Overview: A Tumultuous Quarter for PNB

Punjab National Bank (PNB), the third-largest public sector bank in India, just published its financial results for the quarter ending June 30, 2025. And believe it or not, while its business kept expanding at a healthy pace, something happened that stunned analysts and investors alike: a massive 48% plunge in standalone net profit year-on-year. The culprit? A one-off tax expense so large, it effectively wiped out gains from robust lending and deposit growth.

Picture this: income is up, operations are strong, risk is falling… and then, with one sharp swing of the tax blade, profits tumble.

Key Financial Highlights: Growth Collides with Tax Reality

Let’s break down the numbers. Because, truth is, the headline barely tells the whole story.

Standalone Performance, Q1 FY26 (April–June 2025)

- Net Profit: ₹1,675 crore

(down 48% from ₹3,252 crore same quarter last year) - Total Income: ₹37,232 crore

(up 15.7% year-on-year) - Net Interest Income (NII): ₹10,578 crore

(up just 1% year-on-year) - Operating Profit: ₹7,081 crore

(rise from ₹6,581 crore in Q1 FY25, a sign of solid underlying business) - Tax Expense: ₹5,083 crore

(sharp spike vs. ₹2,017 crore, Q1 FY25, yes, that’s the reality check) - Earnings Per Share (Basic): Dropped in line with profit crash

Consolidated Results

- Net Profit: ₹1,832 crore

(down 52% compared to Q1 FY25) - Total Income: ₹37,999 crore

(16% higher vs. last year)

Funny thing is, on most growth metrics, PNB’s Q1 looked like a textbook case of expansion.

The Tax Shock: What Triggered the Slump?

Here’s the kicker: PNB’s profit didn’t plunge because of business failings, bad loans, or market chaos. The real blow came from a one-time tax expense. And it wasn’t a minor adjustment. Tax outgoes more than doubled year-on-year. Let’s put numbers on it:

- Q1 FY26 Tax Outgo: ₹5,083 crore

(vs. ₹2,017 crore in Q1 FY25, an increase of over 152%) - Management says this was largely a one-off, citing a shift in the tax regime and deferred tax accounting impacts.

If I’m honest, it’s rare for a bank this size to see tax eat nearly a third of operating profit in a single quarter.

Business Expansion Continues, Here’s the Kicker

Despite the headline-grabbing profit plunge, PNB’s core business is growing. Really growing.

Key Growth Metrics

- Global Business: ₹27.19 lakh crore as of June 2025

(up 11.6% year-on-year)

- Global Deposits: ₹15.89 lakh crore (12.9% annual growth)

- Global Advances: ₹11.29 lakh crore (9.8% growth)

- Global Deposits: ₹15.89 lakh crore (12.9% annual growth)

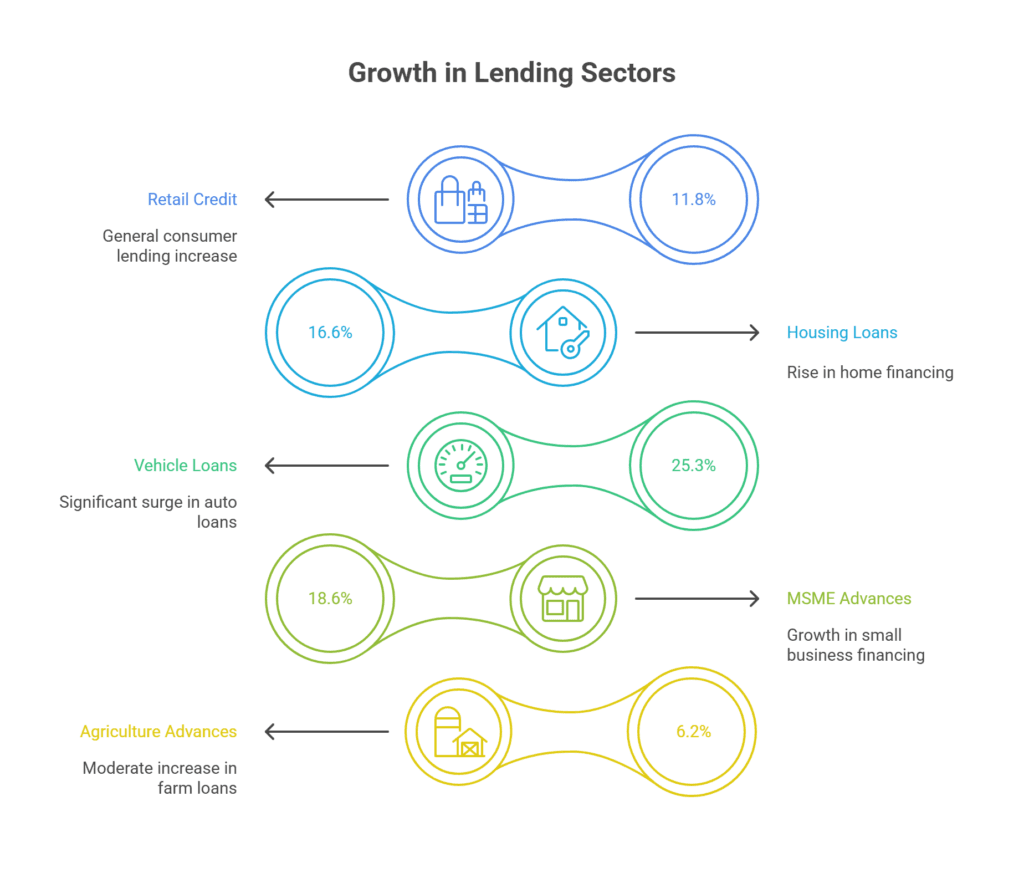

Retail & Priority Sector Lending

- Retail Credit: ₹2.62 lakh crore (11.8% rise)

- Housing Loans: ₹1.18 lakh crore (16.6% up)

- Vehicle Loans: ₹27,229 crore (a whopping 25.3% surge)

- MSME Advances: ₹1.69 lakh crore (18.6% growth)

- Agriculture Advances: ₹1.78 lakh crore (6.2% climb)

So while tax hit short-term profit, the underlying business is very much on the move.

Asset Quality: Silver Lining Amid Turbulence

No story here about “profit falls” is complete without talking about risk. For years, PNB, like many Indian banks, wrestled with bad loans. That tide? It’s finally ebbing.

As of June 30, 2025:

- Gross Non-Performing Asset (GNPA) Ratio:

3.78% (sharply lower from over 4.98% year-ago, and well below March 2025’s 3.95%) - Net Non-Performing Asset (NNPA) Ratio:

0.38% (down from 0.4% just three months prior) - Provision Coverage Ratio:

Industry-leading, nearing 97% in some quarters - Total GNPA (absolute):

Dropped to ₹42,681 crore from ₹56,343 crore a year ago

Takeaway: PNB continues to shed its burden of bad loans. Those improvement percentages beat most of the big names in Indian banking, if I’m honest.

Sector Context: Big Shifts in India’s Banking Landscape

To really “get” these numbers, you have to see PNB’s story in a broader context. Since 2018, Indian public-sector banks have navigated a gauntlet of bad loans, major reforms, and shifting regulations. State-owned lenders have merged, recapitalized, cleaned up their books and rolled out digital banking like never before.

The Reserve Bank of India (RBI) has been pushing for tighter risk controls, stronger capital, and whittling down those scary-sounding NPAs (non-performing assets). For PNB to post such sharp improvements in NPAs and still expand lending? That says something about the grind behind these numbers.

What’s Behind the Numbers?

Let’s unpack this further (hang on tight):

- Interest Earnings:

Interest income rose to ₹31,964 crore (Q1 FY26), up 12% year-on-year. This was driven by strong growth in advances and tighter margin management. - Net Interest Margin (NIM):

A modest 2.84% (domestic), PNB’s spreads remain under pressure from competition and rising funding costs, but stability is a win in this environment. - Non-Interest Income:

Contributed meaningfully, buoyed by fees and treasury operations, but was offset by lower recoveries and mark-to-market hits this quarter. - Operating Expenses:

Increased in line with branch expansion, tech upgrades, and higher wage costs. - Provisioning:

The bank’s provision buffer remains robust, signaling confidence about future asset quality.

“Despite temporary setbacks from higher taxation, Punjab National Bank’s business trajectory is clear: growth in core lending, improving asset quality, and a steady march towards digital transformation.”

, Analyst, economic press review

Management’s Response

As you’d expect, PNB’s leadership had to face the music. Here’s the gist from their post-earnings statements and analyst calls:

- The profit decline is temporary, driven by an unusual tax adjustment unlikely to recur at this scale.

- The balance sheet remains well-capitalized, with capital adequacy at 17.52% (Basel III).

- They see retail and MSME lending as key drivers, with a push toward further reduction in bad loans.

- The focus remains on expanding digital banking and maintaining asset quality improvements.

And in classic cautious style, no grand promises, just a measured commitment to “continue strengthening the foundation for sustainable growth.”

The Road Ahead: What to Watch

PNB’s Q1 2025 paints a picture of resilience tested by a shifting tax regime. The profit shock, though severe, is expected to be a “speed bump” rather than a new normal.

Here’s what to keep an eye on next:

- Sustained Asset Quality:

Will those NPA ratios stay low as lending expands? - Tax Regime Impact:

Are one-time hits really a thing of the past, or is more turbulence coming? - Margins and Growth:

Can PNB defend its NIM in a high-competition space and keep the growth engine humming? - Digital Transformation:

How quickly can PNB transform digital service for its millions of customers (especially new, younger borrowers)?

For now? Despite the profit dip, PNB still looks like a big player keen to keep pace with India’s evolving financial sector.

FAQs: Punjab National Bank Q1 2025 Results Explained

Why did PNB’s Q1 net profit collapse by 48%?

Chiefly due to a one-off spike in tax expenses, which more than doubled year-on-year. Core business and revenue growth remained robust.

Were business fundamentals weak?

Not at all, total income grew 15.7%, and global business and key lending sectors saw double-digit growth.

What about bad loans?

Asset quality improved sharply. Gross and net NPAs fell to multi-year lows, continuing a multi-quarter recovery trend.

Did the profit drop affect PNB’s share price?

Shares slipped slightly after the results, but remain up over 5% for the year, reflecting market faith in the underlying business story.

What’s next for PNB?

More digital, more retail, continued focus on asset quality, and, management hopes, no more profit shocks from surprise tax bills.

Bottom Line

Punjab National Bank’s first quarter of the 2025-26 financial year was one of contrasts: on one side, robust business growth, expanding digital reach, and fast-improving asset quality; on the other, a one-time tax shock that took the shine off the headline profit figure. Most analysts agree: the underlying bank remains on firm ground, with the pain likely to be short-lived. But in the world of finance, as PNB just discovered, curveballs are never in short supply.