Wait, did you say $1.51 trillion?

Picture this: It’s a regular Tuesday. You’re sipping your coffee, scrolling through the business headlines, and, bam!, there it is. CFI Financial Group just clocked a trading volume so massive, so jaw-dropping, it makes last year’s numbers look like pocket change. $1.51 trillion. In just one quarter. Let that sink in for a second.

Now, you might be thinking, “Okay, but what’s the big deal?” Well, let’s spill the beans: this isn’t just a number. It’s a seismic shift in the world of online trading. And if you’re even remotely interested in how the financial world ticks (or you just love a good underdog story), you’ll want to stick around.

Who’s CFI, anyway?

The Backstory: A Quick Stroll Down Memory Lane

CFI Financial Group. Maybe you’ve heard the name tossed around in trading circles. Maybe not. Either way, here’s the scoop: founded back in 1998 (yep, before TikTok, before iPhones, before most of us had even heard the word “forex”), CFI started as a small player with big dreams. Fast-forward to today, and they’re everywhere: London, Dubai, Abu Dhabi, Cape Town, Beirut, and Amman. You get the idea.

But here’s the kicker: they didn’t just grow. They evolved. Think zero-pip spreads, no commission fees, lightning-fast execution, and a buffet of trading options, currencies, stocks, commodities, you name it. Oh, and did I mention their AI-powered tools and multilingual education content? (Because, honestly, who doesn’t want a trading platform that actually helps you learn?)

The $1.51 Trillion Moment, Not Just a Fluke

So, how did they pull this off?

Let’s not beat around the bush. $1.51 trillion isn’t just a “good quarter.” It’s a moonshot. Here’s what went down:

- 18% jump from Q1 2025. (Already impressive.)

- 97% leap compared to Q2 2024. (That’s almost double, for the math nerds.)

- $2.79 trillion total for the first half of 2025. (Yeah, you read that right.)

And if you’re wondering, “Is this just a flash in the pan?”, nope. This is the result of years (decades, really) of building, tweaking, and, well, refusing to settle for “good enough.”

Funny Thing Is…

It wasn’t just about the numbers. It was about momentum. The kind you feel in your bones. The kind that makes you sit up and pay attention.

The Market Was Ripe, But CFI Was Ready

Volatility, Opportunity, and a Dash of Chaos

Let’s be real: 2025 hasn’t exactly been a snooze-fest for the markets. Geopolitical drama, economic curveballs, and a retail trading boom that’s got everyone from college students to retirees glued to their screens. The Middle East? Absolutely buzzing. Financial regulation is tightening, talent is flocking, and, believe it or not, CFI is right in the thick of it.

By the Numbers (Because, Hey, Data Matters)

- Funded accounts: Up 2% from late 2024, up 60% year-on-year.

- Active accounts: Up 22% from H2 2024, up 84% year-on-year.

- Middle East: Still the crown jewel, but CFI’s reach is global.

So, what’s driving all this? A perfect storm of market volatility, tech innovation, and, let’s be honest, a company that knows how to read the room.

Leadership: The Secret Sauce

Changing of the Guard, But Not the Vision

Here’s something you don’t see every day: a leadership shakeup that actually works. In Q2 2025, Ziad Melhem steps in as Group CEO. The co-founders? They’re not out; they’re just moving up (Chairman and Vice Chairman, if you’re keeping score).

And Ziad? He’s not just a figurehead. He’s the guy who says things like

“Q2 2025 was not only about numbers; it was about momentum. From our global partnerships and regional expansion to launching initiatives like the CFI Academy, we are actively shaping the future of trading. The results we’re seeing today reflect years of building, refining, and pushing boundaries.”

You can almost hear the energy, right? It’s not just corporate-speak. It’s a rallying cry.

Strategic Moves: Not Just Luck, It’s Chess, Not Checkers

Expansion, Education, and a Little Star Power

Let’s break it down. CFI didn’t just sit back and hope for the best. They made moves, big ones.

1. New Markets, New Rules

- South Africa? Check.

- Bahrain? Double-check (with a shiny new license from the Central Bank of Bahrain).

2. CFI Academy, Because Knowledge Is Power

- Launched to help traders level up. (And yes, you’ll love this: it’s not just for pros. (Beginners welcome.)

3. Global Partnerships, Because Why Not?

- Official Online Trading Partner of the 2025 Turkish Airlines EuroLeague Final Four.

- Etihad Arena? Yep, they’re in.

- Oh, and Maria Sharapova as Global Brand Ambassador. (Talk about star power.)

4. Tech That Actually Works

- AI-driven tools.

- Multilingual education.

- Zero-pip spreads and no commission fees. (Seriously, who does that?)

Data Time: Let’s See Those Numbers

(Because a Picture’s Worth a Thousand Words)

Trading Volume Growth (Quarterly)

| Quarter | Trading Volume ($ Trillion) | % Change (QoQ) |

| Q2 2024 | 0.77 | , |

| Q1 2025 | 1.28 | +66% |

| Q2 2025 | 1.51 | +18% |

Active & Funded Accounts

- Active accounts: +22% vs. H2 2024, +84% YoY

- Funded accounts: +2% vs. H2 2024, +60% YoY

Regional Breakdown

- Middle East: Still the heavyweight.

- Africa: Fastest-growing new market.

- Europe & Asia: Steady, with room to run.

(If you’re a visual learner, imagine a hockey stick graph, because that’s what this looks like.)

Awards, Accolades, and a Little Bragging (Deserved, Honestly)

The Trophy Case Is Getting Crowded

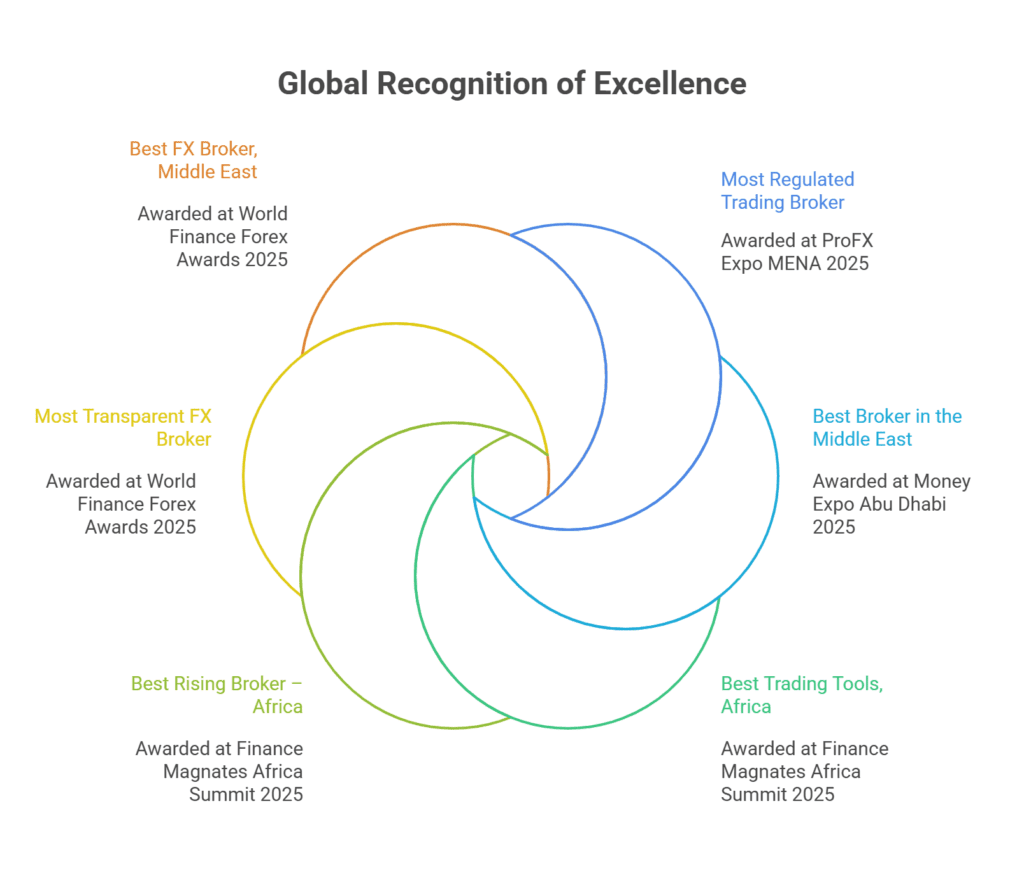

- Most Regulated Trading Broker (ProFX Expo MENA 2025)

- Best Broker in the Middle East (Money Expo Abu Dhabi 2025)

- Best Trading Tools, Africa (Finance Magnates Africa Summit 2025)

- Best Rising Broker – Africa (Finance Magnates Africa Summit 2025)

- Most Transparent FX Broker (World Finance Forex Awards 2025)

- Best FX Broker, Middle East (World Finance Forex Awards 2025)

Not bad for a company that started out as the “little guy,” right?

Why Does This Matter? (And What’s Next?)

For Traders, Investors, and the Just-Plain-Curious

Here’s the thing: CFI’s story isn’t just about big numbers and shiny trophies. It’s about what’s possible when you mix vision, grit, and a willingness to shake things up. For traders? It means more opportunities, better tools, and (hopefully) fatter wallets. For the industry? It’s a wake-up call: adapt or get left behind.

Lessons from the CFI Playbook

- Don’t sleep on education. The CFI Academy is proof that smart traders are made, not born.

- Tech is your friend. AI, fast execution, and zero-pip spreads, these aren’t just buzzwords.

- Partnerships matter. Whether it’s sports, celebrities, or regulators, relationships open doors.

- Stay nimble. New markets, new products, and new ideas, don’t get stuck in your ways.

Ready to Dive In? (Here’s Your Nudge)

If you’ve made it this far, you’re probably at least a little bit curious. Maybe you’re a trader looking for your next platform. Maybe you’re just fascinated by how a company can go from “who?” to “wow!” in a few short years. Either way, give CFI a look.

- Zero-pip spreads.

- No commission fees.

- Ultra-fast execution.

- AI-powered tools.

- Education for all levels.

Want to see what all the fuss is about?. Who knows? You might just find your edge.

The Bottom Line (Because Every Story Needs One)

CFI Financial Group didn’t just break a record; they set a new standard. $1.51 trillion in a single quarter isn’t just a headline. It’s a challenge to the rest of the industry. It’s proof that with the right mix of brains, guts, and a little bit of swagger, you can rewrite the rules.

So, what’s next? If history’s any guide, CFI’s just getting started. And if you’re smart, you’ll be watching.