So, picture this: You’re in Dubai, maybe Abu Dhabi, maybe somewhere a little off the beaten path, shopping bags in hand, sun on your face, and you’ve just snagged that perfect something (or, let’s be real, a few somethings). But here’s the kicker: you can actually get some of that money back. No, really. The UAE’s VAT refund system is like a little “thank you” for coming to play in their retail wonderland. And it’s not just for tourists, either. Citizens are cashing in, too. Wild, right?

Let’s spill the beans on how this all works and why it’s kind of a big deal.

Wait, what’s VAT again? (And Why Should I Care?)

Okay, quick detour. VAT, Value Added Tax. It’s that sneaky little 5% tacked onto almost everything you buy in the UAE. Not a huge deal on a cup of coffee, but buy a designer bag or, say, build a house? Suddenly, it adds up. The UAE rolled out VAT in 2018 (which, if you’re counting, feels like a lifetime ago), mostly to keep the economy humming along without leaning so hard on oil. Smart move, honestly.

But here’s where it gets interesting: Not everyone has to just eat that 5%. If you’re a tourist or a UAE national building your own home, you can get some (sometimes all) of that VAT back. Like a rebate, but with a little more sparkle.

Tourists: The UAE’s Secret Weapon

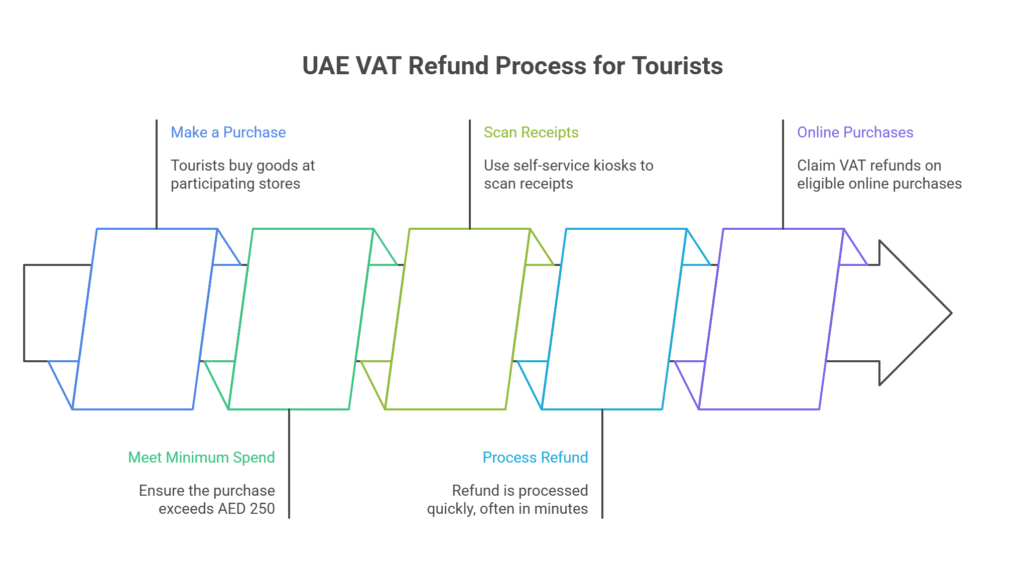

Let’s be honest, shopping is basically a national sport here. Malls the size of small cities, gold souks, and electronics stores that look like spaceships. And the government? They want you to shop. A lot. So, they cooked up this VAT refund system for tourists. Buy something at a participating store (and there are, no joke, over 18,000 of them now), spend at least AED 250 in one go, and you’re in the club.

Here’s the fun part: You don’t have to fill out a mountain of paperwork or stand in a line that snakes around the airport. Nope. There are these slick self-service kiosks at airports, malls, and even some hotels, where you just scan your receipts, tap a few buttons, and boom: refund processed. Sometimes in under two minutes. (I know, right? When does that ever happen?)

And if you’re the type who shops online (who isn’t these days?), the UAE’s got you covered. As of late 2024, you can even claim VAT refunds on eligible e-commerce purchases. Just another way they’re making sure you leave with a smile and maybe a little extra cash in your pocket.

Citizens: Not Just for Tourists Anymore

Now, here’s something a lot of people don’t realize. The VAT refund game isn’t just for out-of-towners. If you’re a UAE national building your own home, you can get VAT back on construction costs. We’re not talking pocket change, either. Since this program kicked off, over 38,000 applications have been approved, with refunds topping AED 3.2 billion. That’s billion, with a “b.” Imagine what you could do with that kind of money back in your account. (New kitchen? Pool? Just saying.)

The process? Submit your invoices and documents to the Federal Tax Authority (FTA), cross your fingers, and, if all goes well, watch the refund roll in. It’s a big help, especially with construction costs being what they are these days.

Digital Everything: The UAE Way

Funny thing is, the UAE doesn’t really do “old school” when it comes to government services. They’re all about digital transformation, a buzzword, sure, but here it actually means something. Those VAT refund kiosks? They’re everywhere. The whole process is online, from tracking your refund to getting paid. No more lost paperwork, no more “please hold” on the phone for hours. It’s all streamlined, fast, and (mostly) painless.

And the e-commerce angle? That’s just the cherry on top. Tourists can now claim VAT refunds on stuff they bought online while visiting. It’s like the system is evolving in real time, keeping up with how people actually shop.

Why Does Any of This Matter?

Here’s the thing: VAT refunds aren’t just a nice perk. They’re a strategic move. The UAE wants to keep tourists coming, keep citizens happy, and keep the economy buzzing. And it’s working. More tourists are shopping, more citizens are building, and the government is raking in revenue without squeezing anyone too hard. Win-win-win.

But, of course, it’s not all sunshine and rainbows. There are hoops to jump through, rules to follow, and the occasional hiccup (because, let’s face it, no system is perfect). Still, compared to a lot of places, the UAE’s VAT refund setup is pretty slick.