Dubai’s Meteoric Rise in Real Estate

Picture this: a dusty desert outpost, transformed, almost overnight, into one of the world’s most dazzling skylines. That’s Dubai. Today, in 2025, the emirate’s property market isn’t just hot. It’s a blazing global magnet for investment dollars, euros, and rupees alike. Investors from Mumbai to London, Moscow to Shanghai, they’re all here. And they’re not just dipping toes, they’re jumping in.

Funny thing is, there’s more magic at work than meets the eye. This isn’t a simple story about skyscrapers or shopping malls. Believe it or not, the real engine? Resilient demand, geopolitical stability, and, wait for it, some of the most investor-friendly perks you’ll find on planet Earth.

This report digs deep into the facts, trends, and truths powering Dubai’s property revolution. Buckle up.

Dubai’s 2025 Property Market, Numbers That Astound

- AED 117 billion in real estate deals logged in the first half of 2025. That’s approximately $31.8 billion.

- A jaw-dropping 125,000+ transactions across every property type in just six months, the highest on record.

- Year-on-year growth? 25% higher than the same period last year. And the parade isn’t slowing.

Let’s zoom in on volume: In just Q1 2025 alone, Dubai counted over 43,000 property transactions, ushering in more than AED 115 billion, and by the halfway mark, deals soared to record levels. It’s not just the sheer bulk of deals, but the pace: experts estimate the emirate will add another 73,000 new homes by the end of the year, bringing total residential inventory toward 300,000 units by 2028.

And prices? As of May 2025, villa values are 66% above their 2014 peak and 175% higher than post-pandemic levels. Apartments trail only slightly, averaging 73% above 2020 valuations. For context: That’s growth rarely seen even in the world’s priciest capital cities.

What’s Fueling Dubai’s Relentless Property Surge?

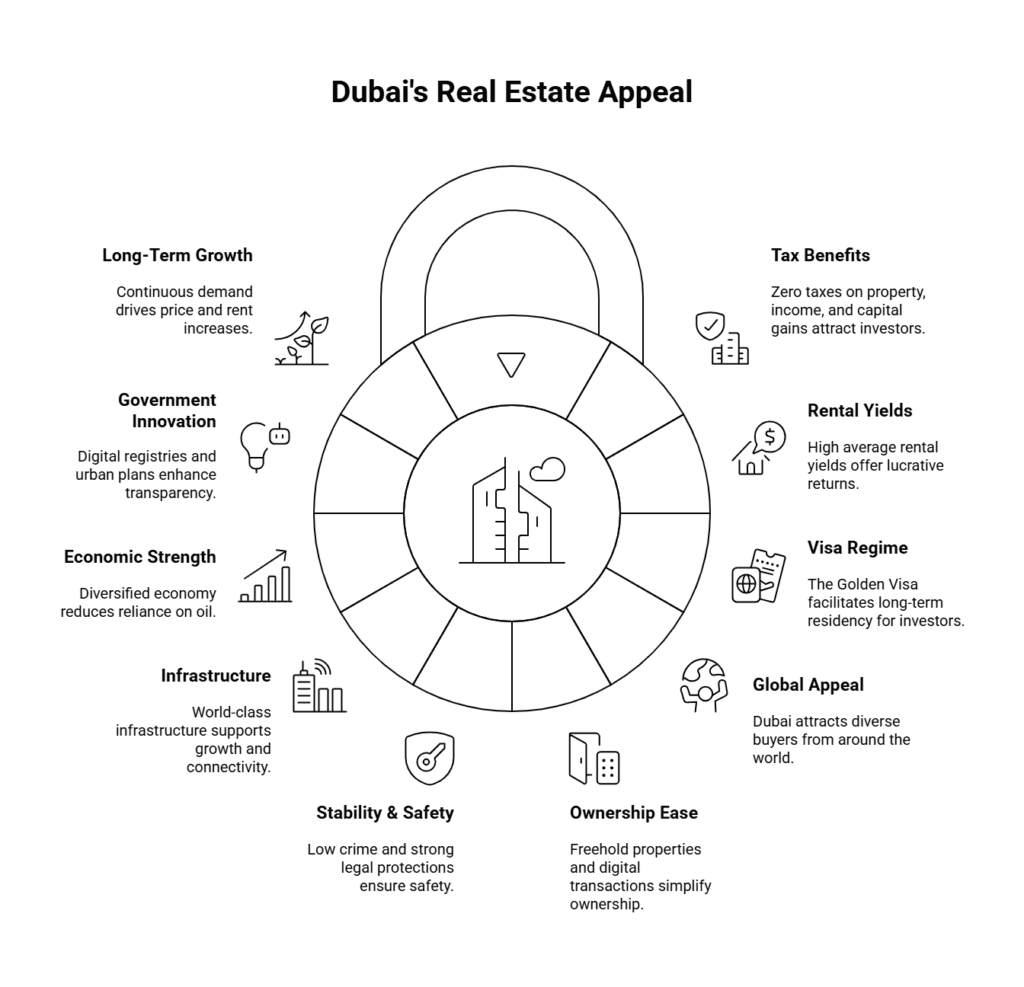

Dubai’s rocket ride isn’t about hype or “FOMO.” Let’s break it down:

Key Drivers

- Tax-Free Returns: Zero property tax, zero income tax, and no capital gains taxes for most property investors.

- High Rental Yields: Average yields range from 5–8%, with short-term rentals reaching even higher.

- Investor-Friendly Visa Regime: The “Golden Visa” allows long-term residency for substantial property buyers, entrepreneurs, and skilled professionals.

- Global Diversification Haven: Dubai attracts buyers from across the globe: GCC countries, Europe, Russia, India, Africa, and beyond.

- Streamlined Ownership: Freehold properties for foreigners and fast, digitally enabled transactions.

- Political Stability & Safety: Low crime, robust legal protections, and a well-established rule of law.

- World-Class Infrastructure: Think new metro lines, high-speed internet, superlative airports, and master-planned communities.

- Strong Economic Fundamentals: Over 90% of the city’s GDP is now non-oil, driven by trade, tourism, and tech, insulating it from global oil price shocks.

- Government Innovation: From the “Dubai 2040 Urban Master Plan” to digital land registries, market transparency, and investor trust keep rising.

- Long-Term Growth: Demand from expats, business leaders, and lifestyle-seekers keeps pushing prices and rents higher.

In short: The emirate’s real estate engine hums on a blend of policy, demand, and innovation you’ll rarely find elsewhere.

Where the Money Is Flowing, Neighborhoods and Segments Surging

Not all parts of Dubai are created equal. Some districts are simply on fire.

- Villas Lead the Charge: Jumeirah Islands (41.5% annual growth), Palm Jumeirah (40.9%), Emirates Hills (28.6%), The Meadows (28.3%).

- Apartments Catching Up: Key areas like The Greens, Dubai Silicon Oasis, and Dubailand Residence Complex, each up 22–24% annually.

- Supply vs. Demand: Even as developers ready 73,000 new homes for 2025, there’s simply not enough to satisfy global appetite. That’s pushing prices higher, especially in well-connected, amenity-rich communities.

The “Metro effect” is also real: New lines and connectivity upgrades are creating fresh investment hotspots in places like Mirdif, Silicon Oasis, and Academic City. As transit grows, so do property values in zones now firmly “on the map.”

FDI, Digitalization, and the New Face of Global Real Estate Investment

Foreign investment is the real heart that keeps Dubai’s property market pumping. Recent statistics tell the tale:

- Direct Foreign Investment (FDI) in Property: In 2024, Dubai’s real estate sector attracted $2 billion in FDI, with strong double-digit growth projected for 2025.

- Digital Transactions: Over 1.3 million real estate “procedures”, from deals to registrations, handled digitally in just the first six months of 2025.

- Ownership Rights: Freehold titles for foreigners, with straightforward transaction rules and nearly instant digital verifications, remove much of the friction seen in more bureaucratic markets.

New reforms, such as paperless land registry and streamlined payment solutions, have shortened transaction times and reduced risk. Result? Investor confidence, both from inside the UAE and worldwide, is at an all-time high.

Rental Yields, Taxes, and the “Golden Visa” Advantage

“Why Dubai?” Foreign investors often start with this question. The answer, in part, comes down to raw numbers and a little legal magic.

Dubai’s Numbers Stack Up:

- Rental Yields: Investors can expect 5–8% annual returns, with some short-letting hotspots seeing 13% returns for long-term leases.

- Tax Benefits: No property tax, no income tax, and no capital gains tax on real estate investments. Compare that to London, New York, or Singapore, where annual property levies can eat into returns.

- Residency and “Golden Visas”: Owning property above a certain value qualifies buyers for long-term residency, often up to 10 years for both the investor and immediate family.

The upshot? Investors keep more of what they earn, and get residency perks to boot.

Off-Plan Developments, A Global Buyer’s Playground

Off-plan properties, those bought before construction, are another pillar of Dubai’s property boom.

Here’s the kicker: Attractively priced units, flexible payment plans, and bespoke options allow even first-time global investors to snag homes in up-and-coming communities. With digital tours and streamlined cross-border payments, buyers from Europe, India, Russia, and beyond are closing deals without ever setting foot in Dubai.

Developers are capitalizing by offering unique payment arrangements, early-buyer privileges, and exclusive previews. That means more options, more excitement, and ever-rising demand for Dubai’s next iconic neighborhoods.

Is This a Bubble? Market Outlook and Ongoing Trends

It’s the question that hovers over every real estate boom: Is it sustainable?

Here’s what top market analysts and the numbers suggest for Dubai:

- Steady, Not Speculative: Growth is increasingly driven by end users (those buying to live, not flip or speculate), which makes for a healthier, more balanced market.

- Moderating but Positive Price Growth: Experts predict overall price growth of 5–10% for 2025, down from last year’s white-hot 25%+, still robust by global standards, but more sustainable.

- Villas Outperform, Apartments Stable: Luxury villa prices are leading, with apartments in select high-demand areas gaining ground as supply remains tight.

- Market Diversification: No one region dominates. Buyers are now truly global, protecting Dubai from regional economic shocks.

- Sustainable Innovation: Ongoing government focus on green building, digitalization, and smart urban planning (the Dubai 2040 Urban Master Plan) bodes well for future supply-demand balance.

So, if I’m honest? All signs point to continued strength, not a speculative bubble.

Dubai vs. Global Competitors: Why It Stands Apart

Why aren’t high-net-worth individuals flocking to London, New York, or Hong Kong instead? Well…

Comparative Advantages:

- Affordability: Even after years of gains, Dubai’s average property prices are still lower per square foot compared to global capitals.

- Ease of Doing Business: Minimal bureaucracy, digital portals for every transaction, and investor-centric dispute resolution.

- Diversity and Scale: Whether you’re a first-time buyer, a family, or an institutional investor, Dubai has properties in every price range, from luxury penthouses to affordable studios.

- Lifestyle Benefits: World-class shopping, dining, entertainment, and education in a city consistently ranked among the safest globally.

- Global Connectivity: Two massive, award-winning airports. Hub status for airlines. Direct flights to virtually every continent. For residents and investors alike, travel is a non-issue.

Risks, Challenges, and What Investors Should Watch

It’s not a fairy tale; no market is without risk. For would-be investors, a few things to keep in mind:

- Supply Surges: With 73,000 new homes coming online this year, certain segments (especially mid-range apartments) could face some short-term oversupply. Still, rapid population growth helps absorb inventory.

- Price Moderation: The breakneck appreciation of 2023–2024 is easing. Investors should plan for high single-digit gains, not 30% rockets.

- Regulatory Changes: While Dubai’s reforms are generally investor-friendly, it pays to stay informed on visa, ownership, and purchase requirements, since tweaks happen fast.

- Global Economic Shocks: Although Dubai’s diversification protects against oil swings and regional unrest, any truly global crisis, pandemic, recession, or major geopolitical event can impact demand.

But for most, especially those with long-term horizons, these challenges pale in comparison to the upside.

The Human Side, Who’s Investing, and Why?

Walk through Dubai Marina, Business Bay, or Palm Jumeirah, and you’ll hear dozens of languages. Investors hail from India, Russia, China, the UK, Germany, the US, Egypt, and many more.

For some, it’s all about returns, high rents, and fast-growing values. For others, Dubai’s clean streets, international schools, and lifestyle perks are critical. Some come for residency. Others see the city as a secure “second home” in uncertain global times. Increasingly, even Western buyers (from Europe and North America) are entering the market in search of diversification, value, and stability.

What’s Next? Future Trends to Watch in Dubai’s Property Scene

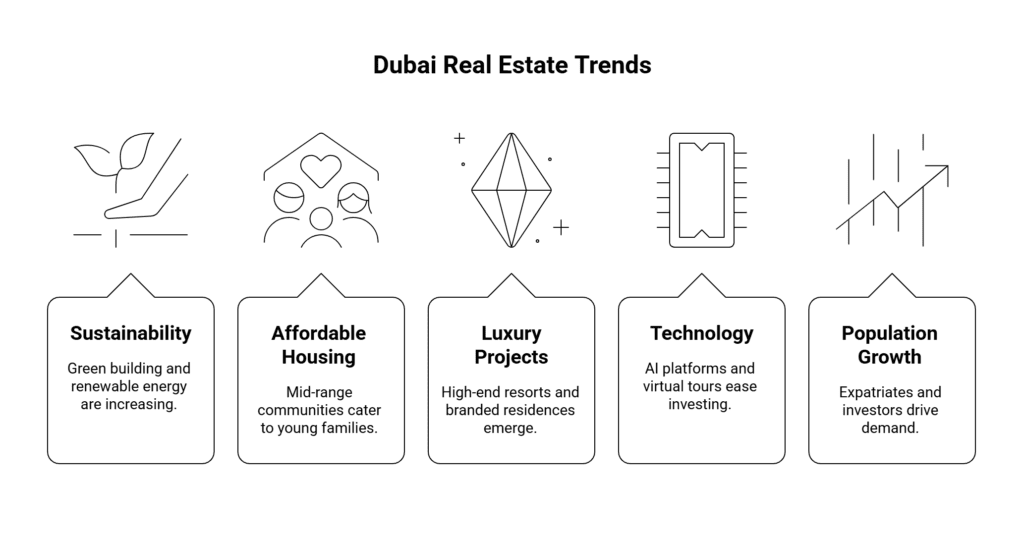

So, what’s on the horizon?

- Sustainability and Smart Living: Green building, renewable energy incentives, and smart-home technologies are on the rise.

- Affordable Housing Initiatives: Not just luxury. With young professionals and families in mind, mid-range and affordable communities are springing up.

- Luxury Super Projects: Think ultra-high-end beach resorts, branded residences, and new concepts like “sky villas.”

- Technology Refines Transactions: AI-powered platforms, digital contracts, and virtual tours make overseas investing ever smoother.

- Population Growth: Continued influx of expatriates, business travelers, and investors ensures ongoing demand, especially in well-connected, amenity-rich areas.

Conclusion: Dubai, A Beacon for Global Real Estate Investment

In 2025, there’s no denying it: Dubai has cemented its position as the world’s preeminent property investment powerhouse. Whether it’s the astonishing price growth, the allure of tax-free returns, or the city’s commitment to blending innovation, hospitality, and security, the emirate offers opportunities you won’t easily find elsewhere.

If you’re scouting for a destination that pairs reliable income, lifestyle transformation, and long-term security, put Dubai near the top of your list. The numbers, and, increasingly, the people, don’t lie. The story’s not over yet, by a long shot.