A Trade Deal Years in the Making

So, here’s the scoop. After what felt like an eternity of back-and-forth (seriously, these negotiations have been going on longer than some Netflix series), India and the UK finally shook hands on a Free Trade Agreement. Big news, right? Especially if you’re in the business of textiles, garments, or, honestly, just rooting for India to snag a bigger slice of the global export pie.

But here’s the kicker: it’s not just about slashing tariffs and calling it a day. There’s a lot more bubbling under the surface. Let’s spill the beans.

Why Textiles? Why Now?

Funny thing is, textiles have always been India’s bread and butter. Or, if you prefer, its chai and samosa. The country’s textile sector is massive; think millions of jobs, billions in exports, and a legacy that stretches back to the days when “Made in India” meant handwoven magic.

But here’s the rub: despite all that, what is India’s share of the UK’s ready-made garment (RMG) imports? Just 6%. Ouch. Especially when you realize China’s sitting pretty at 25%, and Bangladesh is clocking in at 20%. Both of them, by the way, already enjoy zero-duty access to the UK market. So, India’s been playing catch-up.

Now, with this new FTA, the playing field just got a little more level. Or did it?

What’s Actually in the Deal?

Let’s break it down. The UK-India FTA, in a nutshell:

- Tariff elimination on 99% of Indian exports to the UK. That’s not a typo. Ninety-nine percent. Textiles, leather, marine products, you name it.

- Textile tariffs, which used to range from 4% to 12%, are gone. Poof. Just like that.

- Potential for a 30-40% jump in Indian textile exports to the UK. At least, that’s what the optimists are saying.

Sounds like a slam dunk, right? Well, not so fast.

Why Tariff Cuts Aren’t a Magic Wand

Here’s where things get interesting (and, if I’m honest, a little complicated). You’d think that with tariffs out of the way, Indian exporters would be dancing in the streets. But history says otherwise.

Remember the Indo-Japan FTA? India got zero tariffs on textiles there, too. And yet… exports barely budged. Turns out, there’s more to global trade than just taxes and duties.

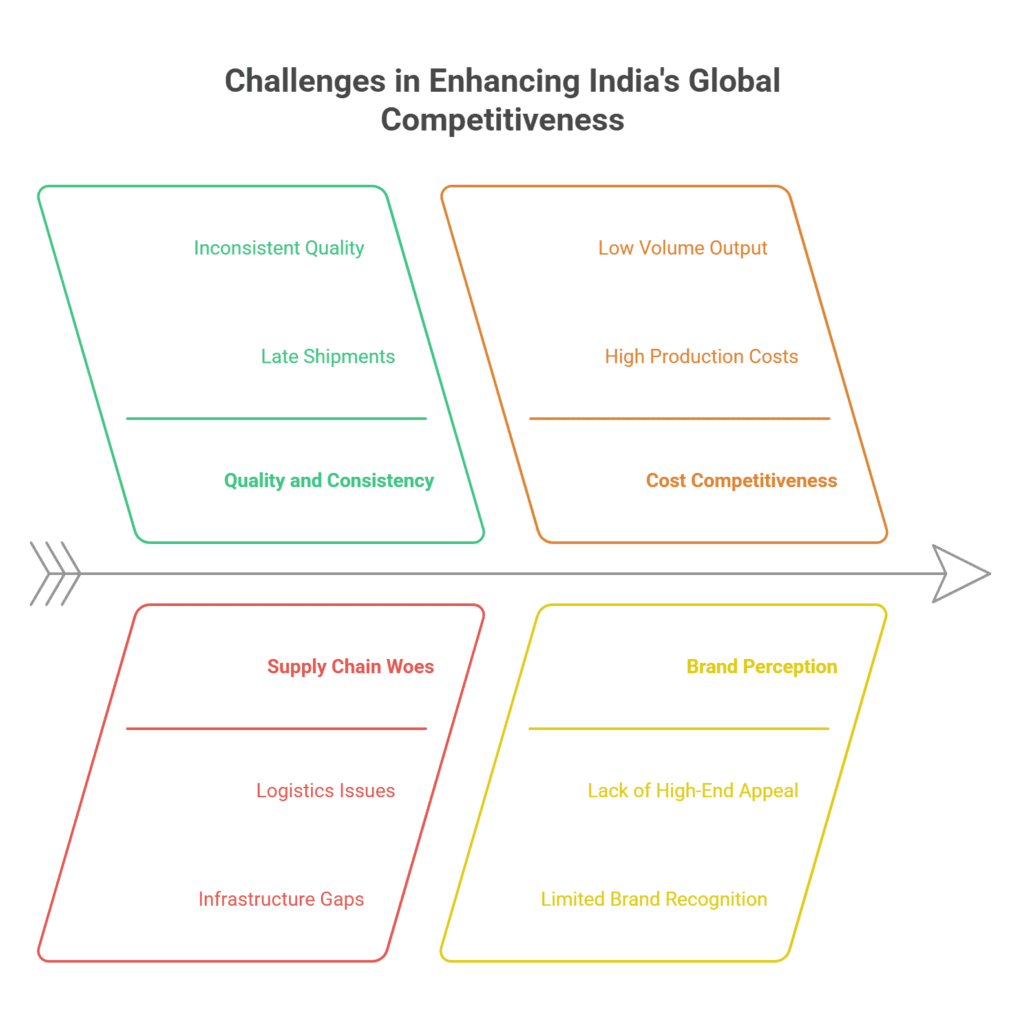

What’s Holding India Back?

- Quality and Consistency: Let’s not beat around the bush; global buyers want reliability. If your shipments are late or your quality’s all over the map, they’ll look elsewhere.

- Supply Chain Woes: Logistics, infrastructure, and red tape—India’s got some work to do here.

- Cost Competitiveness: Bangladesh and Turkey have nailed the low-cost, high-volume game. India? Still catching up.

- Brand Perception: “Made in India” is respected, sure, but it’s not always the first choice for high-end buyers in London or Manchester.

So, while the FTA opens the door, Indian exporters still have to walk through it and maybe fix their shoes on the way.

The Numbers Game: How Big Is the Opportunity, Really?

Let’s talk numbers. The UK imports about $19.6 billion worth of apparel every year. That’s a lot of shirts, dresses, and, presumably, the occasional kilt. India’s share? Just a sliver.

But with tariffs gone, industry insiders are predicting a 30-40% jump in exports. That’s huge. If it happens.

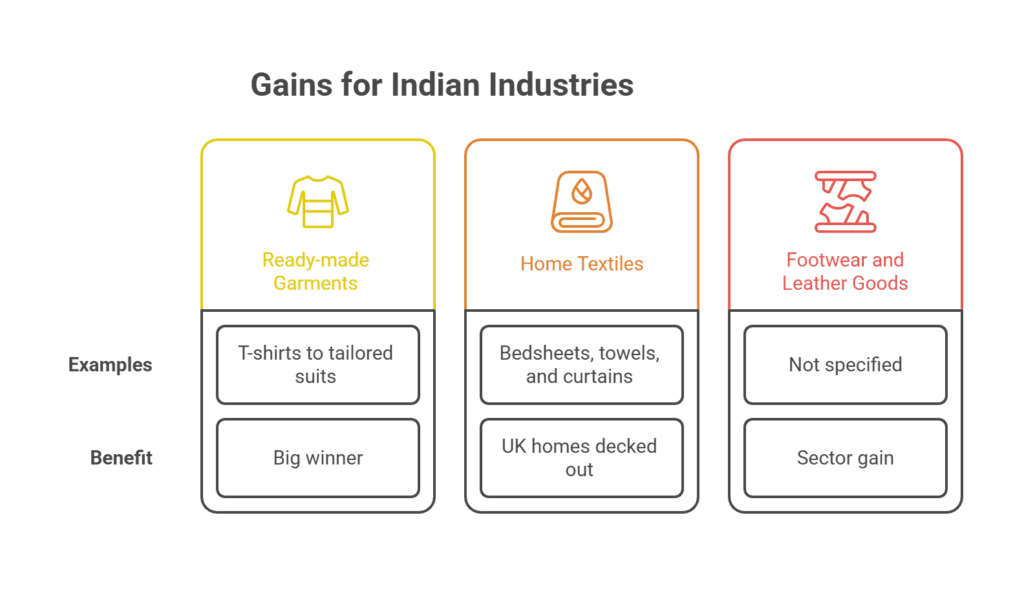

Here’s what’s on the table:

- Ready-made garments: The big winner. Think everything from T-shirts to tailored suits.

- Home textiles: Bedsheets, towels, and curtains. UK homes could soon be decked out in Indian fabrics.

- Footwear and leather goods: Not just textiles, but related sectors stand to gain.

But (and it’s a big but), only if Indian exporters can up their game.

The Competition: Not Just a Two-Horse Race

Let’s not forget the competition. China and Bangladesh aren’t just going to sit back and let India waltz in. They’ve got established supply chains, deep relationships with UK retailers, and, crucially, a reputation for delivering on time and on budget.

And then there’s Turkey, Vietnam, and a handful of other players, all eyeing the same prize.

So, what’s India’s edge? Well, it could be:

- Diverse product range: From handloom to high-tech, India’s got variety.

- Sustainability: The world’s waking up to eco-friendly textiles, and India’s got a story to tell here.

- Skilled workforce: Millions of artisans, designers, and factory workers ready to roll.

But it’ll take more than just potential. Execution is everything.

What Does This Mean for Workers?

Let’s zoom in for a second. Behind every export stat, there are real people, millions, in fact. The textile sector is one of India’s biggest employers, especially for women in rural areas.

If the FTA delivers, it could mean:

- More jobs: Not just in factories, but across the supply chain.

- Better wages: Export growth often leads to higher pay (though, let’s be honest, there’s work to do on that front).

- Skill development: As the industry modernizes, workers will need new skills; think digital design, quality control, and logistics.

But there’s a flip side. If Indian firms can’t compete, jobs could be at risk. It’s a high-stakes game.

The Policy Puzzle

Here’s where the rubber meets the road. Tariff cuts are great, but they’re just the first step. For India to really cash in, policymakers need to:

- Invest in infrastructure: ports, roads, and warehouses. Get the basics right.

- Streamline regulations: Cut the red tape. Make it easier to do business.

- Support innovation: Encourage R&D, especially in sustainable textiles.

- Promote “Brand India”: Tell the world what makes Indian textiles special.

And, maybe most importantly, listen to the people on the ground, the exporters, the workers, and the entrepreneurs.

The Global Context: Why the UK Is Betting on India

Let’s zoom out. Why is the UK so keen on this deal? Simple. Post-Brexit, Britain needs new trade partners. India, with its massive market and growing middle class, is a no-brainer.

For India, the UK is a gateway to Europe (even if it’s technically not in the EU anymore). Plus, it’s a chance to show the world that “Make in India” isn’t just a slogan; it’s a strategy.

And who knows? If this deal works, it could pave the way for FTAs with the EU, the US, and beyond.

The Skeptics: Not Everyone’s Popping Champagne

Of course, not everyone’s convinced. Some industry veterans are on the fence. They’ve seen big promises before; remember the hype around the Indo-Japan FTA? And they’re waiting to see real results.

There are concerns about:

- Non-tariff barriers: Standards, certifications, and other hoops to jump through.

- Currency fluctuations: The pound and the rupee don’t always play nice.

- Political risks: Trade deals can get tangled up in geopolitics.

So, while there’s plenty of optimism, there’s also a healthy dose of caution.

The SEO Angle: What Are People Searching For?

Let’s take a quick detour. If you’re reading this, you might have Googled something like:

- “UK-India trade deal textiles”

- “India textile exports to UK”

- “Tariff elimination: UK-India FTA”

- “Export gains from UK-India trade deal”

- “How will the UK-India FTA impact Indian exporters?”

And you’re not alone. These are hot topics, with businesses, policymakers, and everyday folks all trying to figure out what this deal means for them.

The Road Ahead: What’s Next for Indian Textiles?

So, where do we go from here? If you’re an exporter, now’s the time to double down, invest in quality, build relationships with UK buyers, and get your logistics in order.

If you’re a policymaker, don’t rest on your laurels. The FTA is a great start, but it’s just that, a start.

And if you’re a consumer in the UK? Get ready for more “Made in India” tags on your clothes. (And maybe, just maybe, a little more color in your wardrobe.)

The Good, the Bad, and the “Wait and See”

- The Good: Tariffs are gone. Big opportunity for Indian textiles. Potential for job growth and export gains.

- The Bad: Competition is fierce. Structural issues need fixing. Success isn’t guaranteed.

- The “Wait and See”: Will Indian exporters rise to the challenge? Will policymakers follow through? Only time will tell.

Final Thoughts: Why This Matters (and Why You Should Care)

At the end of the day, this isn’t just about trade stats or government press releases. It’s about real people, workers, entrepreneurs, and families whose lives could change for the better (or, if things go sideways, for the worse).

The UK-India FTA is a big deal. But it’s not a magic wand. It’s an opportunity, a door that’s just been unlocked. Now, it’s up to India to walk through it, ready or not.

So, keep an eye on this space. Because, believe it or not, the story of Indian textiles in the UK is just getting started.