The UAE’s Crypto Scene: Not Just Sand and Skyscrapers

Let’s get one thing straight: the United Arab Emirates isn’t just about luxury cars, gold-plated coffee, and those jaw-dropping skyscrapers. Nope. Lately, it’s been making serious waves in the world of cryptocurrency, especially when it comes to stablecoins. You know, those digital coins that (supposedly) don’t bounce around like a kangaroo on a trampoline? Yeah, those.

Funny thing is, while the rest of the world is still arguing about whether crypto is the future or just a fancy way to lose your shirt, the UAE has quietly rolled up its sleeves and started building a regulatory framework that’s, well, let’s just say it’s turning heads. And wallets.

So, what’s the deal with stablecoin regulations in the UAE? Why is everyone from Wall Street to Silicon Valley (and, let’s be honest, a few folks in their pajamas trading from home) suddenly paying attention? Buckle up. We’re about to spill the beans.

What’s a Stablecoin, Anyway? (And Why Should You Care?)

Okay, quick pit stop. If you’re already a crypto whiz, feel free to skip ahead. But for the rest of us, stablecoins are digital currencies pegged to something “stable” (think: the US dollar, the euro, or, in this case, the UAE dirham). The idea? You get all the speed and flexibility of crypto, minus the wild price swings that make your heart race (and not in a good way).

But here’s the kicker: not all stablecoins are created equal. Some are backed by actual cash in a bank. Others? Well, let’s just say they’re a little more… creative. And that’s where regulation comes in.

The UAE’s Big Move

So, picture this: it’s 2024, and the Central Bank of the UAE (CBUAE) drops a bombshell, an official, detailed regulatory framework for stablecoins. Not just a vague promise or a “we’ll get to it later” memo. We’re talking real rules, real oversight, and (get this) a licensing regime for stablecoin issuers.

SEO keywords in play: stablecoin regulations UAE, UAE crypto laws, dirham-backed stablecoin, UAE Central Bank stablecoin framework.

The Nitty-Gritty (But Not Boring, Promise)

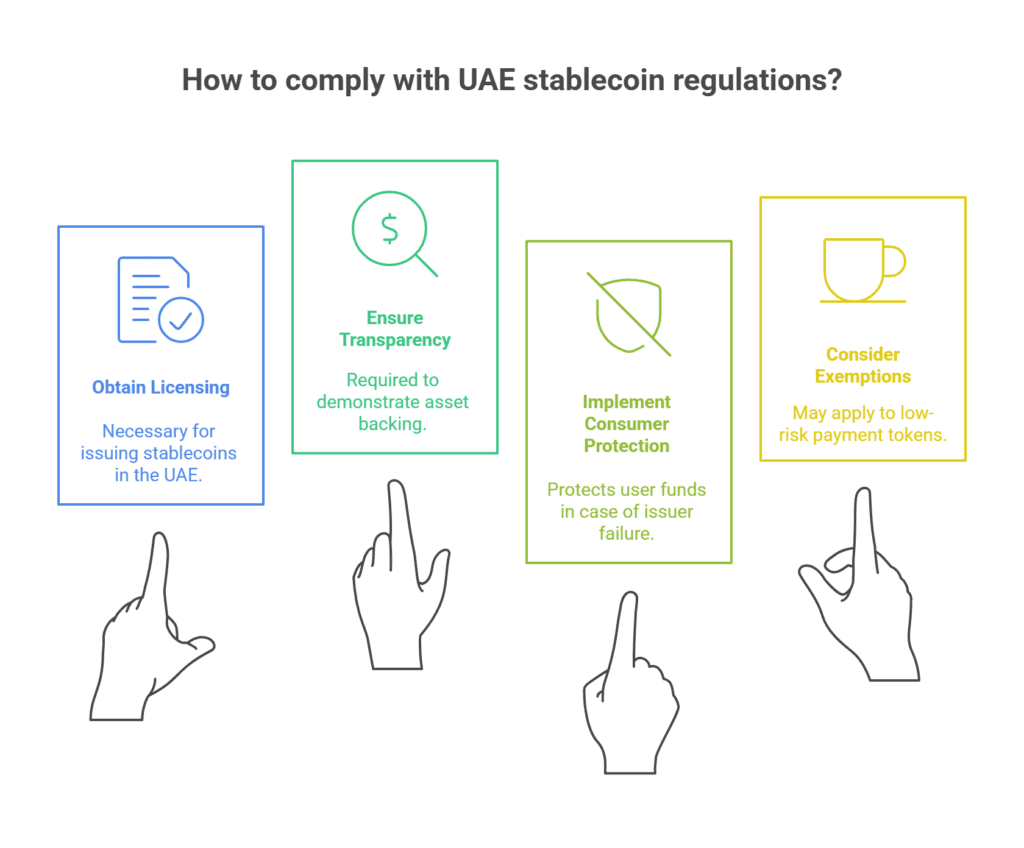

- Licensing: If you want to issue a stablecoin in the UAE, you need a license. No ifs, ands, or buts.

- Transparency: Issuers have to show, on the regular, that their coins are actually backed by real assets. No smoke and mirrors.

- Consumer Protection: The rules are designed to keep your money safe, even if the company behind the coin goes belly-up.

- Exemptions: Not every digital token is treated the same. Low-risk payment tokens (like your favorite coffee shop’s reward points) get a lighter touch.

And here’s where it gets spicy: the UAE’s first dirham-backed stablecoin, AE Coin, just got the official green light. Fully backed by the UAE dirham. Fully compliant. Fully… well, real.

Why now? (And Why the UAE?)

You might be wondering, why is the UAE going all-in on stablecoins right now? Simple. The country wants to be the global hub for fintech and digital assets. And, if I’m honest, they’re not just talking the talk. They’re walking the walk.

The UAE Digital Government Strategy 2025? It’s not just a fancy slogan. It’s a roadmap. And stablecoins are a big part of it.

The Numbers Don’t Lie: Stablecoins Are Taking Over

Here’s a stat that’ll make you do a double-take: stablecoins now account for 51% of all crypto activity in the UAE. That’s more than Bitcoin (19%) and Ethereum (9%) combined. Let that sink in for a second.

And it’s not just a blip. In the first half of 2024, stablecoin usage in the UAE shot up by 55%. We’re talking $9.8 billion in transactions. That’s not pocket change.

Who’s Using Stablecoins?

- Retail Users: Everyday folks buying, selling, and sending money.

- Institutions: Big players moving serious cash.

- Businesses: Companies looking to cut costs and speed up payments.

And with AE Coin in the mix, expect those numbers to keep climbing. Lower transaction costs, faster payments, and better cash flow management, what’s not to love?

The Global Stage: UAE vs. The World

Let’s zoom out for a second. The UAE isn’t just playing catch-up. It’s setting the pace. While regulators in the US and Europe are still arguing over definitions, the UAE has already built the racetrack.

- Regulatory Clarity: The CBUAE’s rules are clear, detailed, and (dare I say) business-friendly.

- Innovation-Friendly: The framework encourages new ideas, not just more paperwork.

- Attracting Talent: Global crypto companies are flocking to Dubai and Abu Dhabi. Why? Because they know where the goalposts are.

And here’s the wild part: the UAE is pushing for dirham-backed stablecoins, not just more USD-pegged tokens. That’s a big deal. It’s about financial sovereignty, taking control of your own digital destiny.

How Does It All Work? (A Quick-and-Dirty Guide)

Let’s break it down. You want to launch a stablecoin in the UAE? Here’s what you’re looking at:

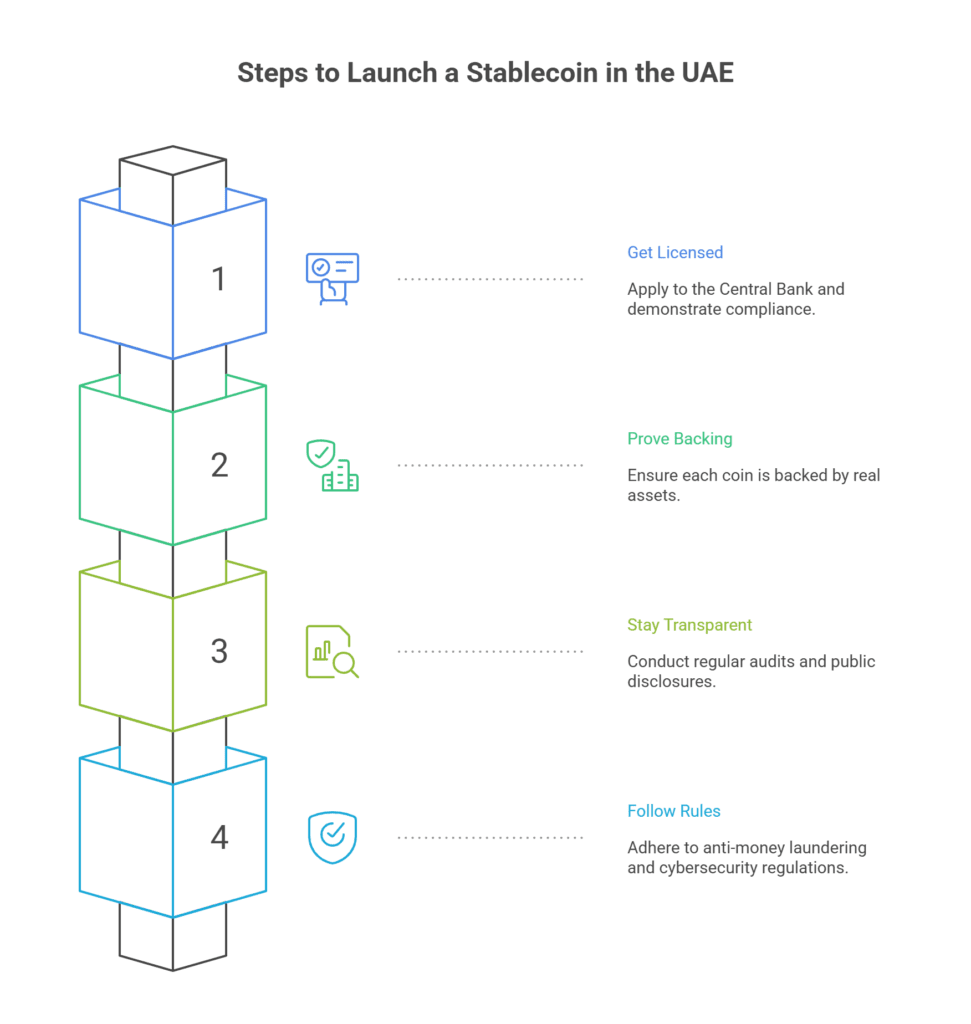

- Get Licensed: Apply to the Central Bank. Show them your business plan, your tech, your compliance chops.

- Prove Your Backing: Every coin you issue needs to be backed by real dirhams (or whatever asset you’re pegging to). No funny business.

- Stay Transparent: Regular audits, public disclosures, the whole nine yards.

- Follow the Rules: Anti-money laundering, consumer protection, cybersecurity, the works.

Sound like a lot? Maybe. But it’s also what gives users (and investors) confidence. And that’s worth its weight in gold. Or, you know, dirhams.

AE Coin: The UAE’s Homegrown Stablecoin

Let’s talk about AE Coin for a second. This isn’t just another digital token. It’s the UAE’s first officially approved, dirham-backed stablecoin. And it’s got some serious backing, both literally and figuratively.

- Fully Collateralized: Every AE Coin is backed 1:1 by UAE dirhams held in reserve.

- Regulated: Licensed under the CBUAE’s Payment Token Services Regulation (Circular No. 2/2024).

- Secure: Top-tier compliance, regular audits, and robust cybersecurity.

But here’s the real kicker: AE Coin isn’t just for crypto geeks. It’s designed for everyone—businesses, individuals, and even government services. Imagine paying your utility bill, sending remittances, or buying real estate, all with a stable, digital dirham. Wild, right?

The Ripple Effect: What This Means for Businesses

If you’re running a business in the UAE, this is huge. Stablecoins like AE Coin can slash transaction costs, speed up settlements, and open up new markets. No more waiting days for cross-border payments to clear. No more sky-high fees.

And for regular folks? It means faster, cheaper, and safer ways to move money. Whether you’re sending cash to family overseas or just splitting the bill at dinner, stablecoins make it a breeze.

The Future: Where’s All This Headed?

Here’s where things get really interesting. The stablecoin market is expected to hit $2 trillion globally by 2028. And the UAE? It’s poised to grab a big slice of that pie.

AE Coin’s roadmap is ambitious; think partnerships with banks, integration with decentralized apps (dApps), and listings on major exchanges. The goal? Make the dirham the go-to digital currency for the region (and maybe beyond).

And don’t be surprised if you see more banks jumping into the stablecoin game. The more, the merrier, and the more legitimate the whole space becomes.

FAQs: Because Everyone’s Got Questions

What are the UAE’s regulations for stablecoins?

The UAE requires stablecoin issuers to get licensed, prove their coins are fully backed, and follow strict rules on transparency and consumer protection.

Can businesses in the UAE accept stablecoins?

Absolutely. In fact, many are already doing it, especially with the launch of AE Coin.

How does the UAE compare to other countries?

Short answer: it’s ahead of the curve. The UAE’s rules are clear, business-friendly, and designed to encourage innovation.

Are foreign stablecoins allowed?

Yes, but they have to play by the rules, just like everyone else.

What’s next for stablecoins in the UAE?

Expect more adoption, more innovation, and (probably) more coins. The future’s looking bright.

The Bottom Line: Why You Should Care

Look, you don’t have to be a blockchain buff to see what’s happening here. The UAE is building a digital financial system that’s fast, secure, and (most importantly) trustworthy. Stablecoins are at the heart of it.

So whether you’re a business owner, a tech enthusiast, or just someone who likes to keep an eye on the next big thing, keep watching the UAE. They’re not just talking about the future of money. They’re building it.

And who knows? The next time you buy a coffee in Dubai, you might just pay with a digital dirham. Stranger things have happened.