Antfin’s Major Strategic Move:

Funny thing is, big deals often go unnoticed, except when they signal seismic shifts in ownership. On August 7, 2025, Alibaba Group’s affiliate, Antfin Singapore Holding Pte. Ltd., executed a substantial bulk deal involving Eternal Ltd., the parent company of Zomato and Blinkit. The total transaction amount? A staggering Rs 4,097 crore… enough to turn heads in even the sleepiest corners of the financial world.

Let’s break that down. Antfin offloaded over 14 crore shares in Eternal at an average price of Rs 289.91 apiece, reducing its stake from 1.95% down to just 0.49% after the sale. And get this, the specifics of who scooped up these shares remain shrouded in mystery. The buyers weren’t disclosed on any major exchange filings, leaving the market with questions and lots of speculation.

Why This Deal Matters: Layering the Context

Alibaba, Antfin, and India’s Digital Play

First, some background. Antfin Singapore Holding Pte. Ltd. operates under the umbrella of Ant Financial, itself an affiliate of the Chinese e-commerce titan Alibaba Group. Over the last several years, Alibaba and its related entities have invested heavily in India’s rapidly growing digital sector, most notably, in platforms like Zomato, Blinkit, and Paytm.

- Eternal Ltd.: Formerly simply Zomato, now the umbrella brand for Zomato and Blinkit, India’s leaders in online food delivery and quick commerce.

- Ant Financial/Antfin: Once a mega-holder in Eternal and Paytm, the company has been winding down its stakes, first in fintech, now in food delivery.

But here’s the kicker: this recent bulk deal follows swift divestitures elsewhere. Just days before the Eternal transaction, Antfin took the bold step of reducing its exposure to Paytm by completely selling its 5.84% stake for about Rs 3,980 crore. Both moves show a clear decoupling from the Indian digital market, at least for now.

The Mechanics of the Deal: Numbers, Timelines, and Tactics

- Date of Transaction: Thursday, August 7, 2025

- Number of Shares Sold: Over 14 crore

- Average Price Per Share: Rs 289.91

- Total Value: Rs 4,097 crore

- Previous Stake: 1.95% (cut down to 0.49% post-sale)

- Parent Brand: Eternal Ltd. (Zomato and Blinkit umbrella)

Market watchers noted an immediate, but modest, share price jump for Eternal:

- Eternal’s stock closed up 1.46% on the National Stock Exchange (NSE), finishing at Rs 303.20 per share post-deal.

- The FII (Foreign Institutional Investor) holding in Eternal declined from 42.34% to 40.39% after Antfin’s divestment.

Recent Financial Performance: Appetite for Growth

Okay, here’s what you might be wondering: is Eternal growing, or just treading water?

Short answer: growth, and lots of it.

- Q1 FY2025 Revenue: Rs 7,167 crore, up from Rs 4,206 crore a year earlier.

- Q1 Net Profit: Rs 25 crore, down from a previous Rs 253 crore; a curious drop despite soaring revenues. Investors have an eye on operational costs and margins.

- Brand Evolution: With a recent rebrand from Zomato to Eternal, the company aims for even greater reach in online delivery and commerce.

The Antfin Exodus: Paytm and Eternal in Focus

Believe it or not, Antfin’s reduction in Indian investments goes well beyond Eternal. In the days leading up to the Eternal stake sale, Antfin closed out its investment in One97 Communications Ltd., the company behind Paytm, India’s payment and financial powerhouse.

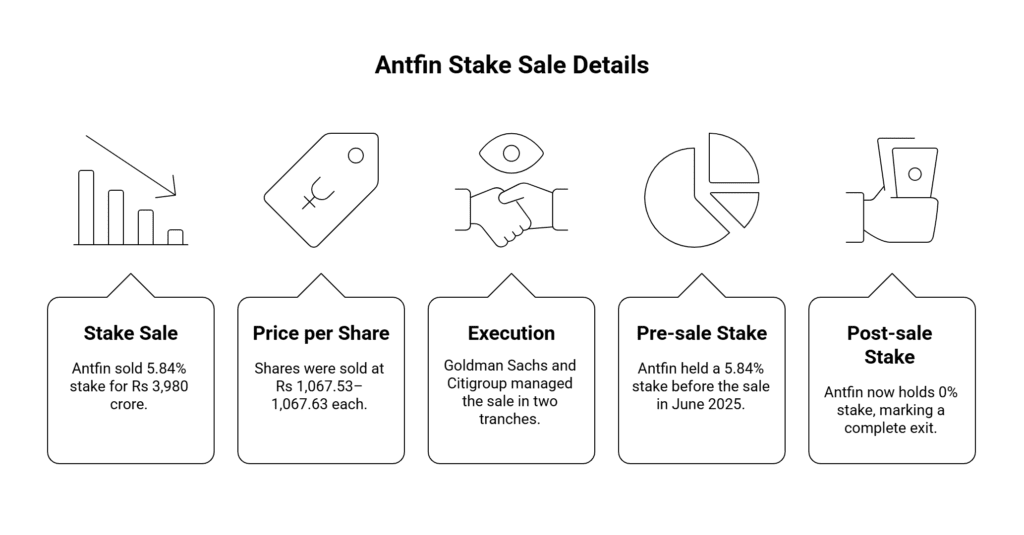

Paytm Bulk Deal Snapshot

- Antfin’s Stake Sale: 5.84% stake offloaded for Rs 3,980 crore

- Price: Rs 1,067.53–1,067.63 per share

- Executed Through: Two tranches, with heavyweight bankers Goldman Sachs and Citigroup steering the process.

- Pre-sale Stake (June 2025): 5.84%

- Post-sale Stake: 0%, a full exit.

Paytm shares saw a slight dip, down 2.38%, following the announcement. But with the “Chinese overhang” gone, analysts speculate that Paytm could benefit by sidestepping regulatory hurdles, possibly gaining new investor confidence and regulatory approvals.

Why the Chinese Exit Now?

Well, geopolitical and regulatory winds have shifted.

- India’s Scrutiny on Foreign Ownership: With New Delhi tightening rules around Chinese investments and foreign control, Alibaba and its affiliates faced increased pressure, especially given concerns about data localization and technological sovereignty.

- Investor Rotation: Other early backers, Japan’s SoftBank, Warren Buffett’s Berkshire Hathaway, have also fully exited Paytm.

- Eternal’s FII Cap: The company has set a ceiling of 49.5% for foreign institutional ownership. Post-Antfin sale, it hovers closer to 40%, leaving room for more domestic investors to step in.

The Scale of Alibaba’s Indian Investment and Returns

Here’s something that’s not just big, it’s nearly unprecedented.

Antfin’s total stake sales in Eternal, including both Zomato and Blinkit, have now exceeded Rs 18,000 crore (almost six times their initial investment of Rs 3,246 crore made between 2018 and 2020). That’s massive, even by the standards of global tech investing.

- Initial Investment (2018–2020): Rs 3,246 crore

- Total Proceeds from Stake Sales: Over Rs 18,000 crore

Timeline of Key Antfin Stake Sales in Indian Tech Giants

| Company | Year | Stake Sold (%) | Amount (Rs crore) | Post-sale Stake (%) | Notes |

| Paytm (One97 Comm) | Aug 2025 | 5.84% | 3,980 | 0 | Full exit from fintech |

| Eternal (Zomato) | Aug 2025 | 1.46% | 4,097 | 0.49 | Reduced stake in food commerce |

| Zomato (Earlier) | Mar 2025 | 2% | 2,827 | – | Ongoing reduction |

| Zomato (Earlier) | Aug 2024 | 4.24% | 3,422 | – | Block deal sale |

| Zomato (Earlier) | Aug 2023 | 2% | 4,771 | – | Block deal sale |

| Zomato (Alipay S’pore) | 2023 | 3.44% | 3,337 | – | Complete Alipay exit |

| Paytm (Earlier) | May 2025 | 4% | 2,065 | 9.85 → 5.84 | Pre-final exit |

| Paytm (Earlier) | Aug 2023 | 3.6% | 2,037 | – | Block deal sale |

| Paytm (Alibaba group) | 2023 | 10.3% | – | 0 | Transferred to Paytm CEO Vijay S Sharma |

Industry Impact, And What It Means Next

So why should anyone pay attention to this string of major exits?

Antfin’s retreat is much more than just financial housekeeping. By divesting from leading Indian platforms, Alibaba’s affiliate marks the tail end of a long relationship with India’s digital market, one that fueled early growth and innovation but now bumps up against regulatory, geopolitical, and strategic realities.

- For Zomato/Blinkit (“Eternal”): The company’s cap table now leans more domestically, perhaps making way for new institutional investors or even more aggressive expansion.

- For Paytm: The removal of Chinese stakeholders may allow for swifter regulatory approvals and remove ownership concerns, critical to its operations under India’s evolving fintech law.

- For Alibaba and Antfin: These moves suggest a larger pivot away from Indian tech amid recurring obstacles.

What Investors and Observers Are Saying

Let’s get candid, market sentiment generally tilts toward optimism when foreign ownership concerns disappear. As one analyst put it:

“With the long-standing overhang from a major Chinese investor now removed, [company] stock could see a positive reaction as ownership concerns ease and supply pressure decreases. Such clean-out trades often provide clarity, allowing investors to refocus on fundamentals and future growth. The exit also aligns the cap table more closely with regulatory expectations, which could be viewed favourably in the context of [pending licenses].”

Still, everything hinges on how Eternal and Paytm deploy this new cap table flexibility. Domestic and international investors are watching for next steps, M&A, expansion, or further restructuring, while regulators keep a close eye on compliance and ownership flows.

What Comes Next: Open Questions

- Buyer Identity: Who bought the bulk of Antfin’s Eternal shares? No names yet, another chapter still unwritten.

- Strategic Moves: Will Eternal’s more domestic-heavy cap table unlock major new partnerships, or accelerate innovation?

- Regulatory Effects: Will Paytm quickly clinch long-awaited payment aggregator licenses as Chinese influence fades?

The Bottom Line

Alibaba Group’s Antfin has, in the space of just days, altered the landscape of India’s digital sector by methodically shedding major stakes in two of its crown jewels: Eternal (Zomato/Blinkit) and Paytm. With Rs 4,097 crore moving in one direction and regulatory clouds lifting, it’s a deal that echoes far beyond stock tickers.

Facts, not just headlines. Antfin’s bulk sale is Indian tech history in the making: a harbinger of changing tides in investor sentiment, regulatory strategy, and global capital flow. Stay tuned, because in this market, anything can happen next.