Portugal’s D7 visa is turning heads and passports among UAE expats living off pensions, rental income, or investments who want a long‑term base in Europe, complete with Schengen visa-free travel.

Think of it as a backdoor to EU living, minus having to found a business or punch a clock. Imagine waking up somewhere greener, calmer, and still plugged into international perks. Totally unexpected? Maybe. Incredibly appealing? You bet.

What Makes the D7 Different (and Why UAE Expats Are Talking About It)

It’s not the D2 Golden Visa…

Funny thing is, the D2 visa steals the spotlight, tailored for start‑up founders and investors. But the D7? That’s the underdog. Also called the Passive‑Income or Retirement Visa, it’s built for people who don’t want to start a company in Portugal or work in one.

So who’s it ideal for?

- Retirees.

- Freelancers and remote workers living abroad.

- Rental‑income enthusiasts.

- Anyone with dividends, royalties, intellectual‑property cash flows…basically any “set it and forget it” income stream.

(And yes, that perfectly describes many UAE residents, those pondering early retirement or just a slower pace of life.)

Why Portugal?

- EU Residency Without the Startup Hustle

No need to launch a business or invest €500K. All you need is to show relatively modest passive income. - Schengen Zone = Travel Freedom

One visa, 27 countries. No visa juggling for holidays, business trips…life. - Lifestyle Switch

Wish to swap city‑center skyscrapers for cobbled lanes, seafood markets, sunlit afternoons…? Portugal delivers. - Future‑Proof Gains

Portuguese residency, then permanent residence or citizenship. In five years, you could even earn a passport. - A Cost‑Effective Alternative

Compared to Golden Visas or second‑home schemes, D7 is budget‑friendly.

The Money Talk: What You Need to Show

You must prove regular passive income, so no freelance gigs under this visa. Sources can include:

- Pensions / retirement funds

- Rent from property

- Investment dividends

- Royalties or IP earnings

Minimums are:

- €8,460/year if you’re solo (~AED 33,500)

- +50% more if your spouse applies

- +30% for each dependent child

Smooth paperwork required: six months of bank statements, a Portuguese bank account, and an address in Portugal. (A rental agreement works just fine!)

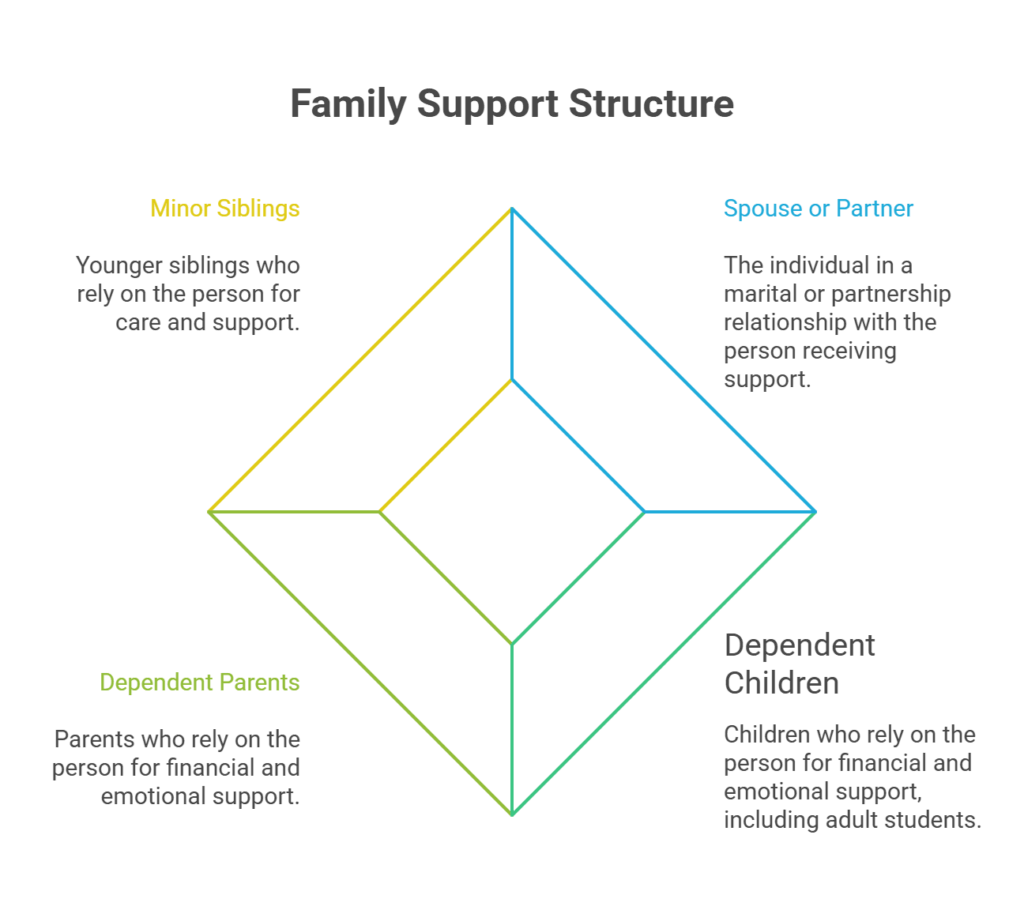

Who Else Gets to Come?

It’s not just you; family comes too:

And once there, you’ll get:

- Public healthcare and education

- Right to work or freelance if you later decide

- Legal protections and benefits

- A path to citizenship after five years

The Passport Timeline: Slow and Steady

- Year 1: You receive the D7 visa and a residence permit.

- Years 2–3: Permit renewals every two years.

- Year 5: Eligible for permanent residency or full Portuguese citizenship.

- Bonus: A basic Portuguese language test, but mostly just a check in to prove you’re settling in

Tax Time: What Changes on Arrival?

Spend more than 183 days per year in Portugal, and it’s tax‑resident territory. That means all global income is taxed. The old Non-Habitual Residency (NHR) scheme ended in 2023, but a tweaked version for high-skilled workers is expected by 2024. Passive-income earners might still benefit in some scenarios, but lawyering up is a smart move.

Cost of Living: The Portuguese Preview

Portugal is cheaper than Dubai or Abu Dhabi on many fronts: food, rent, and healthcare. But:

These are ballpark figures; region and lifestyle matter. Still, compare that with UAE rent, and it’s a good deal. (Just don’t forget unexpected costs, insurance, flights, visiting home, etc.)

FAQs & Reality Checks

Q: Can I work there?

Technically, yes, D7 lets you work or freelance locally if you want. But it’s primarily a passive‑income visa, so active business is off the table (unless you switch to D2). Q: Is €8,460 enough?

It’s the legal minimum. Real‑world costs vary. Many expats show a higher buffer. Plus, you’ll need health insurance, rent, food, flights, etc.

Q: How’s the visa process/where to start?

Get a Portuguese NIF (tax ID), open a bank account, and gather income docs, a rental contract, health insurance, and a clean CR certificate. Apply via the Portuguese consulate in the UAE. After visa approval, you must enter Portugal and apply for your residency permit.

Q: Is bureaucracy tough?

Some say it’s a minefield. Language barriers can complicate paperwork. Most recommend hiring a lawyer or relocation specialist to smooth out the red tape.

Q: Golden Visa vs. D7?

If you’ve got €500K+, the Golden Visa gives flexibility (you needn’t live there). But it’s pricey. D7 is pocket friendlier but requires actual residence. Choose based on lifestyle. Do you want to be based in Portugal? D7 is strong. Prefer absentee investment? Golden might suit better.

Q: What if I stay less than 183 days?

That could exempt you from tax residency but screw with your renewal and E.U. status. Frequent absences may hurt your long‑term residency or citizenship prospects.

Final Take: D7, A Smart Move for the Right Suit

If your life aligns with

- Passive income (without trying to build a side gig in Portugal)

- A European lifestyle I’m talking Portugal: “mi casa es su casa.”

- Family, sun, culture, travel, healthcare perks

- And you’re okay with tax residency…

…then D7 is compelling. No omni-investment, no business headaches, just a path to EU living, with residence and potential citizenship.

A Closer Human Lens (Because It’s About More Than Paperwork)

Imagine your morning: Portuguese coffee. Cobblestone streets dusted gold by sunrise. A fresh pasture of possibilities, walks by the ocean, market stalls, and months stretching in both Arabic and Latin roots.

You’re passive-income based. You’ve got rental returns from Dubai, dividend checks from global stocks, or maybe retirement income from a Gulf pension. That’s your foot in the door. No living-in-Dubai treadmill. You pack a bag and a few warm layers and land somewhere entirely different, without breaking any laws or buying castles.

And the Schengen Access? That’s the cherry. Weekends in Paris, summers in Greece, kids in Brussels schools, all with a single visa.

Not ideal if you crave anonymity. But if your bucket includes Lisbon sunsets, Algarve breezes, and family reunions under green vines…this is it.

Weigh‑In Table: D7 at a Glance

| Feature | D7 Visa Highlights |

| Income Required | €8,460/year + 50% spouse + 30% child |

| Residency Requirement | 183+ days/year for tax residency |

| Work Allowed | Passive only (local work needs switch to D2) |

| Travel Rights | Full Schengen visa-free access |

| Healthcare & Education | Public access for family |

| Citizenship Path | Yes, after 5 years plus a language test |

| Cost of Entry | Low , no major investment required |

| Golden Visa Compromise? | Yes (cheaper, but more “present” than absentees) |

Bottom Line

D7 isn’t a miracle but a clever European exit hatch, especially for UAE dwellers with real passive income and a dream of slow mornings in Lisbon, old‑town dinners, and freedom to roam Europe on your own terms.