former owner. On the other hand, for eligibility, shares must be bought and settled before this date. The payment date is the date when the actual cash dividend is paid to the entitled shareholders.

A significant trend in the Indian market, from 2024, is shifting to the T+1 settlement cycle.

This implies that stock transactions settle on a business day following the execution of the trade. This adjustment has aligned the ex-dividend date and the record date so that they fall on the same day. This alignment makes it easier for investors, eliminating some of the former uncertainty about eligibility for dividends. Previously, the ex-dividend date was typically one business day before the record date due to the T+2 settlement period, which created uncertainty. The alignment of these dates is now clearer for investors and more straightforward for planning trades to receive the dividend benefit. This streamlining enhances overall market efficiency by reducing the opportunity for misinterpretation and increasing the transparency of dividend capture strategies for all stakeholders.

Kotak Mahindra Bank FY2025 Final Dividend Key Dates Metric

| Metric | Details |

|---|---|

| Dividend Amount (per share) | ₹2.50 |

| Declaration Date (approximate) | July 8, 2025 |

| Record Date | Friday, July 18, 2025 |

| Ex-Dividend Date | Friday, July 18, 2025 |

| Payment Date | On or before Friday, August 8, 2025 |

Financial Health and Dividend Capacity

Overview of Kotak Mahindra Bank’s FY2025 Financial Performance

Kotak Mahindra Bank’s FY2025 financials reflect a strong performance, which gives strength to its dividend announcement. Consolidated, the bank posted a Profit After Tax of ₹22,126 crore in FY2025, a whopping 21% year-on-year (YoY) increase from FY2024. Even by stripping out a ₹3,013 crore one-time gain arising from the sale of Kotak General Insurance (KGI), the consolidated PAT still recorded a respectable 5% YoY growth, at ₹19,113 crore. For the fourth quarter of FY2025 (Q4FY25), the consolidated PAT was ₹4,933 crore.

Focusing on standalone performance, the bank’s FY2025 PAT rose by 19% YoY at ₹16,450 crore, including a ₹2,730 crore gain from the divestment of KGI. If this one-time gain is excluded, the standalone PAT was at ₹13,720 crore. The standalone PAT in Q4FY25 was at ₹3,552 crore. Such numbers reflect steady profitability in both consolidated as well as standalone operations.

Net Interest Income (NII), the primary indicator of a bank’s income from its lending operations, also registered favorable growth. Independent NII for FY2025 rose by 9% YoY to ₹28,342 crore, and for Q4FY25, it rose by 5% YoY to ₹7,284 crore. The Net Interest Margin (NIM) continued to be robust at 4.96% for FY25 and 4.97% for Q4FY25, reflecting judicious management of interest-earning assets and interest-bearing liabilities.

The bank also showcased wholesome growth in its advances and deposit portfolios. Average total deposits during Q4FY25 grew by 15% YoY to ₹468,486 crore, with average total deposits for the entire FY25 increasing at 16% YoY. The Current Account Savings Account (CASA) ratio, a good measure of low-cost capital, was healthy at 43.0% as of March 31, 2025. Lending (advances) increased by 14% YoY to ₹4.45 lakh crore in Q1FY26, on top of a loan book of ₹4.27 lakh crore as of the end of FY25. This improvement in core banking indicators supports the bank’s operations-driven strength.

Analysis of Key Prudential Ratios: Capital Adequacy Ratio (CRAR) and Net Non-Performing Assets (Net NPA)

Kotak Mahindra Bank has exceptionally high prudential ratios, which are the basic determinants of its financial health and ability to give dividends. On March 31, 2025, the bank’s Capital Adequacy Ratio (CRAR) under Basel III standards was at 22.2% on a standalone basis and 23.3% on a consolidated basis. The Common Equity Tier 1 (CET1) ratio stood at 21.1%. These figures are significantly above the minimum regulatory requirements set by the Reserve Bank of India (RBI), which typically mandate a CRAR of at least 9% for dividend eligibility.

In addition, the asset quality of the bank is strong, with the Net Non-Performing Assets (Net NPA) ratio being very low at 0.31% as on March 31, 2025. This is far below the RBI’s limit of less than 7% (or less than 5% in case of certain CRAR requirements) for declaration of dividend. The healthy Net NPA reflects good risk management and a sound loan book, keeping potential future provisioning needs to a minimum, thus not affecting profitability and distributable profits.

Evaluation of Dividend Payout Ratio against the backdrop of the profitability of the bank and management of capital

Although a precise calculation of the dividend payout ratio for FY25 is not possible from the given data without knowing the total number of outstanding equity shares, the bank’s robust profitability and sound capital position unmistakably point towards a high ability to sustain a wholesome payout. The overall PAT growth of 21% (or 5% excluding one-time profits) and standalone PAT growth of 19% (or stable excluding one-time profits) in FY25 show that the bank’s core banking operations are making steady and rising profits.

This consistent profitability from its underlying banking activities is important because it makes dividend payments supported by recurring earnings instead of being dependent on one-time profits. This gives a good indication of the dividend’s sustainability, which is an important determinant of long-term investor faith.

The bank’s very high CRAR and low Net NPA ratios, well above regulatory levels, give plenty of financial room for maneuver. This implies that Kotak Mahindra Bank does not have capital requirements binding it in its operations or in its capacity for profit distribution. The excess capital can be prudently invested for different uses, including financing future business growth, investing in technological innovations, or weathering possible economic shocks, while still comfortably covering dividend payments. This robust prudential position sends a very low-risk message to the market in terms of capital adequacy and asset quality. This resilience also turns Kotak Mahindra Bank into a good investment, especially for risk-averse investors, because it enhances the credibility of its dividend policy and stability in general. The bank’s dividend policy, as with most companies, seeks to balance rewarding shareholders with having enough earnings to sustain future growth and stability.

Kotak Mahindra Bank Key Financial Highlights (FY25 vs. FY24)

| Metric | FY2025 Value | FY2024 Value | Year-on-Year Growth (%) |

|---|---|---|---|

| Consolidated PAT | ₹22,126 crore | ₹18,213 crore | 21% |

| Standalone PAT | ₹16,450 crore | ₹13,782 crore | ₹13,782 crore |

| Standalone NII | ₹28,342 crore | ₹25,993 crore | 9% |

| Average Total Deposits (Q4) | ₹468,486 crore | ₹408,321 crore | 15% |

| Advances (Q1FY26 vs. Q1FY25) | ₹4.45 lakh crore | ₹3.90 lakh crore | 14% |

| Net NPA (Standalone, Mar 2025) | 22.2% | N/A | N/A |

| Net NPA (Standalone, Mar 2025) | 0.31% | 0.34% | -8.8% |

Note: A Few FY24 numbers for CRAR and Net NPA were not directly available in the snippets for comparison, but the March 2025 numbers are well indicated as robust.

Regulatory Environment for the Distribution of Dividends

SEBI (Listing Obligations and Disclosure Requirements) Regulations about dividends

In India, listed companies such as Kotak Mahindra Bank are regulated by the Securities and Exchange Board of India (SEBI). Particularly, Regulation 43A of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (SEBI LODR Regulations), requires the top 1000 listed entities in terms of market capitalization to develop and disclose a Dividend Distribution Policy on their company website, a web-link to which shall be furnished in their annual reports. This policy is an open guideline that details the conditions under which shareholders are likely to receive dividends, financial factors that are taken into consideration for declaration, and the inside and outside factors determining such declarations. It also lays down how retained earnings are to be used. The last dividend, recommended by the Board of Directors, is usually declared in the company’s Annual General Meeting (AGM) after shareholder approval. This regulatory requirement provides transparency and foreseeability in a firm’s strategy towards shareholder return.

Reserve Bank of India (RBI) Guidelines for Declaration of Dividend by Banks: Eligibility Criteria and Payment Norms

Being a banking organization, Kotak Mahindra Bank is also governed by strict prudential guidelines by the Reserve Bank of India (RBI) relating to declarations of dividend. These guidelines are formulated to provide financial security and prudent management of banks.

Eligibility Criteria for Declaration of Dividend:

For a bank to qualify to declare dividends, it should fulfill some minimum prudential requirements:

- The dividend declared should be paid out of the net profit of the current year.

- The bank needs to have a Capital to Risk-weighted Assets Ratio (CRAR) of not less than 9% for the last two completed financial years, as well as for the accounting year for which a dividend is sought to be declared.

- The Net Non-Performing Assets (Net NPA) ratio should be below 7%. There is a special provision: if the bank achieves the 9% CRAR standard merely for the ongoing accounting year (and not for the previous two), its Net NPA should be less than 5% to be qualified for declaring a dividend.

- The bank should be adhering to Sections 15 and 17 of the Banking Regulation Act, 1949. Section 15 prohibits the declaration of dividends until all capitalized expenses are carried to the profit and loss account as such, and Section 17 requires that a certain percentage of profit be transferred to a statutory reserve fund before any declaration of dividends.

No direct restriction should be imposed by the RBI on the bank in declaring dividends.

Quantum of Dividend Payable (Payout Ratio):

If a bank meets these qualifying requirements, dividend payout is subject to additional restrictions.

Dividend payout ratio, expressed in terms of a percentage of ‘dividend payable in a year’ (after deducting dividend tax) to ‘net profit during the year’, shall not in general exceed 40%. This upper limit range is specified in a matrix given by the RBI (RBI Circular No. RBI/2004-05/451 dated May 04, 2005). Significantly, where the profit for the period in question consists of any exceptional profits or revenue, such items are generally excluded while calculating the payout ratio so that prudential norms are complied with.

Kotak Mahindra Bank’s Compliance with Regulatory Frameworks

Kotak Mahindra Bank’s financial soundness, as reflected in its CRAR of 22.2% (standalone) and 23.3% (consolidated) and a Net NPA of 0.31% as of March 31, 2025, far exceeds the RBI’s minimum prudential benchmarks to be eligible for payment of dividend. This ability reflects not merely compliance but also a very strong capability to pay dividends without compromising its capital base or asset quality.

In addition, as a leading listed entity, Kotak Mahindra Bank is bound to and follows SEBI’s Listing Obligations and Disclosure Requirements, which involve maintaining and disclosing a Dividend Distribution Policy.

SEBI and RBI’s stringent regulatory system on dividend distribution for banks is an essential banking sector stability and investor protection custodian. These regulations are not bureaucratic obstacles but essential protection measures that refrain banks from over-distributing profits, which would otherwise drain key capital reserves, weaken asset quality, and raise systemic risk in the financial system.

By requiring banks to have strong capital and low non-performing assets, the RBI directly safeguards the stability of the entire financial system.

For shareholders, especially from the banking industry, the fact that dividend payments are strictly scrutinized by such regulatory authorities is an added safeguard. It suggests that the announced dividend is a representation of real, sustainable profitability and not a short-term option that may undermine the bank’s long-term stability. This holistic regulatory supervision builds more confidence and trust in bank stocks, thus making them more attractive to a wide cross-section of investors.

Market Dynamics and Investor Considerations

Kotak Mahindra Bank’s Historical Dividend Payouts (last 5-7 years)

Kotak Mahindra Bank has shown an increasing and consistent trend in its last cash dividend payments over recent past years. The consistency is an interesting feature of its shareholder return approach. Dividend per share has exhibited a distinct upward movement:

- 19 July 2024: ₹2.00 (Final)

- 04 August 2023: ₹1.50 (Final)

- 11 August 2022: ₹1.10 (Final)

- 11 August 2021: ₹0.90 (Final)

- 12 July 2019: ₹0.80 (Final)

The suggested final dividend of ₹2.50 per share for FY25 follows this same trend of being positive, reflecting a focus on growing shareholder value. The bank has a legacy of announcing dividends with a record 22 such announcements since July 21, 2003. In the last 12 months, the equity dividend of ₹2.00 per share has translated into a dividend yield of 0.09% at the prevailing share price.

Kotak Mahindra Bank Dividend History (FY2019-FY2025)

| Ex-Date | Dividend Amount (per share) | Dividend Type | Record Date |

|---|---|---|---|

| 19 Jul 2024 | ₹2.00 | FINAL | 19 Jul 2024 |

| 04 Aug 2023 | ₹1.50 | FINAL | 04 Aug 2023 |

| 11 Aug 2022 | ₹1.10 | FINAL | 12 Aug 2022 |

| 11 Aug 2021 | ₹0.90 | FINAL | 12 Aug 2021 |

| 12 Jul 2019 | ₹0.80 | FINAL | 12 Jul 2019 |

| FY25 Proposed | ₹2.50 | FINAL | 18 Jul 2025 |

Note: The ex-date for FY25 is the same as the record date because of T+1 settlement.

Impact of Dividend Announcements on Stock Price: Short-term Adjustments and Long-term Investor Sentiment

Dividend announcements will usually have both short-term and long-term impacts on a firm’s share price.

On a short-term basis, upon the announcement of a dividend, the share price is likely to rise initially on increased demand by shareholders to qualify for the payment.

On the ex-dividend date, though, the share price will usually fall by around the value of the announced dividend. This adjustment accounts for the cash going out of the company and the share trading without the entitlement to the immediate dividend.

Over the long term, firms that pay and, most importantly, regularly raise their dividends, especially large-cap organizations such as Kotak Mahindra Bank, tend to build very good investor confidence. A steady growth in dividends, particularly from a bank, indicates management’s belief in the bank’s continued profitability, stability of future earnings, and strong cash generation capacity. This indicates the bank’s growth to be not just cyclical but evidence of a healthy underlying business model with the ability to continuously generate profits for distribution, even after retaining funds to reinvest and expand. This ongoing confidence by the management can find expression in favorable investor sentiment and a healthier valuation of the stock.

Such dependability of dividend payments also makes the stock highly appealing to income-focused investors, like retired people or passive-income seekers, who are interested in maintaining regular cash flows at the expense of pure capital appreciation. This steady demand from a part of the investor community can create a bottoming support for the stock price and help in its stability and value over the long term. Empirical studies of Indian banks have also shown that dividend announcements tend to communicate good news to the market and affect stock prices, implying some market inefficiency of the semi-strong type.

Tax Implications for Indian Shareholders on Dividend Income (TDS, Slab Rates)

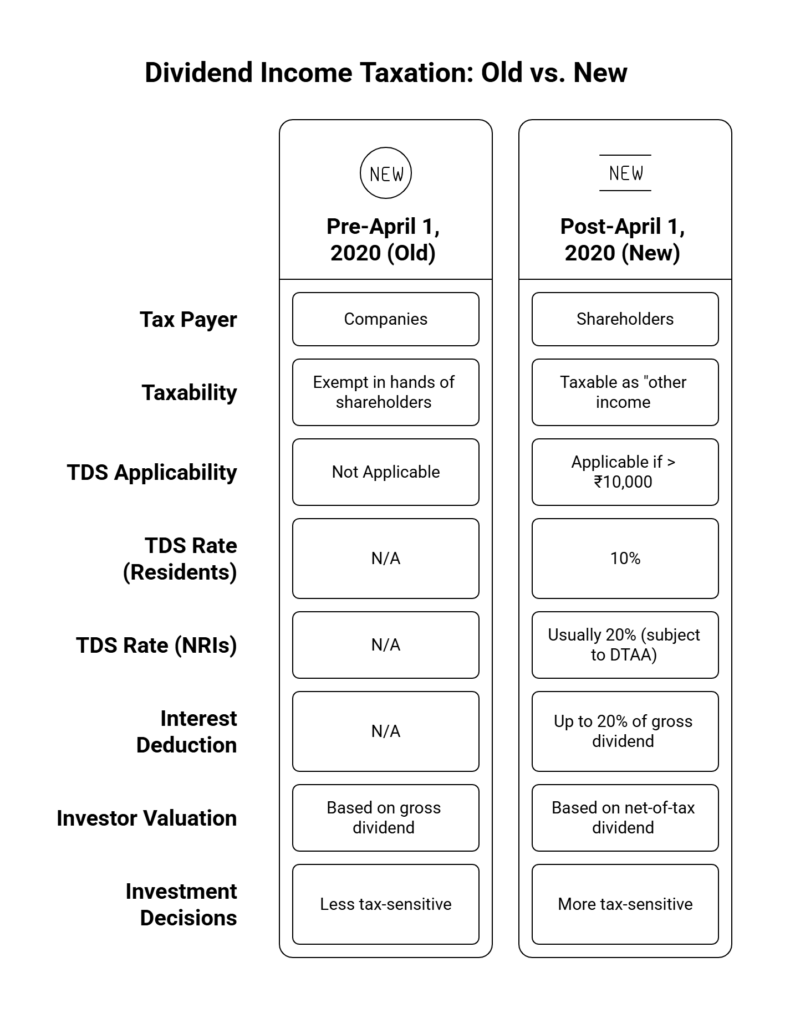

Indian shareholders’ tax treatment of dividend income was radically changed with the Finance Act, 2020. Till then, Dividend Distribution Tax (DDT) used to be paid by the companies, and in the hands of the shareholders, dividend income was exempt to a great extent. Now, from April 1, 2020, dividend income earned by the shareholders from Indian companies is taxable in the hands of the investor/shareholder.

Such dividend income is classified as “income from other sources” and is taxable at the individual investor’s relevant income tax slab rates. This implies that the effective rate of taxation on dividends will differ based on the investor’s overall income as well as their corresponding tax bracket.

In addition, provisions for Tax Deducted at Source (TDS) are applicable. If the amount of dividend received from an Indian entity is more than ₹10,000 during a financial year (the limit was ₹5,000 until FY2024-25), the company is obligated to deduct TDS at 10% under Section 194 of the Income Tax Act.

For NRIs, the TDS rate is usually 20%, although this may be made subject to lowering as per prevailing Double Taxation Avoidance Agreements (DTAs).

Investors can deduct interest costs incurred in respect of the dividend, to an extent of 20% of the gross dividend income.Resident individuals whose estimated income is below the exemption limit may file Form 15G (or Form 15H if they are senior citizens) to the paying company to avoid TDS deduction.This change in taxability, from DDT on the firm to direct taxation in the hands of the shareholder, fundamentally changes the way investors approach the valuation of dividend-paying stocks.

Investors are now forced to consider the net-of-tax dividend yield instead of only the gross declared dividend. This necessitates an individual assessment based on their income tax bracket since the final return from dividends is now dependent on their tax burden. This shift can have the potential to affect investment decisions, as some high-income investors may favor growth stocks or other investments where capital gains tax may be more favorable. It also suggests that firms may turn towards other forms of returning capital to the shareholders, like share buyback,s based on the tax efficiency for various investor groups.

Dividend Payment Process and Unclaimed Funds

Mechanism of Dividend Receipt for Shareholders through Demat Accounts

For Indian shareholders, the dividend receipt process is highly mechanized and tied to their Demat accounts. An investor has to hold the shares in their Demat account as of the ex-dividend/record date to be eligible for a dividend. With the T+1 cycle of settlement, this purchase of stock must be initiated at least one business day before the ex-dividend/record date so that the shares get credited to the Demat account by the cut-off. Dividends are normally credited directly to the main bank account, which is associated with the investor’s Demat account, once eligibility is determined. The processing time for these payments usually ranges from 25 to 45 business days following the record date.

Role and Responsibilities of Registrar and Share Transfer Agents (RTAs) in Dividend Distribution

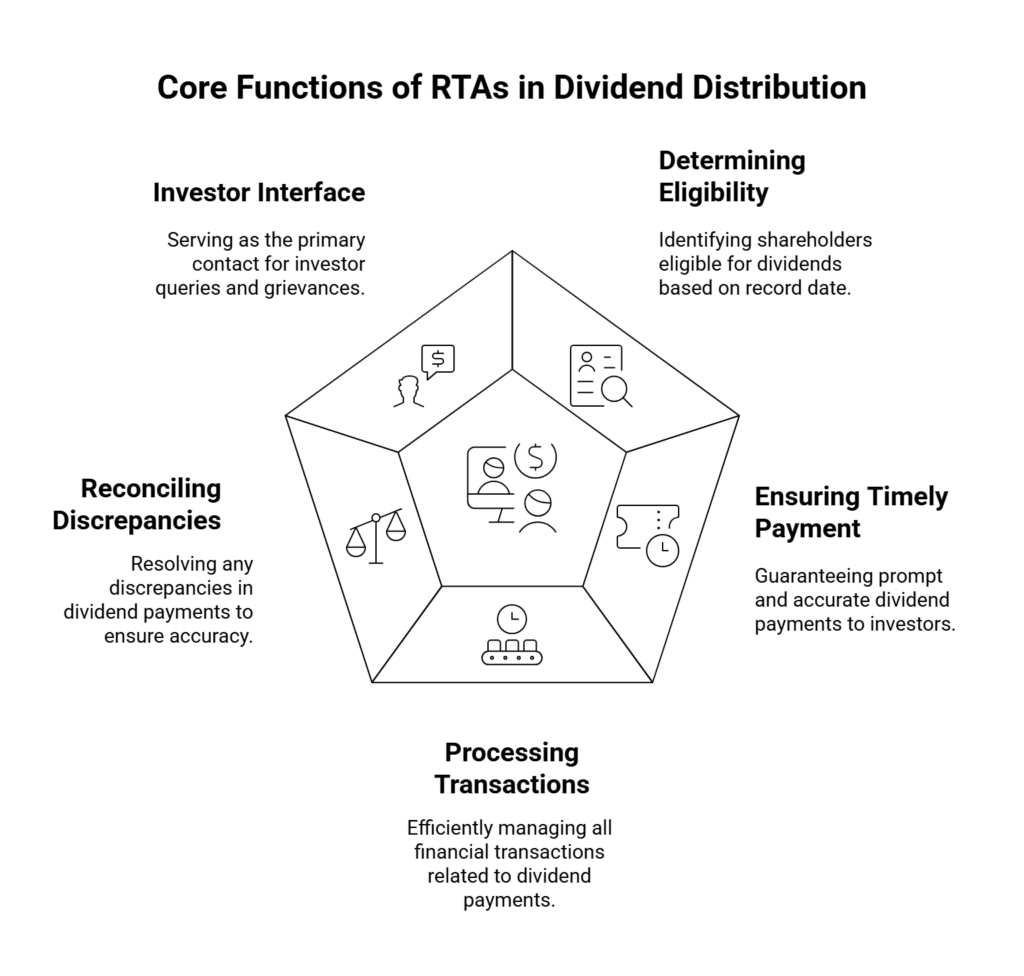

Registrar and Share Transfer Agents (RTAs) play a pivotal role in the seamless and compliant distribution of dividends. These are entities registered with SEBI that are responsible for maintaining accurate and up-to-date records of a company’s investors.

Their main roles during the process of dividend distribution are:

- Determining Eligibility: RTAs determine the shareholders that qualify for the dividend according to the record date.

- Guaranteeing Timely and Accurate Payment: They have the responsibility of ensuring that the right amount of dividend is credited to the bank accounts of the investors promptly and fully as per all the existing legal and regulatory policies.

- Transaction Processing: RTAs take care of the operational functions of paying dividends, in that all financial transactions required are carried out in an efficient manner.

- Reconciliation: They reconcile any differences that could occur during dividend payment to ensure that all investors are paid their due amounts.

- Investor Interface: RTAs are also the key intermediary between the company and its shareholders, taking care of investment-related queries and grievances, including dividend-related ones.

The role of an RTA is not only of a record-keeping nature; they are the operational support system for the effective and compliant handling of corporate actions such as dividend payment.Their careful maintenance of shareholder information and rigorous fulfillment of payment schedules are crucial to averting mistakes and ensuring regulatory compliance.Any inefficiency or mistake on the RTA’s part can be a cause for delay or failure of receipt of dividend, which can result in investor dissatisfaction.This underscores the need for investors to keep their Demat and bank account information updated with their broker and RTA to limit the likelihood of credit failures and the ensuing cumbersome procedure of redemption of unclaimed funds.

Dealing with Unclaimed Dividends: Process and the Investor Education and Protection Fund (IEPF)

An “Unclaimed Dividend” is a dividend announced by a company that is not received by a shareholder within a given time frame, usually 30 days from the date of declaration. When this dividend is not claimed or paid within these seven days of the end of the first 30-day period, the “total amount” is compulsorily required to be deposited into a separate “Unpaid Dividend Account” created for the purpose.Another key step in this process is the Investor Education and Protection Fund (IEPF).When the dividend amount has not been claimed over seven continuous years since it was transferred to the Unpaid Dividend Account, it is transferred to the IEPF.This transfer is required under Section 124 of the Companies Act, 2013. Notably, along with unclaimed dividends, any shares in respect of which such unpaid or unclaimed dividends have been transferred for seven consecutive years or more are also transferred by the company in the name of the IEPF.

For the investors who wish to recover such an amount, a certain procedure is followed. They may verify unclaimed dividends by going to the investor relations page of the website of the company or going to the IEPF website directly. Investors usually have to submit Form IEPF-5 on the Ministry of Corporate Affairs (MCA) website to make a claim.This consists of furnishing requisite documentation, including proof of identity, address, PAN, and cancelled cheque, and then mailing physical copies of the above documents to the company’s specified Nodal Officer. In case the first dividend credit fails (e.g., because of bad bank details), the company’s RTA will send a physical dividend warrant by courier to the investor’s registered postal address.

The IEPF mechanism acts as a vital safety net to ensure that even long-unclaimed funds are not lost forever but are kept available for recovery by their owners or legal heirs. The multi-step, time-bound process for recovery of such funds, however, points out that even though a safety net is available, it needs effort on the part of the investor. That makes a silent statement of the foremost importance of investors taking an active role in monitoring their investments and dividend payments. The presence and operational mechanism of the IEPF also hint at a larger requirement for increased investor education on corporate actions and judicious management of investment portfolios to avoid funds going unclaimed in the first instance.

Conclusion and Strategic Outlook

Synthesis of Findings Regarding the Dividend’s Significance

Kotak Mahindra Bank’s proposed final dividend of ₹2.50 a share for FY2025 is a direct reflection of its sound financial health and judicious management. The bank’s FY2025 performance, marked by healthy growth in Profit After Tax (PAT), exceptionally high Capital Adequacy Ratio (CRAR), and an astonishingly low Net Non-Performing Assets (Net NPA) ratio, forms a sound base for this distribution. These key financials show how the bank is able to produce distributable profits while also having a healthy balance sheet. The announcement of the dividend is consistent with minute detail with the tight prudential guidelines established by the Reserve Bank of India (RBI) applicable to banks and the requirement for transparency imposed by SEBI on all listed companies. Compliance with such regulatory standards further underscores the bank’s good governance and fiscal discipline, assuring the market of the sustainability and validity of its dividend policy.

Also, the bank’s stable and rising dividend payments over recent years provide a positive signal to the market. This trend supports long-term investor confidence, as it reflects the confidence of management in the bank’s continued profitability and capability to generate consistent cash flows, despite their retention for future growth projects. For investors, the simplified eligibility provided by the T+1 settlement cycle makes dividend capture easier, and an understanding of one’s tax liabilities on dividend income becomes a determinant in evaluating net returns.

Forward-Looking View of Kotak Mahindra Bank’s Dividend Policy and Financial Path

Considering its solid financial standing, sturdy operating performance, and firm compliance with regulatory guidelines, Kotak Mahindra Bank stands poised to maintain its consistent dividend practice shortly.The bank’s strategy of balancing rewarding shareholders and holding internal accruals for business growth indicates a value creation model that is sustainable. This balance is important for a bank that must finance book growth in the loan book, invest in digital change, and hold capital buffers against possible economic change.

Dividend decisions in the future will surely remain driven by a number of factors, including the bank’s sustained profitability, its need for capital to support strategic projects (such as loan growth and technological innovation), and the wider economic and regulatory landscape. The encouraging market reaction to the bank’s latest business progress and its ongoing efforts to improve customer service and digital services suggests a positive outlook for its enduring performance.

This ongoing resilience is likely to translate into consistent creation of shareholder value, not just in the form of periodic dividend distributions but also in terms of possible capital appreciation of its stocks.