It’s not every month you see headlines like this, let alone in the heart of summer, that liminal stretch when bureaucrats usually coast. But June 2025 served up a jolt for economists, business owners, and policymakers across the globe: the U.S. international trade deficit shrank by a stunning 16%, settling at $60.2 billion, the narrowest gap since September 2023. The reason? A steep, sudden retreat in imports, with knock-on effects that ripple far beyond balance sheets.

The Numbers: What Changed and By How Much?

Let’s start with the core data points, the kind that show up on PowerPoint slides in congressional hearings and in emails that CFOs fire off at 3 a.m.:

- June 2025 U.S. Trade Deficit: $60.2 billion, down from a revised $71.7 billion in May, an abrupt 16% swing lower.

- Total Exports (Goods & Services): $277.3 billion, just marginally below May’s total (down roughly $1.3 billion, or 0.5%).

- Total Imports: $337.5 billion, down a hefty $12.8 billion, or 3.7% from May.

So the deficit didn’t shrink because Americans suddenly started exporting more. Imports just fell, hard and fast.

Why Did Imports Collapse? Tariffs, Tariffs, Tariffs

Funny thing is, this wasn’t a garden-variety slowdown. Several converging forces brought imports crashing down, with President Donald Trump’s sweeping tariffs on foreign goods leading the charge.

- Tariffs up, imports down: Starting in April, the Trump administration slapped new tariffs, 10% on most U.S. trading partners, plus even steeper rates on steel, aluminum, and automobiles. The impact? Imports of consumer goods dropped by $8.4 billion in June alone. Industrial supplies and materials also took a hit, down $2.7 billion, while imports of cars and parts eased by $1.3 billion.

- Businesses stockpiled early: Earlier in the year, importers rushed to bring goods in before higher tariffs hit, causing a record trade gap in March 2025. By June, much of that stockpiled inventory was sitting in warehouses, and new orders slowed to a crawl.

- Supply chains dodge tariffs: Several companies began rearranging global supply lines and seeking alternative sources, a scramble that shows up in the declining trade gap not just with China, but also with the European Union and Mexico.

Tariff Timeline: A Quick Recap

If I’m honest, tracing the sequence of tariff hikes is dizzying. Here’s the kicker: by August 7, 2025, new tariffs ranging from 10% up to triple-digit rates were set to snap into place for dozens of countries. Yale’s Budget Lab calculated that the average U.S. tariff rate for imported goods had surged to 18.3%, levels not seen since 1934. This is a far cry from the 2-3% rates that prevailed before Trump’s return to office that January.

Temporary truces and flashes of negotiation briefly softened the blow, like a May agreement with China to lower duties until August 12, but there was no hiding the shift in global commerce.

The Deficit with China Hits 21-Year Low

The U.S.-China trade gap, long the focus of political rancor and headline risk, plunged to just $9.4 billion, the smallest deficit with Beijing in more than 21 years. For context: this deficit was nearly $14 billion in May.

Why? A cocktail of factors worked together:

- Duty reductions triggered a brief burst of exports to China (up $3.1 billion to China in June).

- Imports from China, on the other hand, dipped as tariffs curbed demand and alternative suppliers stepped in.

- Temporary agreements froze tariff escalations until mid-August, buying a little breathing room for both sides.

Shifting Trade Gaps with Other Major Partners

Don’t blink or you’ll miss the ways these shifts played out, region by region. Beyond China:

- Mexico: Still the largest trade deficit, but down slightly to $16.3 billion in June from $17.1 billion in May.

- European Union (EU): Deficit with the EU shrank dramatically to about $9.5 billion from $22.5 billion just a month earlier. Here’s the twist: that gap is expected to whipsaw again if new U.S. tariffs take effect in August.

- Vietnam, Taiwan, India: Deficits with these Asian economies grew modestly, as supply chains rerouted and export patterns shuffled around, with the U.S. pulling in more electronics and machinery from Vietnam and Taiwan compared to earlier in the year.

Which Sectors Got Hit the Hardest?

Let’s break out the magnifying glass and look at the sectors that saw the sharpest swings:

- Consumer Goods: Imports dropped a staggering $8.4 billion as buyers pulled back on everything from apparel to electronics to toys.

- Pharmaceuticals: Possibly the most eye-popping statistic, imports of pharmaceutical goods plunged $9.6 billion in June, directly impacting overseas suppliers, from India’s generic drugmakers to European laboratories.

- Industrial Supplies & Materials: Down $2.7 billion, reflecting lower imports of commodities and intermediate goods.

- Automobiles & Parts: Off by another $1.3 billion; not a surprise given new U.S. tariffs on foreign autos and ongoing efforts to boost domestic assembly.

But it wasn’t all gloomy on the import front, capital goods (think manufacturing machinery, computer equipment, and high-value industrial tools) bucked the trend, rising slightly in June and hinting at continued investment in U.S. industry.

Exports Eased Too, but Not as Drastically

On the other side of the ledger, exports did slip, but just a hair:

- Total exports, goods & services: $277.3 billion, down 0.5% from May.

- Declines concentrated in: Industrial supplies, gold, metals, and computer accessories.

- Bright spots: Slight uptick in capital goods exports (U.S. machinery, heavy equipment, and advanced electronics), as foreign buyers took delivery of backlogged orders or anticipated future restrictions.

Many analysts see the minor dip in exports as reflecting weaker global demand and ongoing currency volatility, especially in emerging markets.

The Broader Economic Picture: What This Means for U.S. GDP

Here’s where it all connects to the bigger story: economic growth.

- June’s deficit retreat did wonders for second-quarter GDP. The U.S. economy rebounded sharply, posting a 3.0% annualized expansion in Q2 after a 0.5% contraction in Q1, a reversal that government officials credit mostly to smaller imports.

- But, the underlying picture wasn’t all rosy: job growth disappointed, inventories are high, and the upcoming ratcheting up of tariffs could bring even more volatility in the coming months.

Supply Chains: Still in Flux, Still in Limbo

American supply chains, already battered by years of pandemic disruptions and global uncertainty, have been thrown yet another curveball. In recent quarters, businesses faced dizzying deadlines; many rushed to stock up inventories before new tariffs hit, only to find those purchases now sitting idle as demand softens.

Some key trends to watch:

- Reshoring & “Friend-Shoring”: More companies are talking about (and some moving forward with) returning manufacturing to U.S. soil, or shifting to allies with less punitive tariff regimes.

- Diversification: Instead of single points of failure (like exclusive reliance on China for certain goods), importers are spreading bets across Southeast Asia, South America, and even Canada.

Are Tariffs Here to Stay? Policy Outlook for the Rest of 2025

With more tariff hikes poised to kick in after August 7, there’s plenty of uncertainty for importers, exporters, and global investors. The Trump administration has signaled willingness both to escalate and negotiate depending on responses from key partners, a “maximum leverage” strategy that injects a lot of stop-and-go, hurry-up-and-wait energy into trade forecasts.

A few things worth noting:

- Talks with China and the EU: Temporary truces hold (for now), but both sides remain locked in negotiations. The specter of tit-for-tat tariffs hangs over global markets like a summer storm cloud.

- Domestic policy response: With signs of softening job growth and supply chain jitters, some lawmakers are pressing for targeted relief, tax incentives to draw investment home, or new trade agreements to offset choke points in pharmaceuticals and critical minerals.

- Forecasts: While some analysts expect the deficit to remain lower than earlier in the year, a return to larger trade gaps is not out of the question, especially if demand bounces back or if tariffs spark retaliatory measures abroad.

The Takeaways, In Plain English

So what does all of this mean for everyday Americans, business leaders, and policymakers?

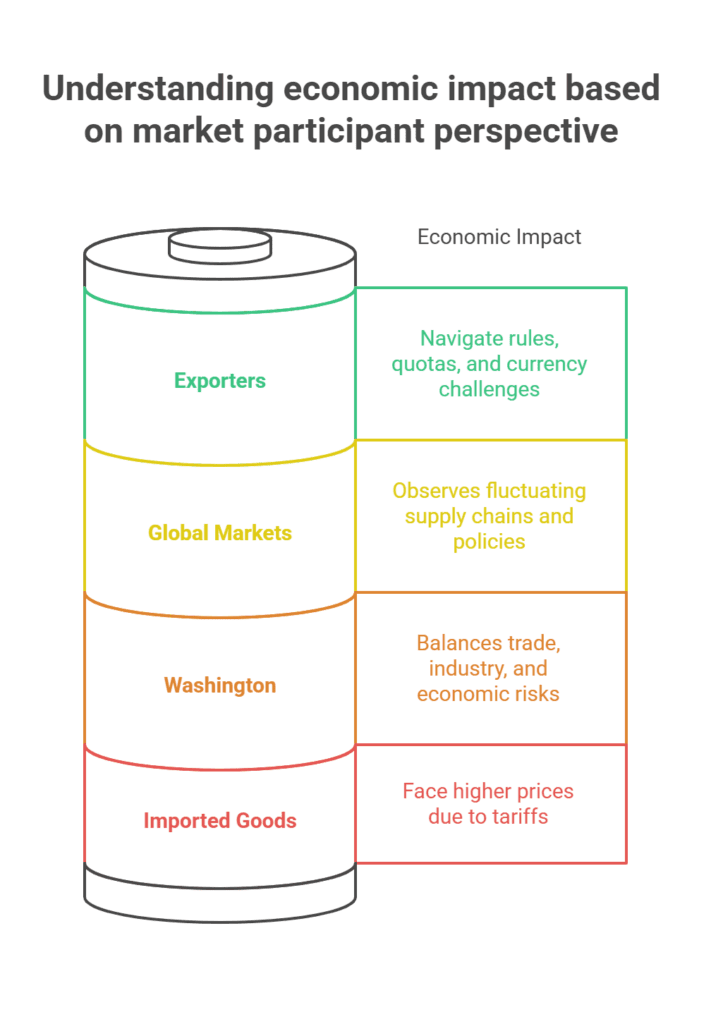

- Imported goods? Prices will likely remain elevated, tariffs boost costs, and those costs trickle down to wallets at checkout counters.

- Exporters? Still treading water. U.S. firms with global customers navigate a thickening web of rules, quotas, and currency swings, but a weaker dollar could help, if it holds.

- Washington? The administration is threading a tightrope: balancing goals of fair trade and domestic industry support against the very real risk of slower growth and higher prices down the line.

- Global Markets? Watching. And waiting. Supply chains, in flux; forecasts, in flux; policies, in flux.

In Quotes: The Data at a Glance

“The U.S. international trade deficit in goods and services narrowed to $60.2 billion in June 2025, down 16% from May’s revised $71.7 billion… driven by a sharp decline in goods imports, particularly consumer and pharmaceutical goods.”

U.S. Census Bureau & Bureau of Economic Analysis

“Imports of consumer goods fell to the lowest level since September 2020.”

Commerce Department summary

“The goods deficit with China dropped by $4.6 billion to $9.4 billion in June, the lowest in over 21 years.”

Official trade bulletin

Looking Ahead: Uncertainty Still Rules

If there’s a single, neat conclusion here, it might be this: America’s trade numbers are neither simple nor static. June’s sharp drop in the deficit reflects a collision of tariffs, business strategy, and the inescapable tide of global events. Next month, or next quarter, could bring another swing. New tariffs take effect, old supply patterns return or vanish, and the only constant in U.S. trade policy, for now, seems to be change.